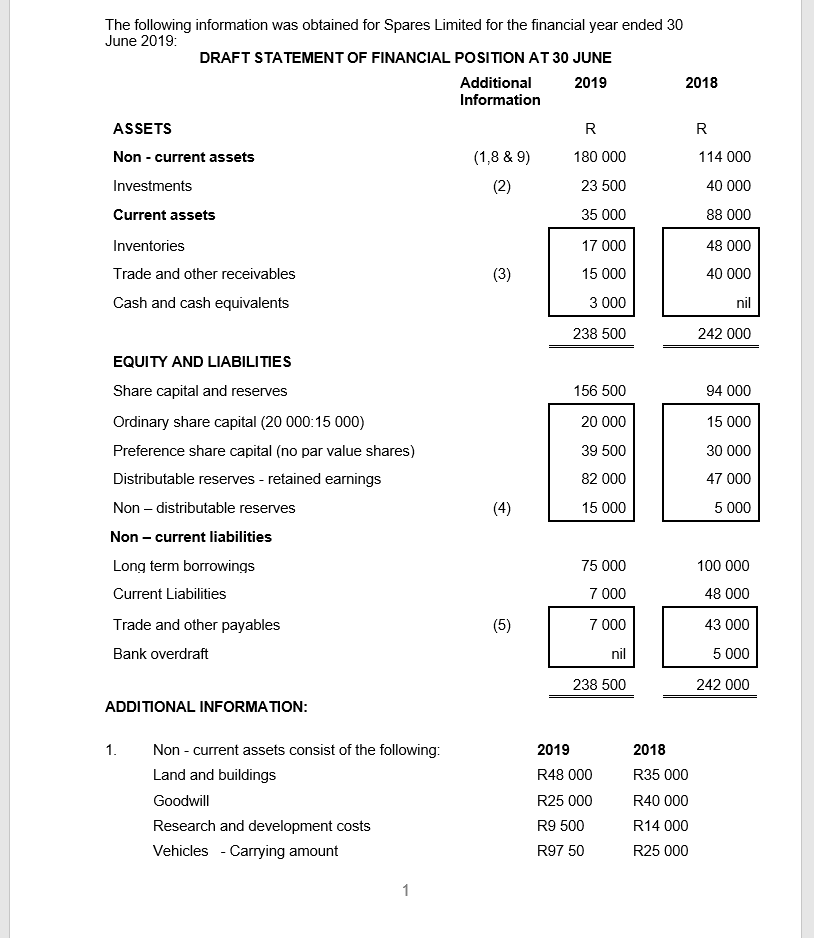

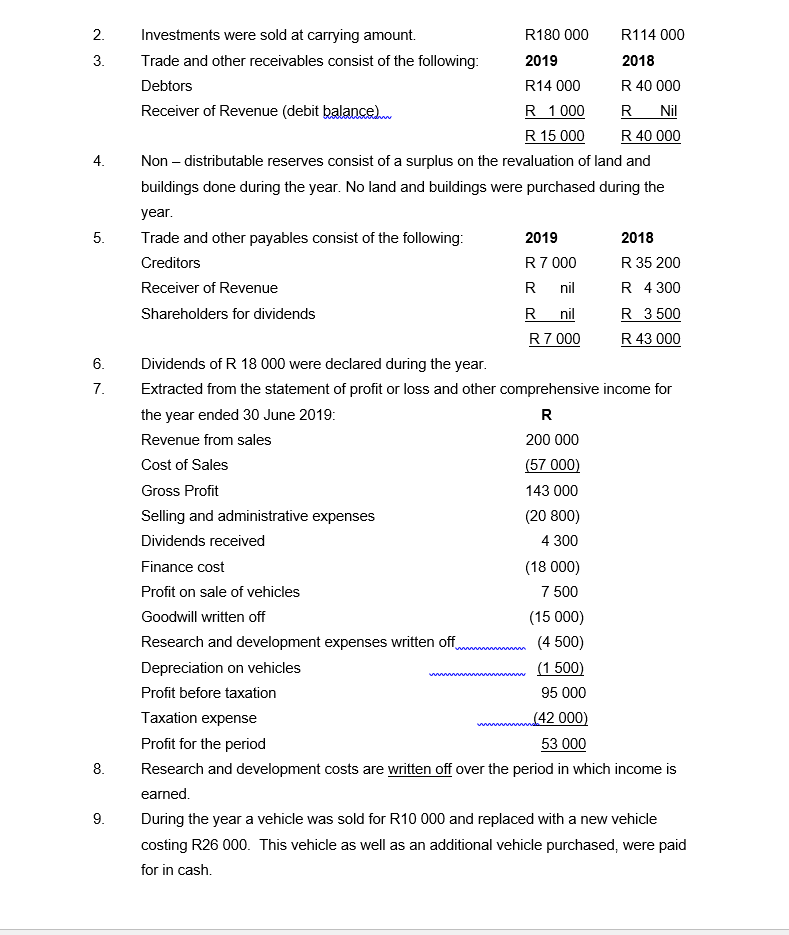

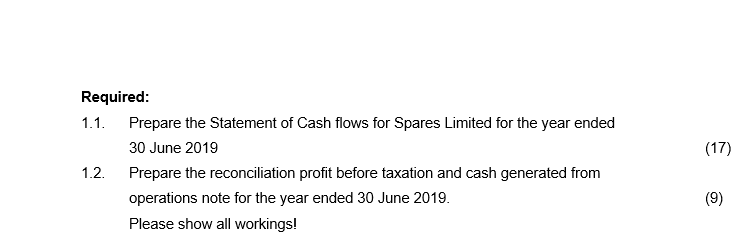

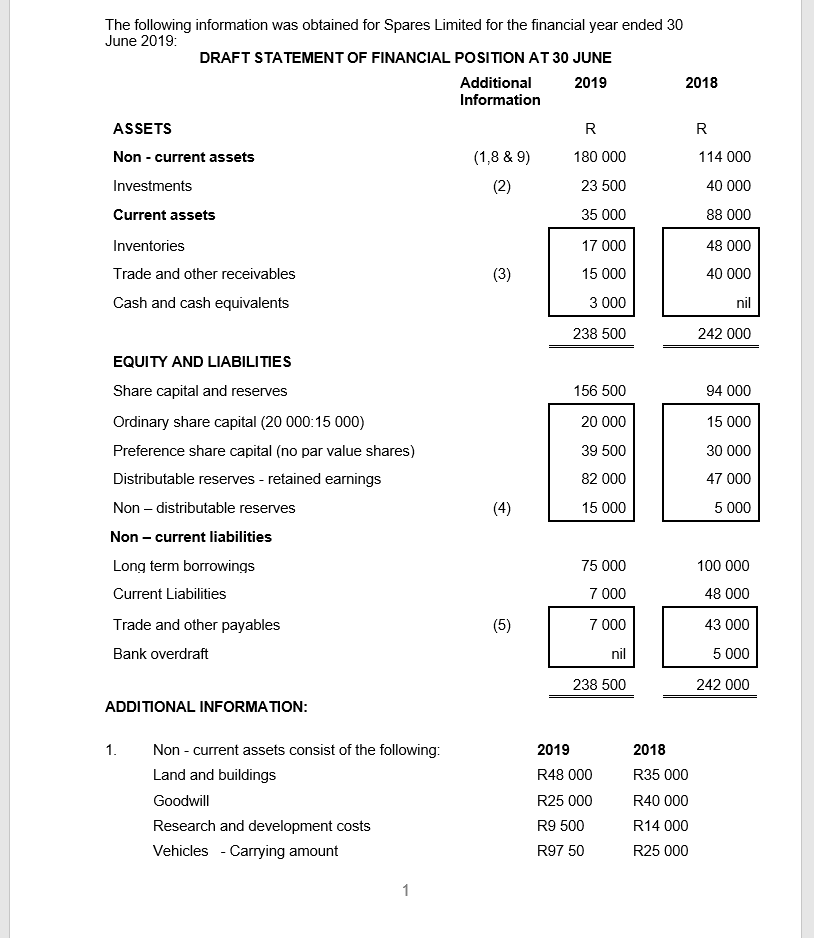

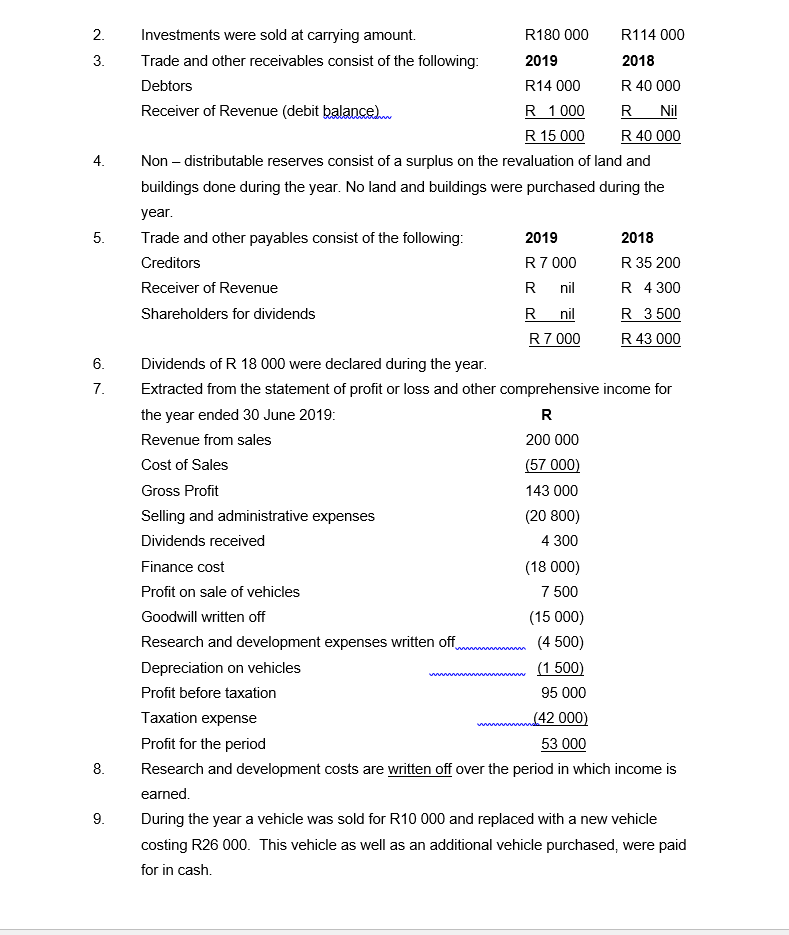

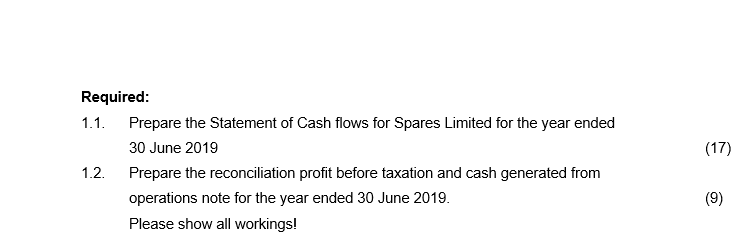

The following information was obtained for Spares Limited for the financial year ended 30 June 2019: DRAFT STATEMENT OF FINANCIAL POSITION AT 30 JUNE Additional 2019 2018 Information ASSETS R R Non - current assets (1,8 & 9) 180 000 114 000 Investments (2) 23 500 40 000 Current assets 35 000 88 000 Inventories 17 000 48 000 Trade and other receivables 15 000 40 000 Cash and cash equivalents 3 000 nil (3) 238 500 242 000 156 500 94 000 20 000 15 000 39 500 30 000 82 000 47 000 EQUITY AND LIABILITIES Share capital and reserves Ordinary share capital (20 000:15 000) Preference share capital (no par value shares) Distributable reserves - retained earnings Non-distributable reserves Non - current liabilities Long term borrowings Current Liabilities Trade and other payables Bank overdraft 15 000 5 000 75 000 100 000 7 000 48 000 (5) 7 000 43 000 nil 5 000 238 500 242 000 ADDITIONAL INFORMATION: 1. Non-current assets consist of the following: Land and buildings Goodwill Research and development costs Vehicles - Carrying amount 2019 R48 000 R25 000 R9 500 R97 50 2018 R35 000 R40 000 R14 000 R25 000 1 2. 3. 4. 5. 6. 