Answered step by step

Verified Expert Solution

Question

1 Approved Answer

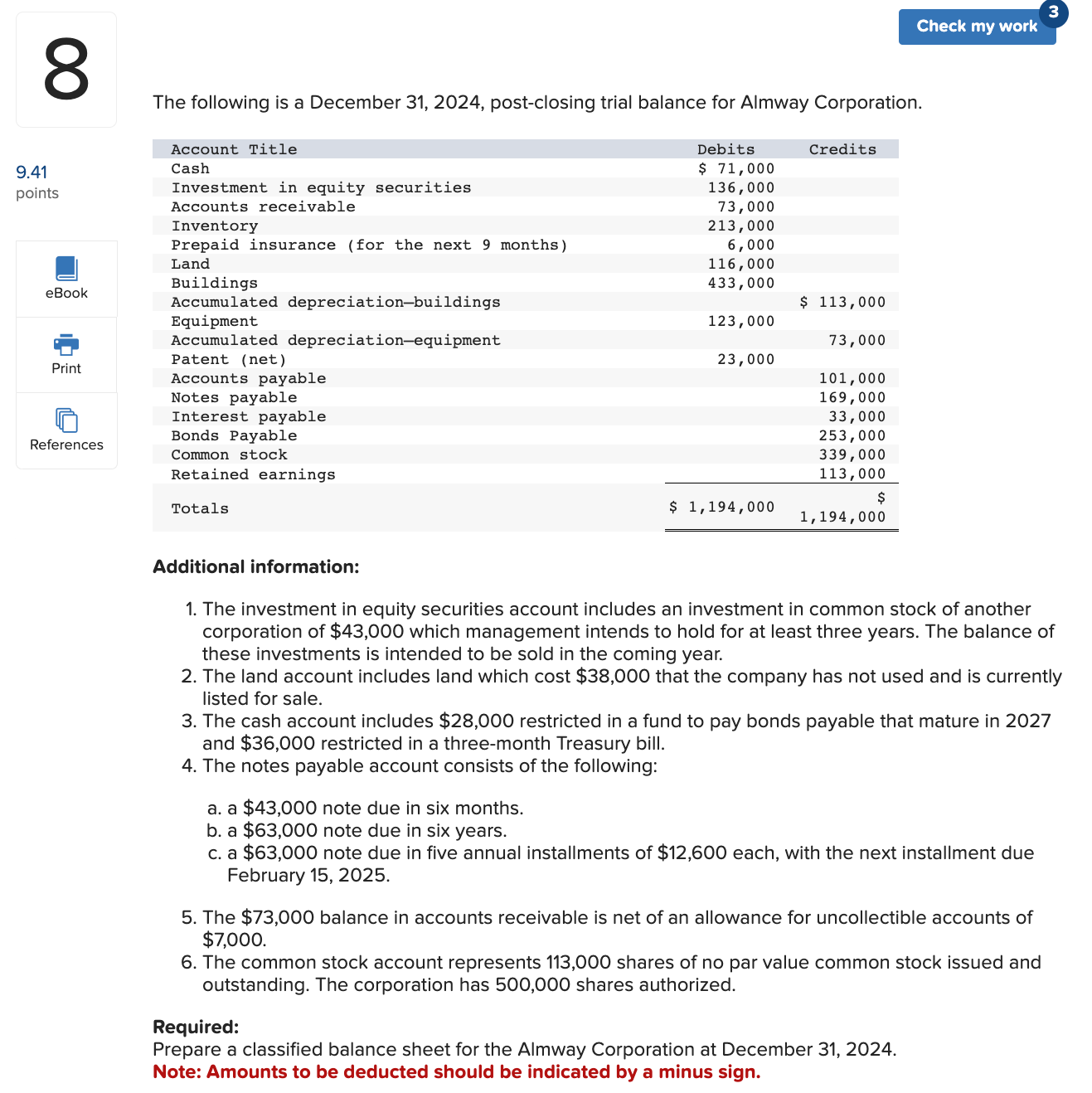

The following is a December 31, 2024, post-closing trial balance for Almway Corporation. Additional information: 1. The investment in equity securities account includes an investment

