Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following information is for Jason's landscaping business: The truck was over 6 , 0 0 0 l b . The Hurtings had the following

The following information is for Jason's landscaping business:

The truck was over The Hurtings had the following itemized deductions:

The Hurtings made four federal estimated payments of $ each on their due dates. Prepare Form plus appropriate schedules for

the Hurtings for The Hurtings had qualifying health care coverage at all times during the tax year.

We have provided selected filledin source documents that are available in the Connect Library.Take Section if the assets are eligible. The truck is more than pounds.

Please use the TaxAct software to complete the return.Tax Return Problem

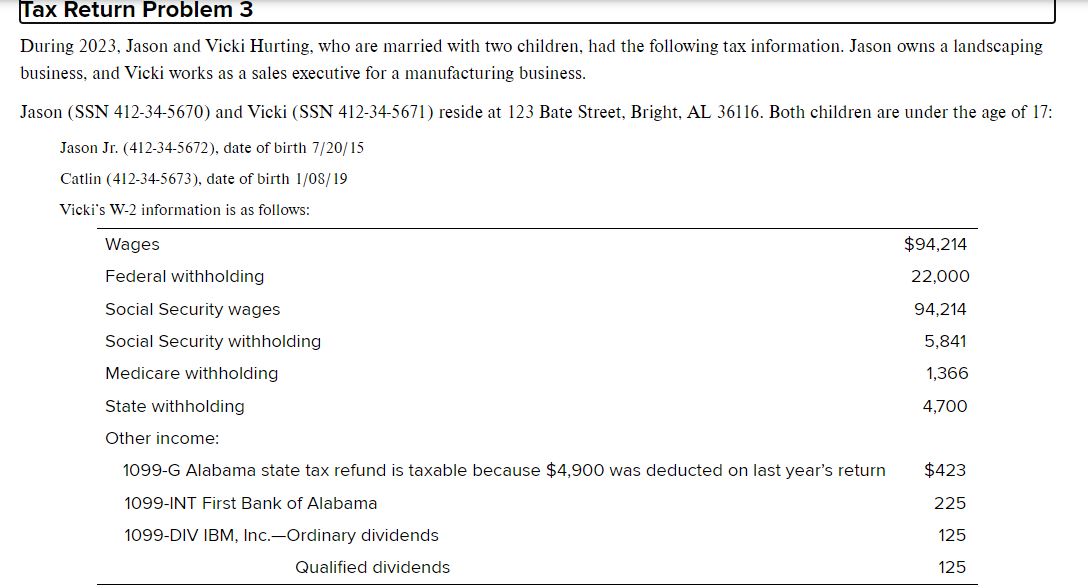

During Jason and Vicki Hurting, who are married with two children, had the following tax information. Jason owns a landscaping

business, and Vicki works as a sales executive for a manufacturing business.

Jason SSN and Vicki SSN reside at Bate Street, Bright, AL Both children are under the age of :

Jason Jr date of birth

Catlin date of birth

Vicki's W information is as follows:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started