7. Investments were sold at carrying amount. R180 000 R114 000 Trade and other receivables consist of the following: 2019 2018 Debtors R14 000 R 40 000 Receiver of Revenue (debit balanced R1 000 R Nil R 15 000 R 40 000 Non distributable reserves consist of a surplus on the revaluation of land and buildings done during the year. No land and buildings were purchased during the year. Trade and other payables consist of the following: 2019 2018 Creditors R7 000 R 35 200 Receiver of Revenue Rnil R 4 300 Shareholders for dividends R nil R 3500 R 7000 R 43 000 Dividends of R 18 000 were declared during the year. Extracted from the statement of profit or loss and other comprehensive income for the year ended 30 June 2019: R Revenue from sales 200 000 Cost of Sales (57 000) Gross Profit 143 000 Selling and administrative expenses (20 800) Dividends received 4 300 Finance cost (18 000) Profit on sale of vehicles 7 500 Goodwill written off (15 000) Research and development expenses written offm (4 500) Depreciation on vehicles (1 500) Profit before taxation 95 000 Taxation expense 142 000) Profit for the period 53 000 Research and development costs are written off over the period in which income is earned. During the year a vehicle was sold for R10 000 and replaced with a new vehicle costing R26 000. This vehicle as well as an additional vehicle purchased, were paid for in cash. 8. 