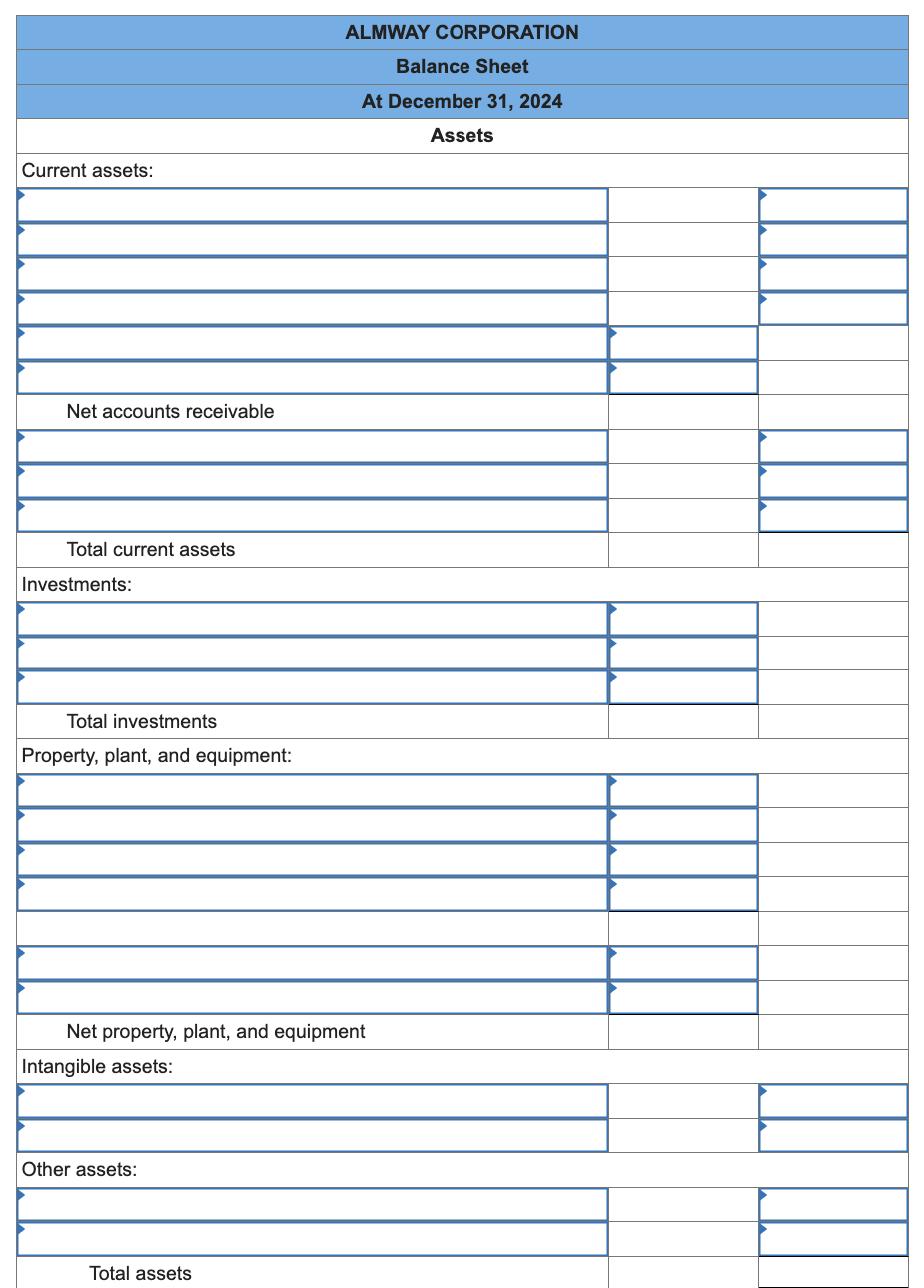

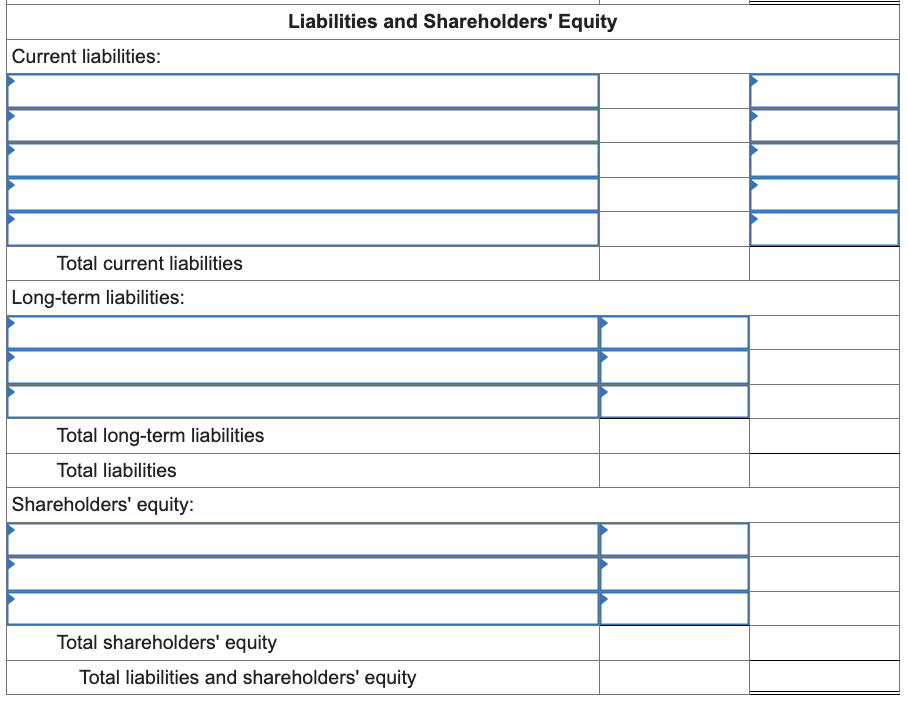

The following is a December 31, 2024, post-closing trial balance for Almway Corporation. Additional information: 1. The investment in equity securities account includes an investment in common stock of another corporation of $43,000 which management intends to hold for at least three years. The balance of these investments is intended to be sold in the coming year. 2. The land account includes land which cost $38,000 that the company has not used and is currently listed for sale. 3. The cash account includes $28,000 restricted in a fund to pay bonds payable that mature in 2027 and $36,000 restricted in a three-month Treasury bill. 4. The notes payable account consists of the following: a. a $43,000 note due in six months. b. a $63,000 note due in six years. c. a $63,000 note due in five annual installments of $12,600 each, with the next installment due February 15, 2025. 5. The $73,000 balance in accounts receivable is net of an allowance for uncollectible accounts of $7,000. 6. The common stock account represents 113,000 shares of no par value common stock issued and outstanding. The corporation has 500,000 shares authorized. Required: Prepare a classified balance sheet for the Almway Corporation at December 31, 2024. Note: Amounts to be deducted should be indicated by a minus sign. ALMWAY CORPORATION Balance Sheet At December 31, 2024 Assets Current assets: \begin{tabular}{|c|c|c|} \hline \multicolumn{2}{|c|}{ Liabilities and Shareholders' Equity } \\ \hline Current liabilities: & & \\ \hline & & \\ \hline & & \\ \hline Total current liabilities & & \\ \hline Long-term liabilities: & & \\ \hline & & \\ \hline Total long-term liabilities & & \\ \hline Total liabilities & & \\ \hline Shareholders' equity: & \\ \hline Total