Answered step by step

Verified Expert Solution

Question

1 Approved Answer

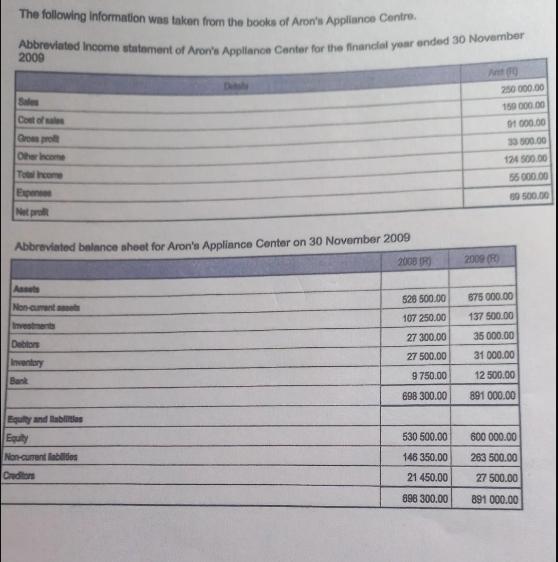

The following information was taken from the books of Aron's Appliance Centre. Abbreviated Income statement of Aron's Appliance Center for the financial year ended

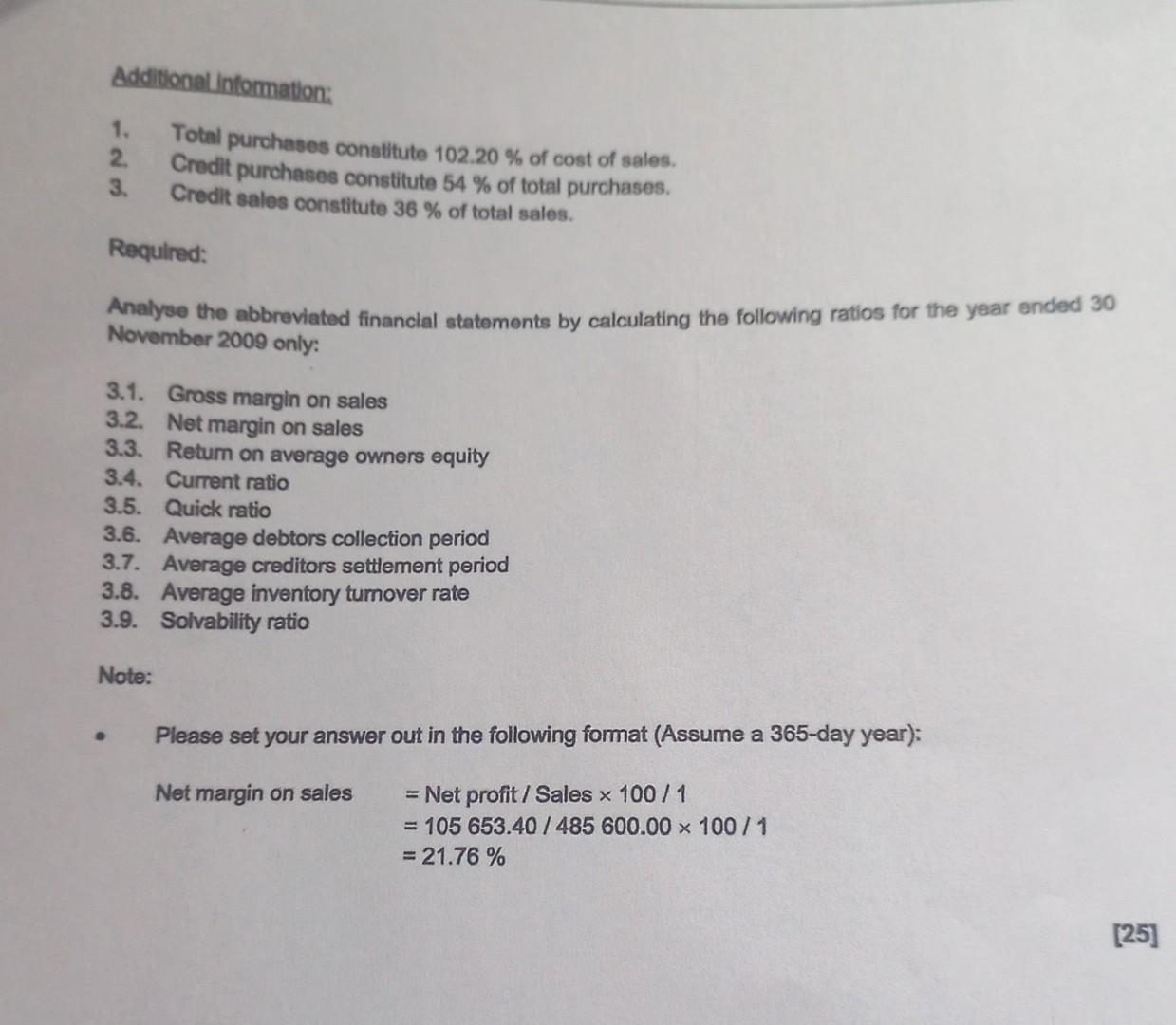

The following information was taken from the books of Aron's Appliance Centre. Abbreviated Income statement of Aron's Appliance Center for the financial year ended 30 November 2009 Sales Cost of sales Gross prof Other Income Total Income Expenses Net prot Abbreviated balance sheet for Aron's Appliance Center on 30 November 2009 2008 (R) Assets Non-cument ass Debtors Inventory Bank Equity and lablities Equity Non-current liabides Creditors 528 500.00 107 250.00 27 300.00 27 500.00 9750.00 698 300.00 530 500.00 146 350.00 21 450.00 896 300.00 Art (10) 2009 (R 250 000.00 150 000.00 91 000.00 33 500.00 124 500.00 56 000.00 69 500.00 675 000.00 137 500.00 35 000.00 31 000.00 12 500.00 891 000.00 600 000.00 263 500.00 27 500.00 891 000.00 Additional Information: 1. 2. 3. Total purchases constitute 102.20 % of cost of sales. Credit purchases constitute 54 % of total purchases. Credit sales constitute 36 % of total sales. Required: Analyse the abbreviated financial statements by calculating the following ratios for the year ended 30 November 2009 only: 3.1. Gross margin on sales 3.2. Net margin on sales 3.3. Return on average owners equity 3.4. Current ratio 3.5. Quick ratio 3.6. Average debtors collection period 3.7. Average creditors settlement period 3.8. Average inventory turnover rate 3.9. Solvability ratio Note: Please set your answer out in the following format (Assume a 365-day year): Net margin on sales = Net profit / Sales 100 / 1 = 105 653.40/485 600.00 100 / 1 = 21.76 % [25]

Step by Step Solution

★★★★★

3.47 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started