9. (17) Required: 1.1. Prepare the Statement of Cash flows for Spares Limited for the year ended 30 June 2019 1.2. Prepare the reconciliation profit before taxation and cash generated from operations note for the year ended 30 June 2019. Please show all workings! (9) The following information was obtained for Spares Limited for the financial year ended 30 June 2019: DRAFT STATEMENT OF FINANCIAL POSITION AT 30 JUNE Additional 2019 2018 Information ASSETS R R Non - current assets (1,8 & 9) 180 000 114 000 Investments (2) 23 500 40 000 Current assets 35 000 88 000 Inventories 17 000 48 000 Trade and other receivables 15 000 40 000 Cash and cash equivalents 3 000 nil (3) 238 500 242 000 156 500 94 000 20 000 15 000 39 500 30 000 82 000 47 000 EQUITY AND LIABILITIES Share capital and reserves Ordinary share capital (20 000:15 000) Preference share capital (no par value shares) Distributable reserves - retained earnings Non-distributable reserves Non - current liabilities Long term borrowings Current Liabilities Trade and other payables Bank overdraft 15 000 5 000 75 000 100 000 7 000 48 000 (5) 7 000 43 000 nil 5 000 238 500 242 000 ADDITIONAL INFORMATION: 1. Non-current assets consist of the following: Land and buildings Goodwill Research and development costs Vehicles - Carrying amount 2019 R48 000 R25 000 R9 500 R97 50 2018 R35 000 R40 000 R14 000 R25 000 1 2. 3. 4. 5. 6. 