Question

The following information is from the Jue, 30, 1998, balance sheet for Delta Air Lines (all dollar are in millions): Delta also included this note

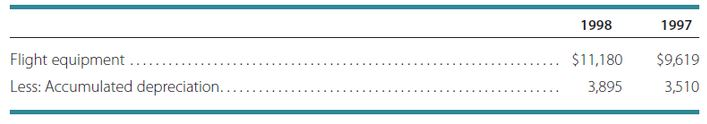

The following information is from the Jue, 30, 1998, balance sheet for Delta Air Lines (all dollar are in millions):

Delta also included this note to its financial statements:

Depreciation and Amortization - Effective July 1, 1998, the Company increased the depreciable life of certain new generation aircraft types from 20 to 25 years. Owned flight equipment is depreciated on a straight-line basis to a residual value equal to 5% of cost.

1, Assume that all flight equipment will be affected by this policy change. The new policy will not be reflected in the 1998 financial statements, as the policy was changed on July 1, 1998. Estimate the total depreciation expense recognized by Delta on flight equipment for the year ended June 30, 1998, using the old 20-year life and the new 25-year life. Assume there were no flight equipment retirements during the year and new acquisitions are depreciated for half the year.

2. How reasonable is the assumption that there were no flight equipment retirements in 1998?

Flight equipment Less: Accumulated depreciation. 1998 1997 $11,180 $9,619 3,895 3,510Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started