Question

The following information is relevant: i) The inventory of Picant includes $8,000 of goods purchased for cash from Sander at cost plus 25%. (ii) On

The following information is relevant: i) The inventory of Picant includes $8,000 of goods purchased for cash from Sander at cost plus 25%. (ii) On 1 June 20X7 Picant transferred an item of plant to Sander for $15,000. Its carrying amount at that date was $10,000. The asset had a remaining useful economic life of 5 years. (iii) The Picant Group values the non-controlling interest using the fair value method. At the date of acquisition the fair value of the 40% non controlling interest was $50,000 (iv) An impairment loss of $1,000 is to be charged against goodwill at the year-end. (v) Sander earned a profit of $9,000 in the year ended 30 October 20X7. (vi) The loan note in Sanders books represents monies borrowed from Picant on 30 October 20X7. (vii) Included in Picants receivables is $4,000 relating to inventory sold to Sander during the year. Sander raised a cheque for $2,500 and sent it to Picant on 29 October 20X7. Picant did not receive this cheque until 4 December 20X7 Required: Prepare the consolidated Statement of Financial Position as at 30 October 20X7

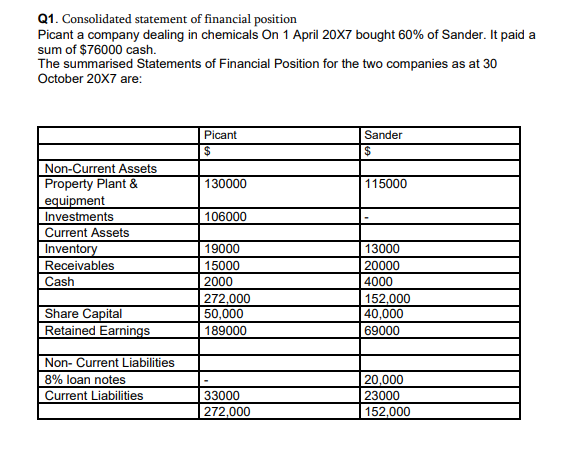

Q1. Consolidated statement of financial position Picant a company dealing in chemicals On 1 April 20X7 bought 60% of Sander. It paid a sum of $76000 cash. The summarised Statements of Financial Position for the two companies as at 30 October 20X7 are: Picant $ Sander $ 130000 115000 106000 Non-Current Assets Property Plant & equipment Investments Current Assets Inventory Receivables Cash 19000 15000 2000 272,000 50,000 189000 13000 20000 4000 152.000 40,000 69000 Share Capital Retained Earnings Non-Current Liabilities 8% loan notes Current Liabilities 33000 272,000 20,000 23000 152.000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started