7. Investments were sold at carrying amount. R180 000 R114 000 Trade and other receivables consist of the following: 2019 2018 Debtors R14 000 R 40 000 Receiver of Revenue (debit balanced R1 000 R Nil R 15 000 R 40 000 Non distributable reserves consist of a surplus on the revaluation of land and buildings done during the year. No land and buildings were purchased during the year. Trade and other payables consist of the following: 2019 2018 Creditors R7 000 R 35 200 Receiver of Revenue Rnil R 4 300 Shareholders for dividends R nil R 3500 R 7000 R 43 000 Dividends of R 18 000 were declared during the year. Extracted from the statement of profit or loss and other comprehensive income for the year ended 30 June 2019: R Revenue from sales 200 000 Cost of Sales (57 000) Gross Profit 143 000 Selling and administrative expenses (20 800) Dividends received 4 300 Finance cost (18 000) Profit on sale of vehicles 7 500 Goodwill written off (15 000) Research and development expenses written offm (4 500) Depreciation on vehicles (1 500) Profit before taxation 95 000 Taxation expense 142 000) Profit for the period 53 000 Research and development costs are written off over the period in which income is earned. During the year a vehicle was sold for R10 000 and replaced with a new vehicle costing R26 000. This vehicle as well as an additional vehicle purchased, were paid for in cash. 8. 9. (17) Required: 1.1. Prepare the Statement of Cash flows for Spares Limited for the year ended 30 June 2019 1.2. Prepare the reconciliation profit before taxation and cash generated from operations note for the year ended 30 June 2019. Please show all workings! (9)