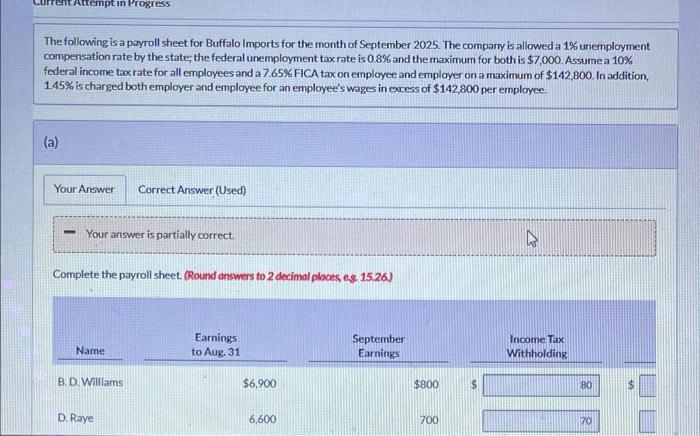

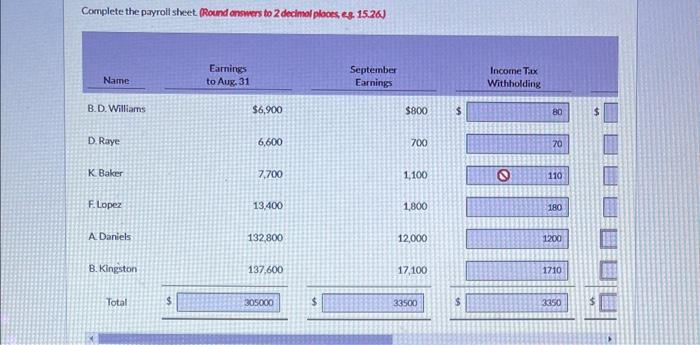

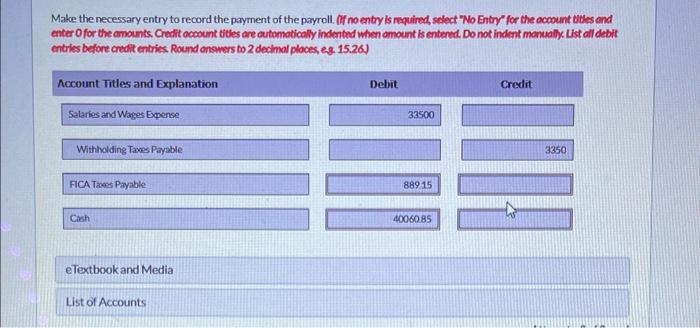

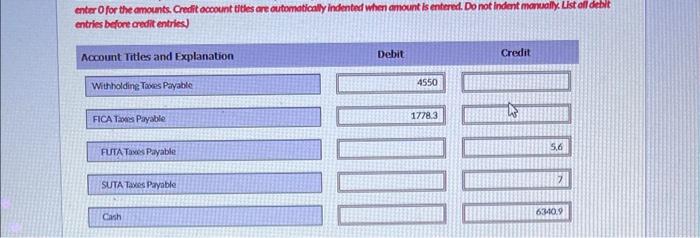

The following is a payroll sheet for Buffalo Imports for the month of September 2025 . The compary is allowed a 1% unemployment compensation rate by the state; the federal unemployment tax rate is 0.8% and the maximum for both is $7,000. Assume 10% federal income tax rate for all employees and a 7.65%FICA tax on employee and employer on a maximum of $142,800. In addition, 1.45% is charged both employer and employee for an employee's wages in exess of $142,800 per employee (a) - Your answer is partially correct. Complete the payroll sheet. (Round answers to 2 decimal plooes eg. 15.26) Complete the payroll sheet (Round enswers to 2 decimol plooes, eg. 15.26) Make the necessary entry to record the payment of the payroll. (ff no entry is required, select "No Entry" for the ocoount viles and enter 0 for the amounts. Credit occount tibles are outomaticolly indented when amount is entened. Do not indent manually List oll debit entries before credit entries. Round onswers to 2 decinal ploces, eg. 15.26) enter Ofor the anounts. Credit ocoount vites are outomatically indented when enount is entered. Do not indent monuaily. Lst ell debit entries before credit entries) The following is a payroll sheet for Buffalo Imports for the month of September 2025 . The compary is allowed a 1% unemployment compensation rate by the state; the federal unemployment tax rate is 0.8% and the maximum for both is $7,000. Assume 10% federal income tax rate for all employees and a 7.65%FICA tax on employee and employer on a maximum of $142,800. In addition, 1.45% is charged both employer and employee for an employee's wages in exess of $142,800 per employee (a) - Your answer is partially correct. Complete the payroll sheet. (Round answers to 2 decimal plooes eg. 15.26) Complete the payroll sheet (Round enswers to 2 decimol plooes, eg. 15.26) Make the necessary entry to record the payment of the payroll. (ff no entry is required, select "No Entry" for the ocoount viles and enter 0 for the amounts. Credit occount tibles are outomaticolly indented when amount is entened. Do not indent manually List oll debit entries before credit entries. Round onswers to 2 decinal ploces, eg. 15.26) enter Ofor the anounts. Credit ocoount vites are outomatically indented when enount is entered. Do not indent monuaily. Lst ell debit entries before credit entries)