Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following information is relevant to the preparation of the group financial statements of Quick Group: On 1st June 2019, Quick Bhd acquired 140 million

The following information is relevant to the preparation of the group financial statements of Quick Group:

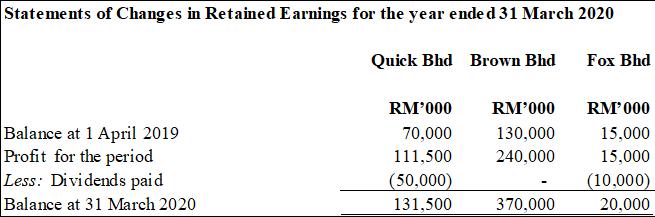

- On 1st June 2019, Quick Bhd acquired 140 million ordinary shares in Brown Ltd at RM2 per share when the retained earnings were RM170 million. On 1 April 2019, Quick Bhd acquired 30 million shares in Fox paying RM1.5 for each share when retained earnings were RM15 million.

- On 1 April 2019, Quick purchased 40% of the preference shares of Brown for a par value of RM20 million. The preference shares of Brown are redeemable on 31 March 2025 and recognized as a liability in the financial statements under MFRS 132 Financial Instruments: Presentation and Disclosure. They were originally issued at par on 1 April 2017. A 10% preference dividend is declared and paid on 31 March every year. Both companies have correctly reflected this dividend in their financial statements.

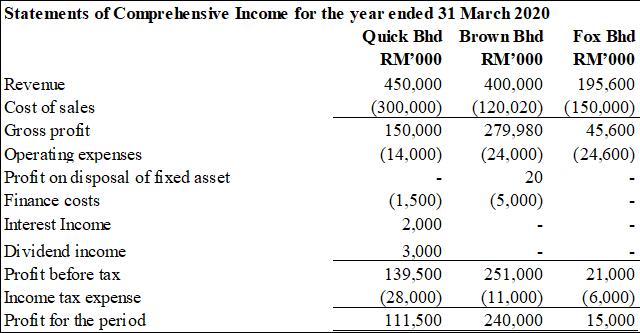

- A fair value exercise was carried out for the buildings of Brown at the date of acquisition. The fair value of buildings was RM3,600,000 greater than book value. On 1st June 2019, the buildings had an estimated useful life of 20 years. The above revaluation has been not reflected in Brown’s own financial statements.

- On 30 March 2020, Brown sent a payment of RM5,000,000 to Quick. This payment was received and recorded by Quick on 2 April 2020.

- In February 2020, Quick Bhd sold goods to Brown Bhd at a margin of 25% for RM25 million. Brown Bhd held half of these goods in inventory at 31st March, 2020.

- Quick Bhd charged Brown Bhd an administration charge of RM10,000 per month. The charges are included in the turnover of Quick Bhd and the other operating expenses of Brown Bhd

- On 31 March 2020, Brown Bhd sold a Motor Vehicle to Quick Bhd for RM50,000 when book value was RM30,000. The motor vehicle had a useful life of 5 years remaining.

- The goodwill arising on consolidation of Brown is considered to be impaired by RM5 million at 31 March 2020.

- The directors of Quick Bhd and Fox Bhd paid ordinary dividends of 10 cents per share on 31 March 2020.

- It is group policy to value the non-controlling interest using the proportion of net assets method

- Assume that revenue, expenses and profits accrue evenly throughout the year.

Required:

- Prepare a consolidated statement of comprehensive income for Quick Bhd and its group companies for the year to 31 March 2020. (25 marks)

- Prepare a consolidated statement of financial position for Quick Bhd and its group companies as at 31 March 2020. (35 marks)

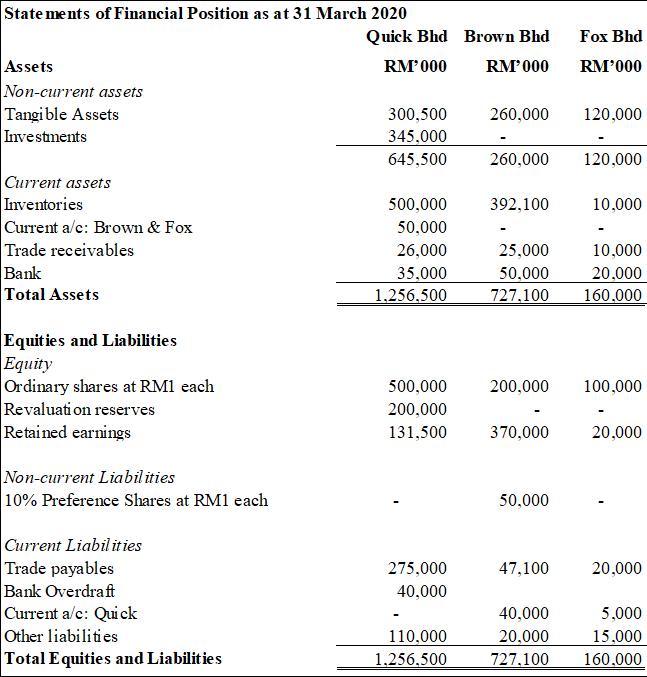

Statements of Financial Position as at 31 March 2020 Assets Non-current assets Tangible Assets Investments Current assets Inventories Current a/c: Brown & Fox Trade receivables Bank Total Assets Equities and Liabilities Equity Ordinary shares at RM1 each Revaluation reserves Retained earnings Non-current Liabilities 10% Preference Shares at RM1 each Current Liabilities Trade payables Bank Overdraft Current a/c: Quick Other liabilities Total Equities and Liabilities Quick Bhd RM'000 300,500 345,000 645,500 500,000 50,000 26,000 35,000 1,256,500 500,000 200,000 131,500 275,000 40,000 110,000 1,256,500 Brown Bhd RM'000 260,000 260,000 392,100 370,000 Fox Bhd RM'000 50,000 120,000 25,000 10,000 50,000 20,000 727,100 160,000 47,100 120,000 200,000 100,000 10,000 20,000 20,000 40,000 5,000 20,000 15,000 727,100 160,000

Step by Step Solution

★★★★★

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Quick Bhd and its group companies Statement of comprehensive income for the year ended 31 March 2020 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started