Question

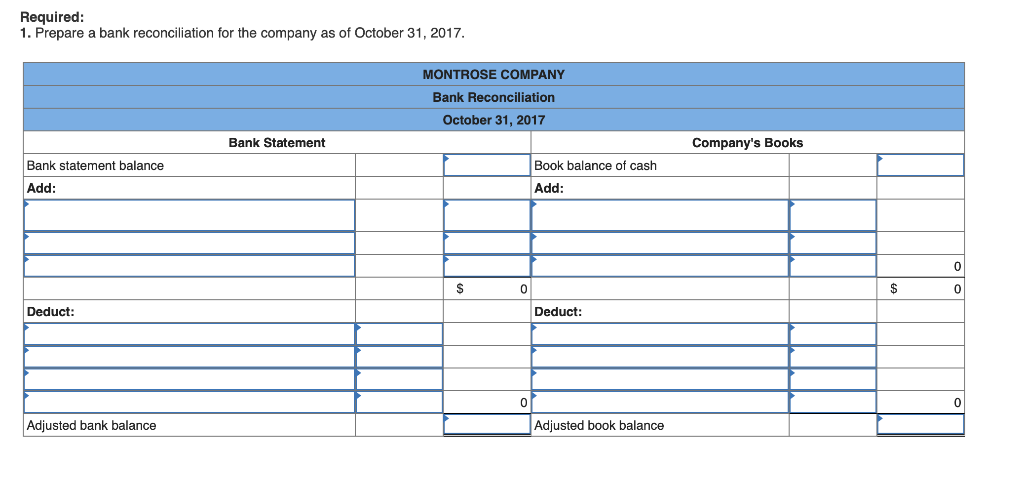

The following information was available to reconcile Montrose Companys book balance of Cash with its bank statement balance as of October 31, 2017: a. After

The following information was available to reconcile Montrose Companys book balance of Cash with its bank statement balance as of October 31, 2017:

| a. | After all posting was completed on October 31, the companys Cash account had a $14,365 debit balance, but its bank statement showed a $31,903 balance. |

| b. | Cheques #296 for $1,452 and #307 for $13,880 were outstanding on the September 30 bank reconciliation. Cheque #307 was returned with the October cancelled cheques, but cheque #296 was not. It was also found that cheque #315 for $972 and cheque #321 for $2,178, both written in October, were not among the cancelled cheques returned with the statement. |

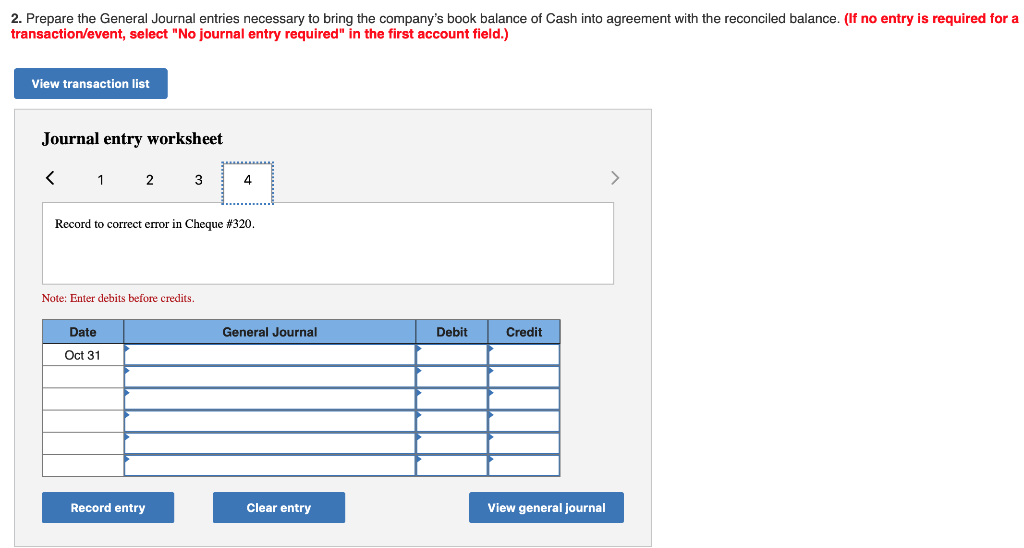

| c. | In comparing the cancelled cheques returned by the bank with the entries in the accounting records, it was found that cheque #320 for the October rent was correctly written for $4,070 but was erroneously entered in the accounting records as $4,700. |