shareholders' equity & \\ \hline \end{tabular} The following is a December 31, 2024, post-closing trial balance for Almway Corporation. Additional information: 1. The investment in equity securities account includes an investment in common stock of another corporation of $43,000 which management intends to hold for at least three years. The balance of these investments is intended to be sold in the coming year. 2. The land account includes land which cost $38,000 that the company has not used and is currently listed for sale. 3. The cash account includes $28,000 restricted in a fund to pay bonds payable that mature in 2027 and $36,000 restricted in a three-month Treasury bill. 4. The notes payable account consists of the following: a. a $43,000 note due in six months. b. a $63,000 note due in six years. c. a $63,000 note due in five annual installments of $12,600 each, with the next installment due February 15, 2025. 5. The $73,000 balance in accounts receivable is net of an allowance for uncollectible accounts of $7,000. 6. The common stock account represents 113,000 shares of no par value common stock issued and outstanding. The corporation has 500,000 shares authorized. Required: Prepare a classified balance sheet for the Almway Corporation at December 31, 2024. Note: Amounts to be deducted should be indicated by a minus sign. ALMWAY CORPORATION Balance Sheet At December 31, 2024 Assets Current assets: \begin{tabular}{|c|c|c|} \hline \multicolumn{2}{|c|}{ Liabilities and Shareholders' Equity } \\ \hline Current liabilities: & & \\ \hline & & \\ \hline & & \\ \hline Total current liabilities & & \\ \hline Long-term liabilities: & & \\ \hline & & \\ \hline Total long-term liabilities & & \\ \hline Total liabilities & & \\ \hline Shareholders' equity: & \\ \hline Total shareholders' equity & \\ \hline \end{tabular}

