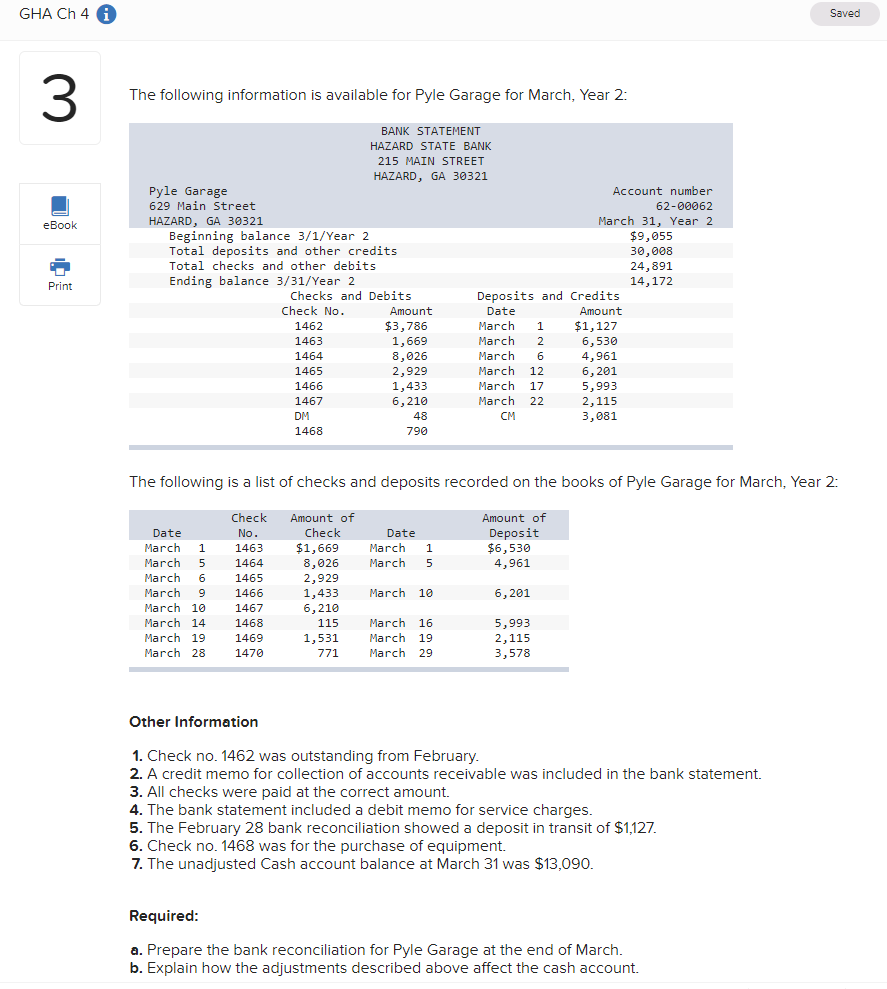

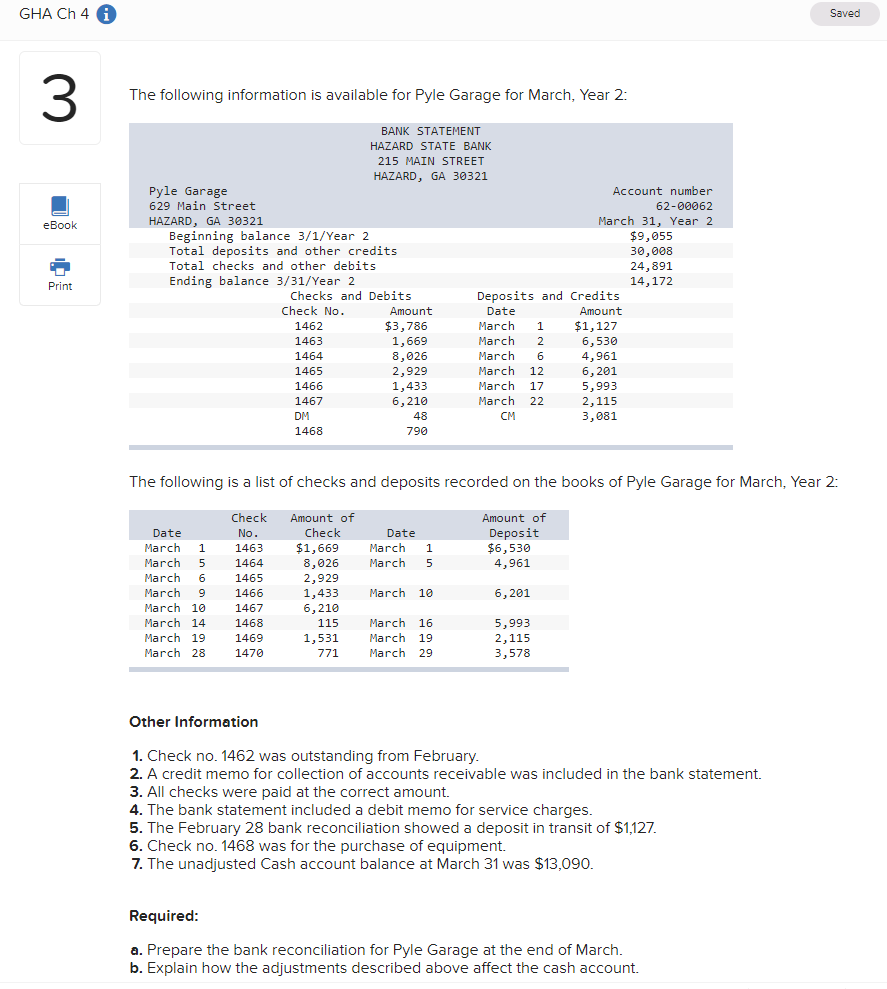

The following information is available for Pyle Garage for March, Year 2:

Other Information

Check no. 1462 was outstanding from February.

A credit memo for collection of accounts receivable was included in the bank statement.

All checks were paid at the correct amount.

The bank statement included a debit memo for service charges.

The February 28 bank reconciliation showed a deposit in transit of $1,127.

Check no. 1468 was for the purchase of equipment.

The unadjusted Cash account balance at March 31 was $13,090.