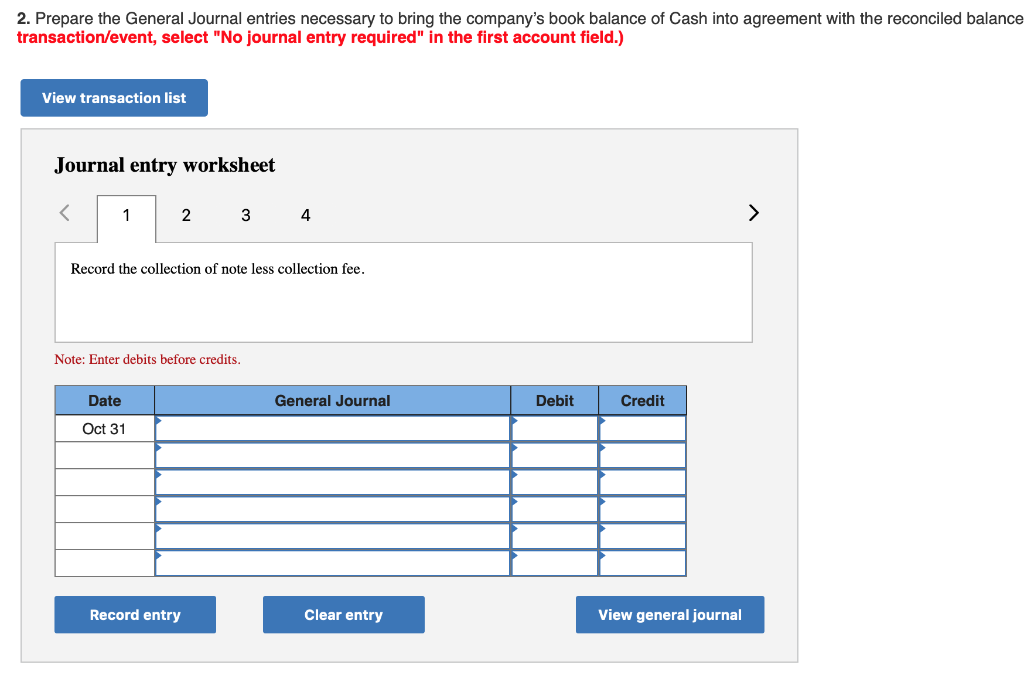

| d. | A credit memo enclosed with the bank statement indicated that there was an electronic fund transfer related to a customer payment for $22,100. A $130 bank service charge was deducted. This transaction was not recorded by Montrose before receiving the bank statement. |

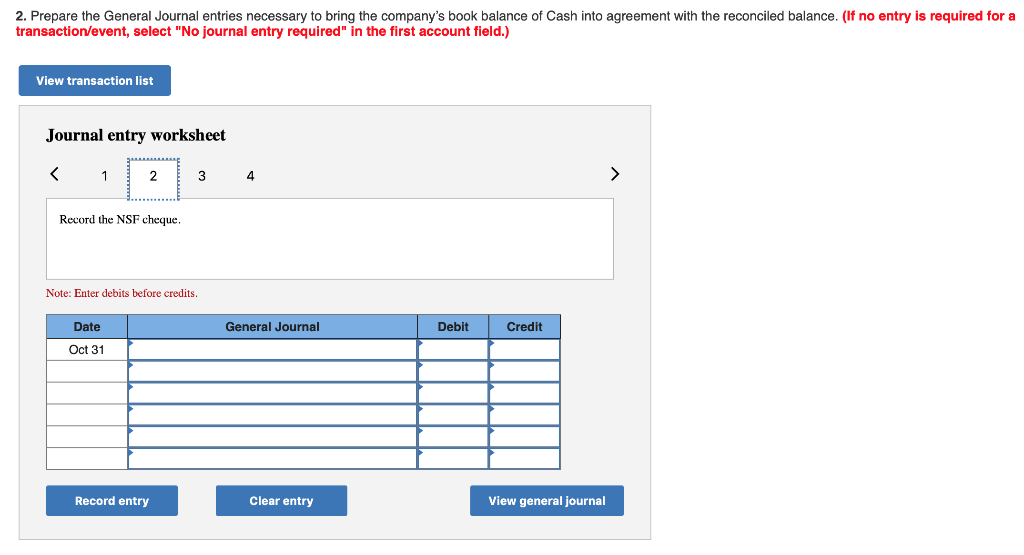

| e. | A debit memo for $3,521 listed a $3,467 NSF cheque plus a $54 NSF charge. The cheque had been received from a customer, Jefferson Tyler. Montrose had not recorded this bounced cheque before receiving the statement. |

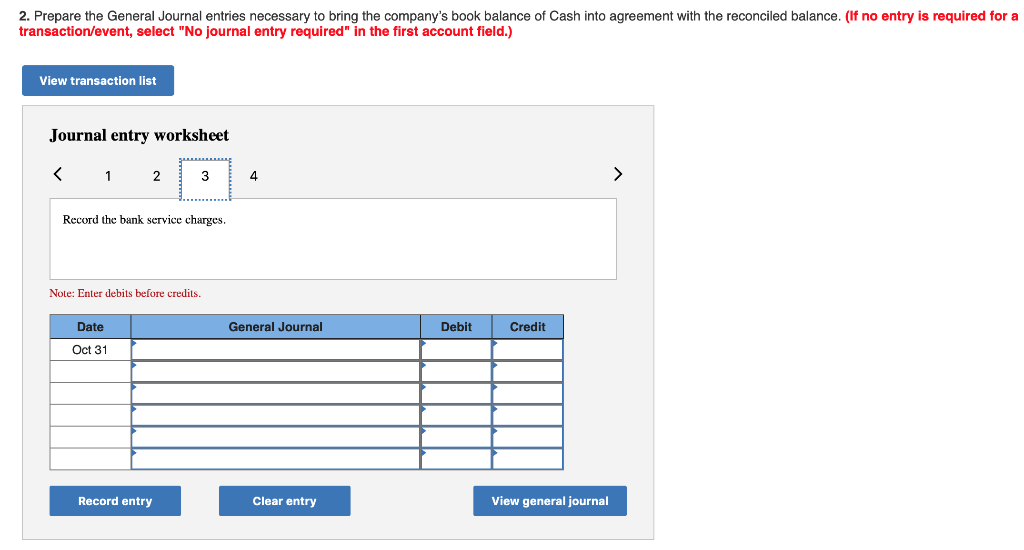

| f. | Also enclosed with the statement was a $81 debit memo for bank services. It had not been recorded because no previous notification had been received. |

| g. | The October 31 cash receipts, $6,062, were placed in the banks night depository after banking hours on that date and this amount did not appear on the bank statement. |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started