Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following information is available for ZAC Incorporated: ZAC Inc. Income Statement For the Year Ended December 31, 2016 Service Revenue $ 450, 000 Operating

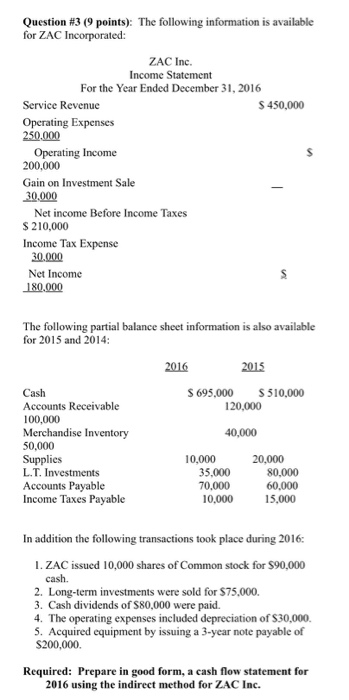

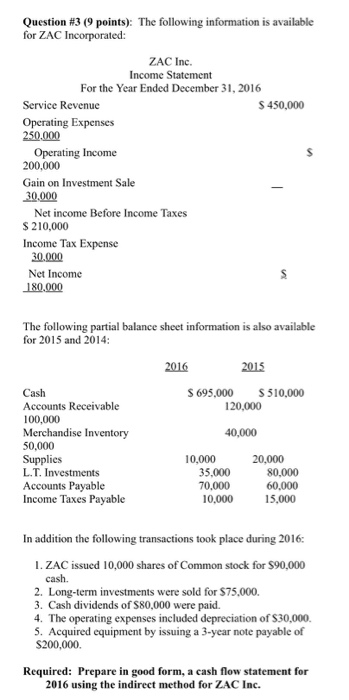

The following information is available for ZAC Incorporated: ZAC Inc. Income Statement For the Year Ended December 31, 2016 Service Revenue $ 450, 000 Operating Expenses 250.000 Operating Income $ 200, 000 Gain on Investment Sale _ 30, 000 Net income Before Income Taxes $ 210, 000 Income Tax Expense 30, 000 Net Income $ 180, 000 The following partial balance sheet information is also available for 2015 and 2014: 2016 2015 Cash $695, 000 $ 510, 000 Accounts Receivable 120, 000 100, 000 Merchandise Inventory 40, 000 50, 000 Supplies 10, 000 20, 000 L.T. Investments 35, 000 80, 000 Accounts Payable 70, 000 60, 000 Income Taxes Payable 10, 000 15, 000 In addition the following transactions took place during 2016: ZAC issued 10, 000 shares of Common stock for $90.000cash. Long-term investments were sold for $75.000. Cash dividends of $80, 000 were paid. The operating expenses included depreciation of $30.000. Acquired equipment by issuing a 3-year note payable of $200, 000. Required: Prepare in good form, a cash flow statement for 2016 using the indirect method for ZAC Inc

The following information is available for ZAC Incorporated: ZAC Inc. Income Statement For the Year Ended December 31, 2016 Service Revenue $ 450, 000 Operating Expenses 250.000 Operating Income $ 200, 000 Gain on Investment Sale _ 30, 000 Net income Before Income Taxes $ 210, 000 Income Tax Expense 30, 000 Net Income $ 180, 000 The following partial balance sheet information is also available for 2015 and 2014: 2016 2015 Cash $695, 000 $ 510, 000 Accounts Receivable 120, 000 100, 000 Merchandise Inventory 40, 000 50, 000 Supplies 10, 000 20, 000 L.T. Investments 35, 000 80, 000 Accounts Payable 70, 000 60, 000 Income Taxes Payable 10, 000 15, 000 In addition the following transactions took place during 2016: ZAC issued 10, 000 shares of Common stock for $90.000cash. Long-term investments were sold for $75.000. Cash dividends of $80, 000 were paid. The operating expenses included depreciation of $30.000. Acquired equipment by issuing a 3-year note payable of $200, 000. Required: Prepare in good form, a cash flow statement for 2016 using the indirect method for ZAC Inc

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started