Answered step by step

Verified Expert Solution

Question

1 Approved Answer

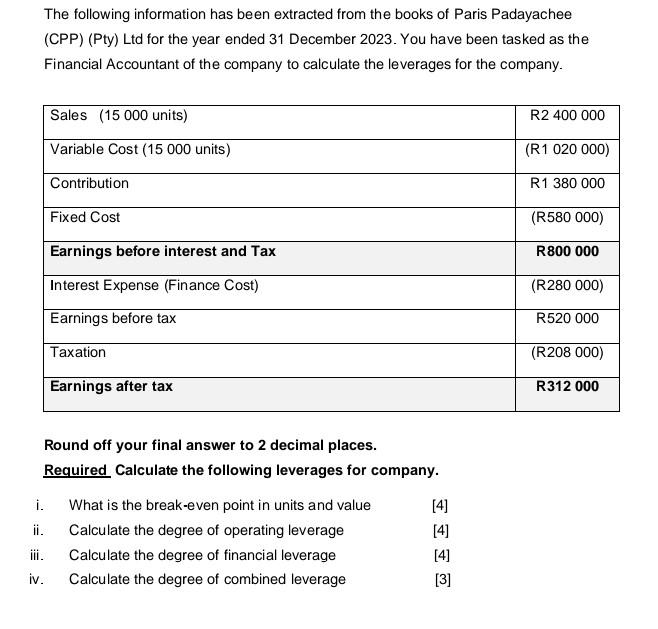

The following information has been extracted from the books of Paris Padayachee (CPP) (Pty) Ltd for the year ended 31 December 2023. You have

The following information has been extracted from the books of Paris Padayachee (CPP) (Pty) Ltd for the year ended 31 December 2023. You have been tasked as the Financial Accountant of the company to calculate the leverages for the company. Sales (15 000 units) Variable Cost (15 000 units) Contribution Fixed Cost Earnings before interest and Tax Interest Expense (Finance Cost) Earnings before tax Taxation R2 400 000 (R1 020 000) R1 380 000 (R580 000) R800 000 (R280 000) R520 000 (R208 000) Earnings after tax Round off your final answer to 2 decimal places. Required Calculate the following leverages for company. i. What is the break-even point in units and value [4] ii. Calculate the degree of operating leverage [4] iii. Calculate the degree of financial leverage [4] iv. Calculate the degree of combined leverage [3] R312 000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started