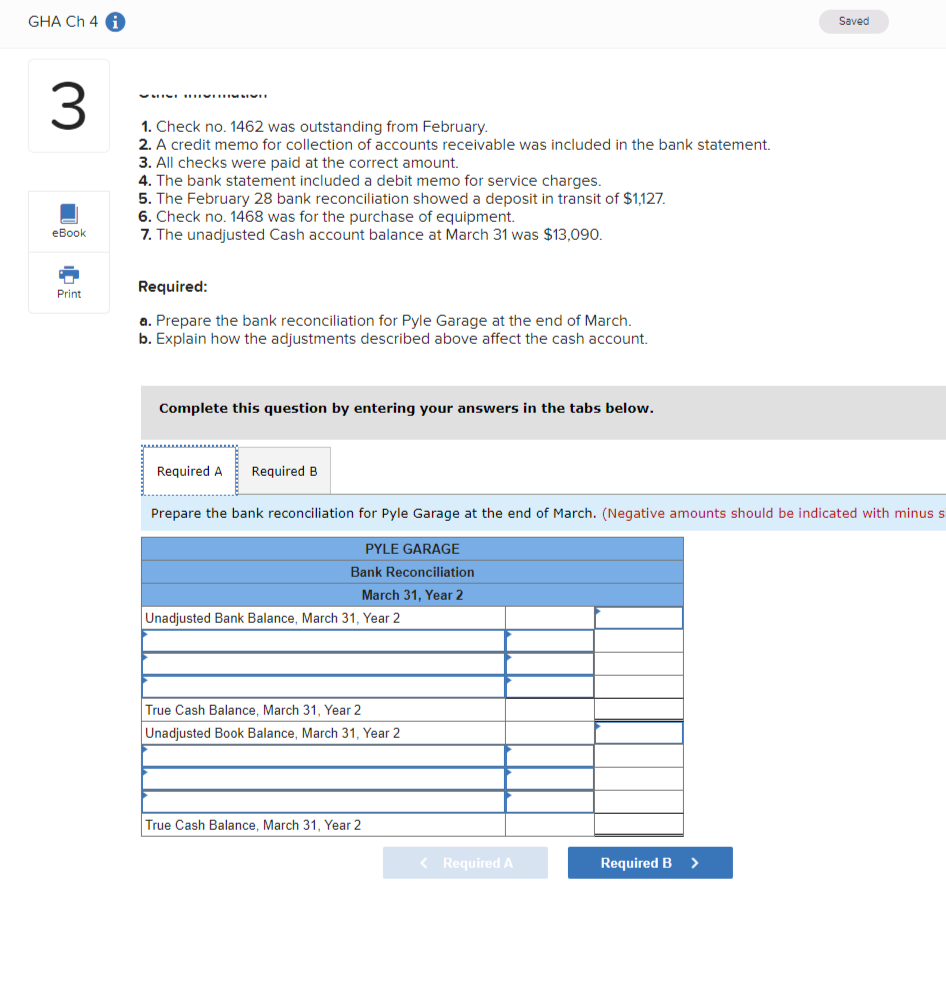

Required:

