The following information is available for ACT230 Company: Beginning inventory First purchase 600 units at $4 900 units at $6 500 units at $7

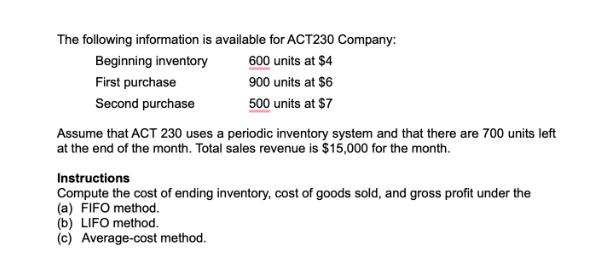

The following information is available for ACT230 Company: Beginning inventory First purchase 600 units at $4 900 units at $6 500 units at $7 Second purchase Assume that ACT 230 uses a periodic inventory system and that there are 700 units left at the end of the month. Total sales revenue is $15,000 for the month. Instructions Compute the cost of ending inventory, cost of goods sold, and gross profit under the (a) FIFO method. (b) LIFO method. (c) Average-cost method.

Step by Step Solution

3.41 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

a FIFO Method Under the FIFO method the cost of ending inventory is based on the cost of the most recent purchases while the cost of goods sold is bas...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started