Answered step by step

Verified Expert Solution

Question

1 Approved Answer

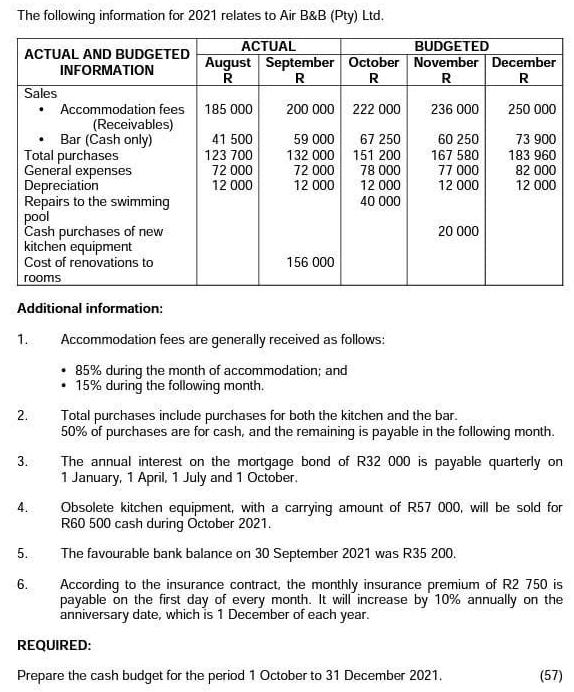

The following information for 2021 relates to Air B&B (Pty) Ltd. ACTUAL ACTUAL AND BUDGETED INFORMATION Sales Total purchases General expenses Depreciation Repairs to

The following information for 2021 relates to Air B&B (Pty) Ltd. ACTUAL ACTUAL AND BUDGETED INFORMATION Sales Total purchases General expenses Depreciation Repairs to the swimming pool Cash purchases of new kitchen equipment Cost of renovations to rooms 1. Additional information: 2. 3. Accommodation fees (Receivables) 4. Bar (Cash only) 5. 6. August September October R R R 185 000 41 500 123 700 72 000 12 000 200 000 59 000 132 000 72 000 12 000 156 000 222 000 67 250 151 200 78 000 12 000 40 000 Accommodation fees are generally received as follows: 85% during the month of accommodation; and . 15% during the following month. BUDGETED November December R R 236 000 250 000 60 250 73 900 167 580 183 960 82 000 12 000 77 000 12 000 20 000 Total purchases include purchases for both the kitchen and the bar. 50% of purchases are for cash, and the remaining is payable in the following month. The annual interest on the mortgage bond of R32 000 is payable quarterly on 1 January, 1 April, 1 July and 1 October. Obsolete kitchen equipment, with a carrying amount of R57 000, will be sold for R60 500 cash during October 2021. The favourable bank balance on 30 September 2021 was R35 200. According to the insurance contract, the monthly insurance premium of R2 750 is payable on the first day of every month. It will increase by 10% annually on the anniversary date, which is 1 December of each year. REQUIRED: Prepare the cash budget for the period 1 October to 31 December 2021. (57)

Step by Step Solution

★★★★★

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Preparation of Cash Budget of Air BB Pty Ltd for period 1 october to 21 December 2021 Air BB pty Ltd ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started