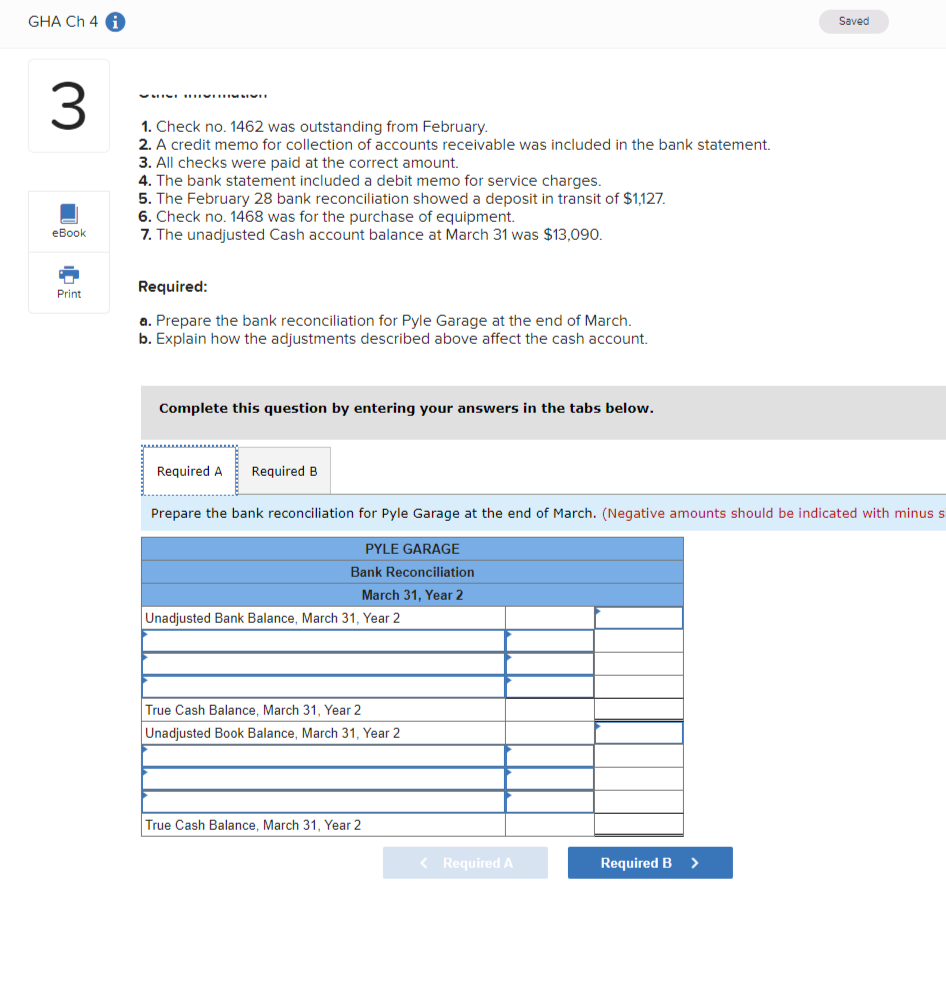

Prepare the bank reconciliation for Pyle Garage at the end of March.