The following is a December 31, 2024, post-closing trial balance for Almway Corporation. Additional information: 1. The investment in equity securities account includes an investment in common stock of another corporation of $43,000 which management intends to hold for at least three years. The balance of these investments is intended to be sold in the coming year. 2. The land account includes land which cost $38,000 that the company has not used and is currently listed for sale. 3. The cash account includes $28,000 restricted in a fund to pay bonds payable that mature in 2027 and $36,000 restricted in a three-month Treasury bill. 4. The notes payable account consists of the following: a. a $43,000 note due in six months. b. a $63,000 note due in six years. c. a $63,000 note due in five annual installments of $12,600 each, with the next installment due February 15, 2025. 5. The $73,000 balance in accounts receivable is net of an allowance for uncollectible accounts of $7,000. 6. The common stock account represents 113,000 shares of no par value common stock issued and outstanding. The corporation has 500,000 shares authorized. Required: Prepare a classified balance sheet for the Almway Corporation at December 31, 2024. Note: Amounts to be deducted should be indicated by a minus sign. ALMWAY CORPORATION Balance Sheet At December 31, 2024 Assets Current assets: \begin{tabular}{|c|c|c|} \hline \multicolumn{2}{|c|}{ Liabilities and Shareholders' Equity } \\ \hline Current liabilities: & & \\ \hline & & \\ \hline & & \\ \hline Total current liabilities & & \\ \hline Long-term liabilities: & & \\ \hline & & \\ \hline Total long-term liabilities & & \\ \hline Total liabilities & & \\ \hline Shareholders' equity: & \\ \hline Total shareholders' equity & \\ \hline \end{tabular} The following is a December 31, 2024, post-closing trial balance for Almway Corporation. Additional information: 1. The investment in equity securities account includes an investment in common stock of another corporation of $43,000 which management intends to hold for at least three years. The balance of these investments is intended to be sold in the coming year. 2. The land account includes land which cost $38,000 that the company has not used and is currently listed for sale. 3. The cash account includes $28,000 restricted in a fund to pay bonds payable that mature in 2027 and $36,000 restricted in a three-month Treasury bill. 4. The notes payable account consists of the following: a. a $43,000 note due in six months. b. a $63,000 note due in six years. c. a $63,000 note due in five annual installments of $12,600 each, with the next installment due February 15, 2025. 5. The $73,000 balance in accounts receivable is net of an allowance for uncollectible accounts of $7,000. 6. The common stock account represents 113,000 shares of no par value common stock issued and outstanding. The corporation has 500,000 shares authorized. Required: Prepare a classified balance sheet for the Almway Corporation at December 31, 2024. Note: Amounts to be deducted should be indicated by a minus sign. ALMWAY CORPORATION Balance Sheet At December 31, 2024 Assets Current assets: \begin{tabular}{|c|c|c|} \hline \multicolumn{2}{|c|}{ Liabilities and Shareholders' Equity } \\ \hline Current liabilities: & & \\ \hline & & \\ \hline & & \\ \hline Total current liabilities & & \\ \hline Long-term liabilities: & & \\ \hline & & \\ \hline Total long-term liabilities & & \\ \hline Total liabilities & & \\ \hline Shareholders' equity: & \\ \hline Total shareholders' equity & \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started