Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following information relates to the accounting income for Yukon Uranium Enterprises (YUE) for the current year ended December 31. (Click the icon to view

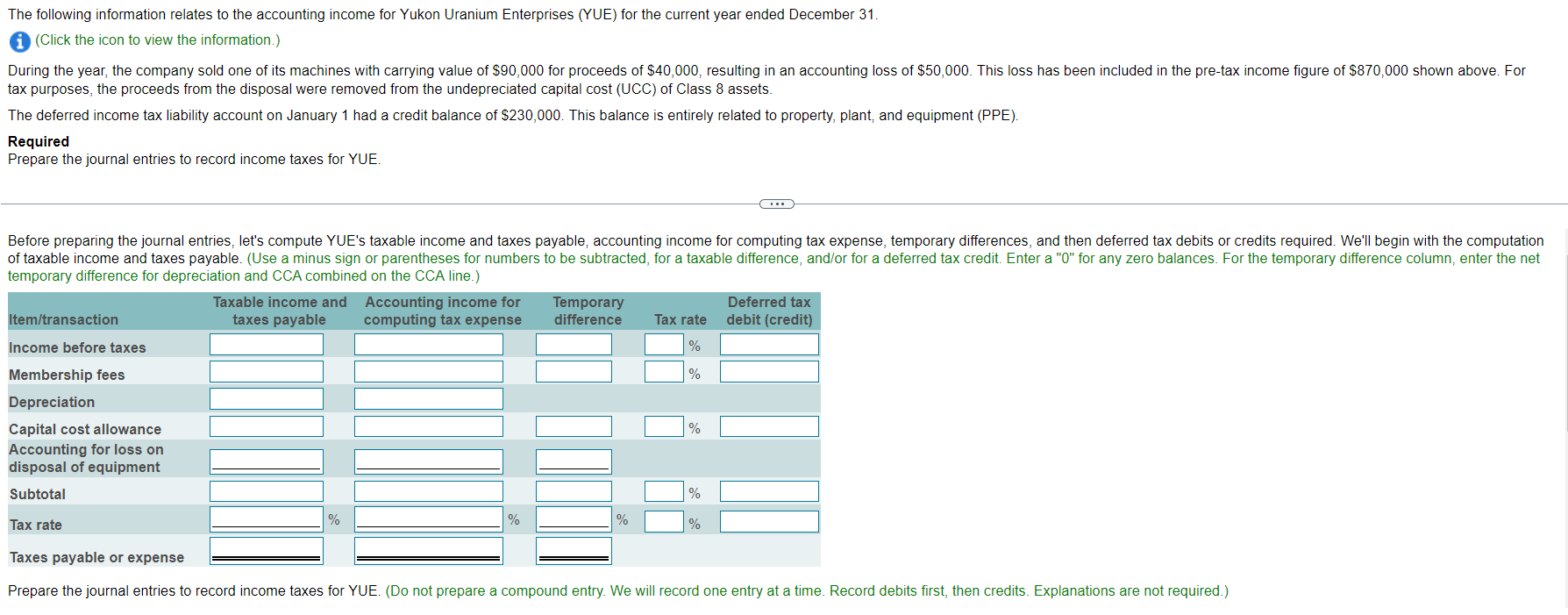

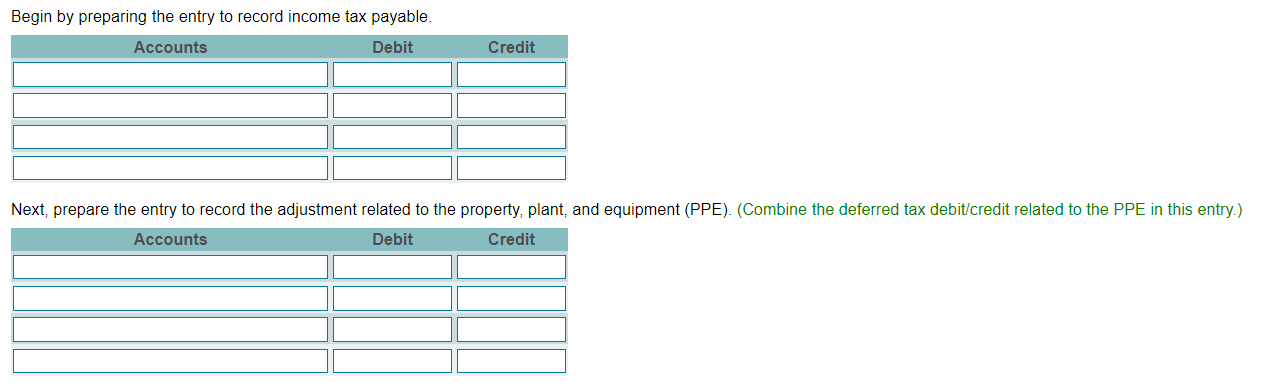

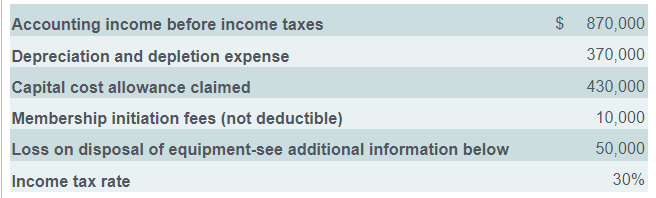

The following information relates to the accounting income for Yukon Uranium Enterprises (YUE) for the current year ended December 31. (Click the icon to view the information.) tax purposes, the proceeds from the disposal were removed from the undepreciated capital cost (UCC) of Class 8 assets. The deferred income tax liability account on January 1 had a credit balance of $230,000. This balance is entirely related to property, plant, and equipment (PPE). Required Prepare the journal entries to record income taxes for YUE. Begin by preparing the entry to record income tax payable. \begin{tabular}{lr} \hline Accounting income before income taxes & $870,000 \\ \hline Depreciation and depletion expense & 370,000 \\ \hline Capital cost allowance claimed & 430,000 \\ \hline Membership initiation fees (not deductible) & 10,000 \\ \hline Loss on disposal of equipment-see additional information below & 50,000 \\ \hline Income tax rate & 30% \end{tabular}

The following information relates to the accounting income for Yukon Uranium Enterprises (YUE) for the current year ended December 31. (Click the icon to view the information.) tax purposes, the proceeds from the disposal were removed from the undepreciated capital cost (UCC) of Class 8 assets. The deferred income tax liability account on January 1 had a credit balance of $230,000. This balance is entirely related to property, plant, and equipment (PPE). Required Prepare the journal entries to record income taxes for YUE. Begin by preparing the entry to record income tax payable. \begin{tabular}{lr} \hline Accounting income before income taxes & $870,000 \\ \hline Depreciation and depletion expense & 370,000 \\ \hline Capital cost allowance claimed & 430,000 \\ \hline Membership initiation fees (not deductible) & 10,000 \\ \hline Loss on disposal of equipment-see additional information below & 50,000 \\ \hline Income tax rate & 30% \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started