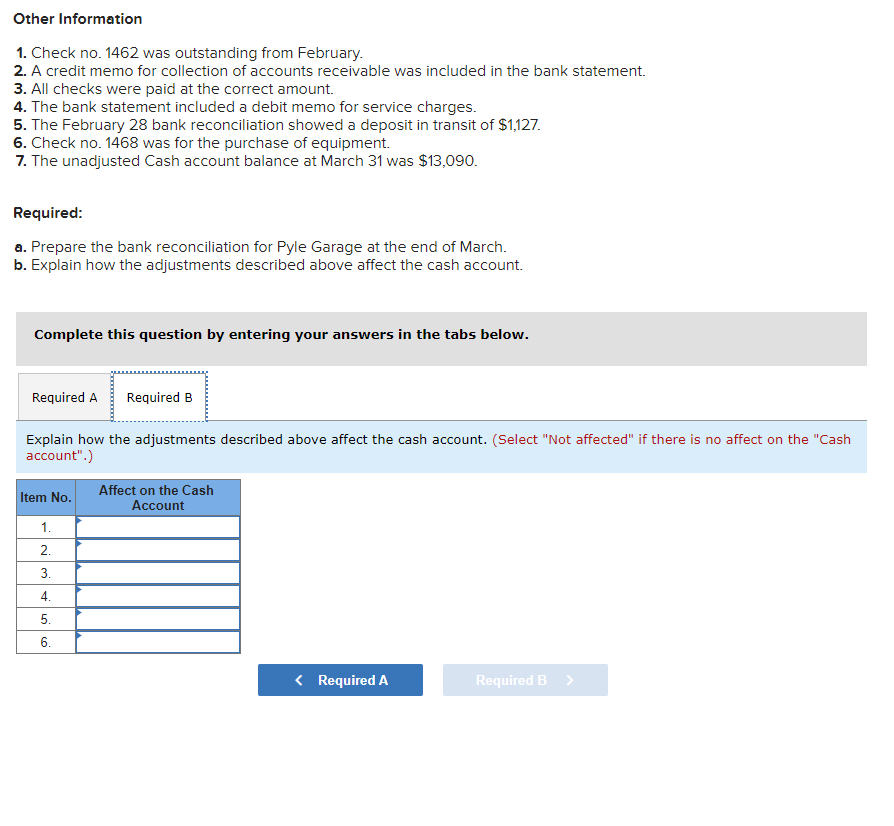

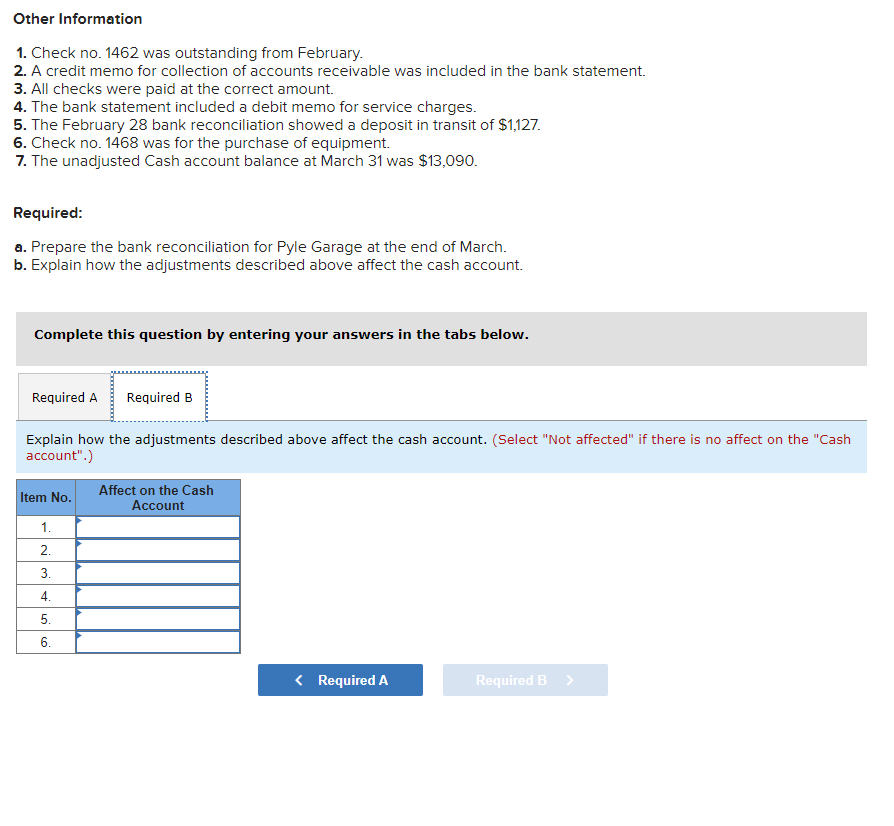

Explain how the adjustments described above affect the cash account.

The following information is available for Pyle Garage for March, Year 2: The following is a list of checks and deposits recorded on the books of Pyle Garage for March, Year 2: Other Information 1. Check no. 1462 was outstanding from February. 2. A credit memo for collection of accounts receivable was included in the bank statement. 3. All checks were paid at the correct amount. 4. The bank statement included a debit memo for service charges. 5. The February 28 bank reconciliation showed a deposit in transit of $1,127. 6. Check no. 1468 was for the purchase of equipment. 7. The unadjusted Cash account balance at March 31 was $13,090. Required: a. Prepare the bank reconciliation for Pyle Garage at the end of March. b. Explain how the adjustments described above affect the cash account. 1. Check no. 1462 was outstanding from February. 2. A credit memo for collection of accounts receivable was included in the bank statement. 3. All checks were paid at the correct amount. 4. The bank statement included a debit memo for service charges. 5. The February 28 bank reconciliation showed a deposit in transit of $1,127. 6. Check no. 1468 was for the purchase of equipment. 7. The unadjusted Cash account balance at March 31 was $13,090. Required: a. Prepare the bank reconciliation for Pyle Garage at the end of March. b. Explain how the adjustments described above affect the cash account. Complete this question by entering your answers in the tabs below. Prepare the bank reconciliation for Pyle Garage at the end of March. (Negative amounts should be indicated with minus Other Information 1. Check no. 1462 was outstanding from February. 2. A credit memo for collection of accounts receivable was included in the bank statement. 3. All checks were paid at the correct amount. 4. The bank statement included a debit memo for service charges. 5. The February 28 bank reconciliation showed a deposit in transit of $1,127. 6. Check no. 1468 was for the purchase of equipment. 7. The unadjusted Cash account balance at March 31 was $13,090. Required: a. Prepare the bank reconciliation for Pyle Garage at the end of March. b. Explain how the adjustments described above affect the cash account. Complete this question by entering your answers in the tabs below. Explain how the adjustments described above affect the cash account. (Select "Not affected" if there is no affect on the "Cash account".)