Answered step by step

Verified Expert Solution

Question

1 Approved Answer

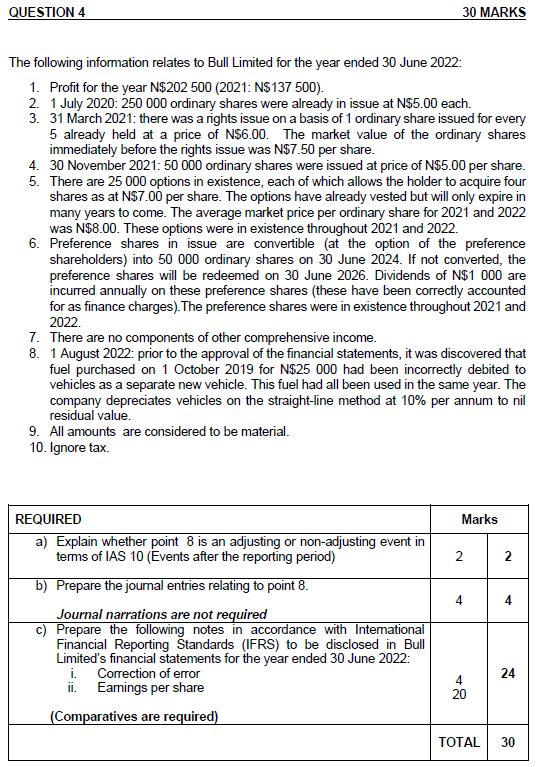

The following information relates to Bull Limited for the year ended 30 June 2022: 1. Profit for the year N$202500 (2021: N$137 500). 2. 1

The following information relates to Bull Limited for the year ended 30 June 2022: 1. Profit for the year N$202500 (2021: N\$137 500). 2. 1 July 2020: 250000 ordinary shares were already in issue at N$5.00 each. 3. 31 March 2021: there was a rights issue on a basis of 1 ordinary share issued for every 5 already held at a price of N\$6.00. The market value of the ordinary shares immediately before the rights issue was N$7.50 per share. 4. 30 November 2021: 50000 ordinary shares were issued at price of N$5.00 per share. 5. There are 25000 options in existence, each of which allows the holder to acquire four shares as at N\$7.00 per share. The options have already vested but will only expire in many years to come. The average market price per ordinary share for 2021 and 2022 was N\$8.00. These options were in existence throughout 2021 and 2022. 6. Preference shares in issue are convertible (at the option of the preference shareholders) into 50000 ordinary shares on 30 June 2024. If not converted, the preference shares will be redeemed on 30 June 2026. Dividends of N$1000 are incurred annually on these preference shares (these have been correctly accounted for as finance charges). The preference shares were in existence throughout 2021 and 2022. 7. There are no components of other comprehensive income. 8. 1 August 2022: prior to the approval of the financial statements, it was discovered that fuel purchased on 1 October 2019 for N$25000 had been incorrectly debited to vehicles as a separate new vehicle. This fuel had all been used in the same year. The company depreciates vehicles on the straight-line method at 10% per annum to nil residual value. 9. All amounts are considered to be material. 10. Ignore tax

The following information relates to Bull Limited for the year ended 30 June 2022: 1. Profit for the year N$202500 (2021: N\$137 500). 2. 1 July 2020: 250000 ordinary shares were already in issue at N$5.00 each. 3. 31 March 2021: there was a rights issue on a basis of 1 ordinary share issued for every 5 already held at a price of N\$6.00. The market value of the ordinary shares immediately before the rights issue was N$7.50 per share. 4. 30 November 2021: 50000 ordinary shares were issued at price of N$5.00 per share. 5. There are 25000 options in existence, each of which allows the holder to acquire four shares as at N\$7.00 per share. The options have already vested but will only expire in many years to come. The average market price per ordinary share for 2021 and 2022 was N\$8.00. These options were in existence throughout 2021 and 2022. 6. Preference shares in issue are convertible (at the option of the preference shareholders) into 50000 ordinary shares on 30 June 2024. If not converted, the preference shares will be redeemed on 30 June 2026. Dividends of N$1000 are incurred annually on these preference shares (these have been correctly accounted for as finance charges). The preference shares were in existence throughout 2021 and 2022. 7. There are no components of other comprehensive income. 8. 1 August 2022: prior to the approval of the financial statements, it was discovered that fuel purchased on 1 October 2019 for N$25000 had been incorrectly debited to vehicles as a separate new vehicle. This fuel had all been used in the same year. The company depreciates vehicles on the straight-line method at 10% per annum to nil residual value. 9. All amounts are considered to be material. 10. Ignore tax Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started