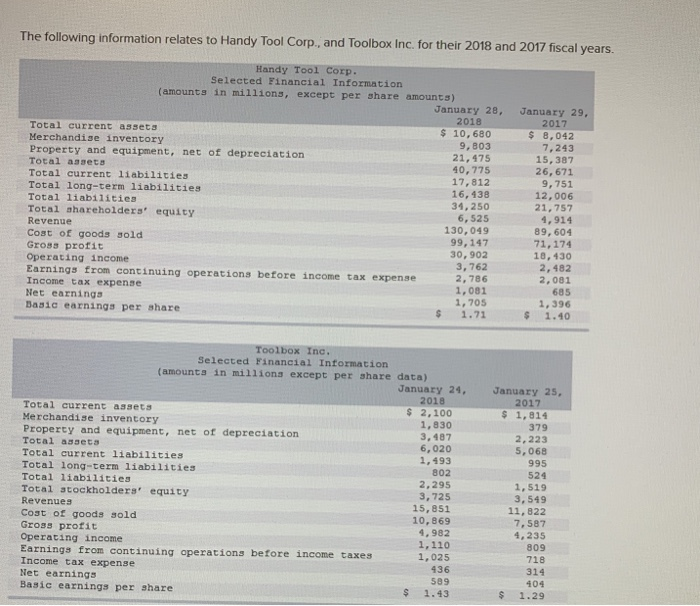

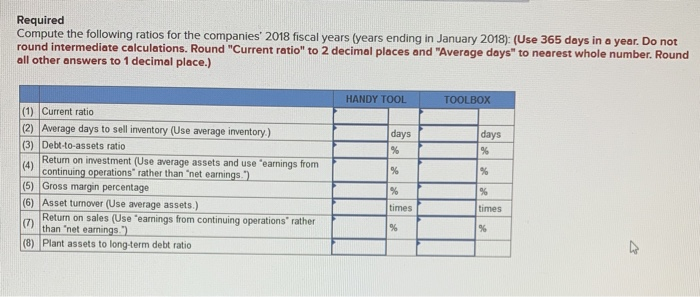

The following information relates to Handy Tool Corp., and Toolbox Inc. for their 2018 and 2017 fiscal years. Handy Tool Corp. Selected Financial Information (amounts in millions, except per share amounts) January 28, 2018 Total current assets $ 10, 680 Merchandise inventory 9,803 Property and equipment, net of depreciation 21,475 Total assets 40, 775 Total current liabilities 17,812 Total long-term liabilities 16,138 Total liabilities 34,250 Total shareholders' equity 6,525 Revenue 130,049 Cost of goods sold 99,147 Gross profit 30,902 Operating income 3,762 Earnings from continuing operations before income tax expense 2,786 Income tax expense 1,081 Net earnings 1, 705 Basic earnings per share $ 1.71 January 29, 2017 $ 8,042 7,243 15,387 26, 671 9,751 12,006 21,757 1,914 89,604 71, 174 18,430 2, 482 2,081 685 1, 396 $ 1.40 Toolbox Inc. Selected Financial Information (amounts in millions except per share data) January 24, 2018 Total current assets $ 2,100 Merchandise inventory 1,830 Property and equipment, net of depreciation 3,187 Total assets 6,020 Total current liabilities 1,493 Total long-term liabilities B02 Total liabilities 2.295 Total stockholders' equity 3,725 Revenues 15,851 Cost of goods gold 10,869 Gross profit 4.982 Operating income 1,110 Earnings from continuing operations before income taxes 1,025 Income tax expense 436 Net earnings 589 Basic earnings per share $ 1.43 January 25, 2017 $ 1,814 379 2.223 5,068 995 524 1,519 3,549 11,822 7,587 4,235 809 718 314 404 $ 1.29 Required Compute the following ratios for the companies' 2018 fiscal years (years ending in January 2018): (Use 365 days in a year. Do not round intermediate calculations. Round "Current ratio" to 2 decimal places and "Average days" to nearest whole number. Round all other answers to 1 decimal place.) HANDY TOOL TOOLBOX I days days % (1) Current ratio (2) Average days to sell inventory (Use average inventory.) (3) Debt-to-assets ratio 4 Return on investment (Use average assets and use earnings from continuing operations rather than "net earnings.") (5) Gross margin percentage (6) Asset turnover (Use average assets.) Return on sales (Use "earnings from continuing operations" rather than "net earnings) (8) Plant assets to long-term debt ratio times times