Answered step by step

Verified Expert Solution

Question

1 Approved Answer

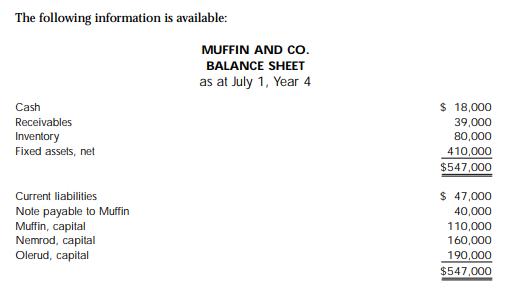

The following information is available: MUFFIN AND co. BALANCE SHEET as at July 1, Year 4 Cash $ 18,000 Receivables 39,000 Inventory Fixed assets,

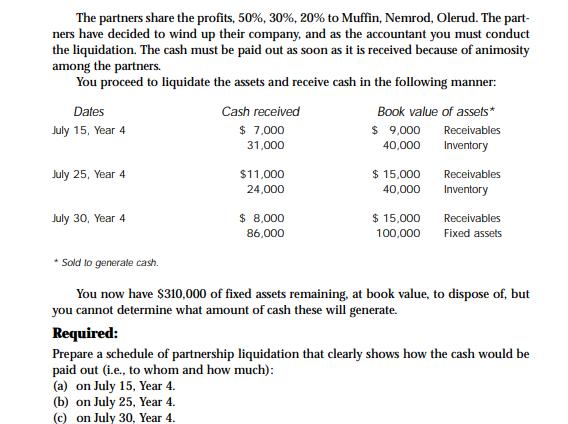

The following information is available: MUFFIN AND co. BALANCE SHEET as at July 1, Year 4 Cash $ 18,000 Receivables 39,000 Inventory Fixed assets, net 80,000 410,000 $547,000 Current liabilities $ 47,000 Note payable to Muffin Muffin, capital Nemrod, capital Olerud, capital 40,000 110,000 160,000 190,000 $547,000 The partners share the profits, 50%, 30%, 20% to Muffin, Nemrod, Olerud. The part- ners have decided to wind up their company, and as the accountant you must conduct the liquidation. The cash must be paid out as soon as it is received because of animosity among the partners. You proceed to liquidate the assets and receive cash in the following manner: Dates Cash received Book value of assets* $ 7,000 31,000 $ 9,000 July 15, Year 4 Receivables 40,000 Inventory July 25, Year 4 $11,000 $ 15,000 Receivables 24,000 40,000 Inventory $ 8,000 $ 15,000 100,000 July 30, Year 4 Receivables 86,000 Fixed assets Sold to generate cash. You now have $310,000 of fixed assets remaining, at book value, to dispose of, but you cannot determine what amount of cash these will generate. Required: Prepare a schedule of partnership liquidation that clearly shows how the cash would be paid out (i.e., to whom and how much): (a) on July 15, Year 4. (b) on July 25, Year 4. (c) on July 30, Year 4.

Step by Step Solution

★★★★★

3.50 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

All amounts are in Note 1 Muffin amount is after adding capital and note payable 110000 40000 150000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started