Answered step by step

Verified Expert Solution

Question

1 Approved Answer

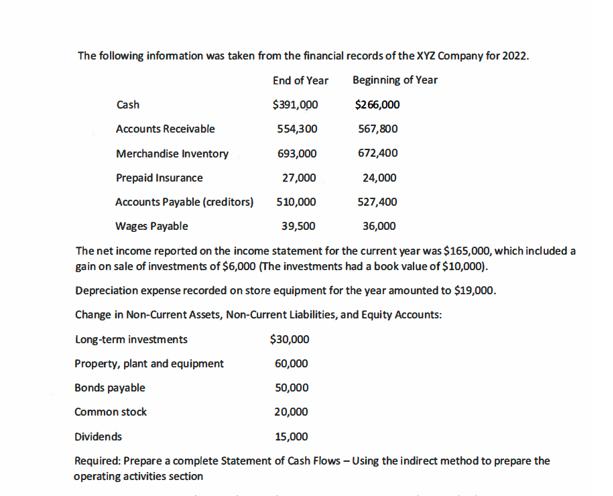

The following information was taken from the financial records of the XYZ Company for 2022. End of Year Beginning of Year Cash $391,000 $266,000

The following information was taken from the financial records of the XYZ Company for 2022. End of Year Beginning of Year Cash $391,000 $266,000 Accounts Receivable 554,300 567,800 Merchandise Inventory 693,000 672,400 Prepaid Insurance 27,000 24,000 Accounts Payable (creditors) 510,000 527,400 Wages Payable 39,500 36,000 The net income reported on the income statement for the current year was $165,000, which included a gain on sale of investments of $6,000 (The investments had a book value of $10,000). Depreciation expense recorded on store equipment for the year amounted to $19,000. Change in Non-Current Assets, Non-Current Liabilities, and Equity Accounts: Long-term investments $30,000 Property, plant and equipment 60,000 Bonds payable 50,000 Common stock 20,000 Dividends 15,000 Required: Prepare a complete Statement of Cash Flows - Using the indirect method to prepare the operating activities section

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Statement of Cash Flows for the year ended December 31 2022 using the indirect method Operating Acti...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started