Answered step by step

Verified Expert Solution

Question

1 Approved Answer

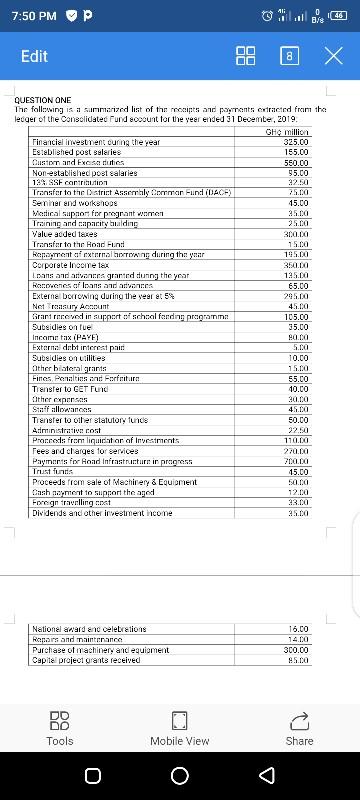

7:50 PM P Edit Financial investment curing the year Established post salaries Custom and Excise duties Non-established post salaries 13% SSF contribution Transfer to

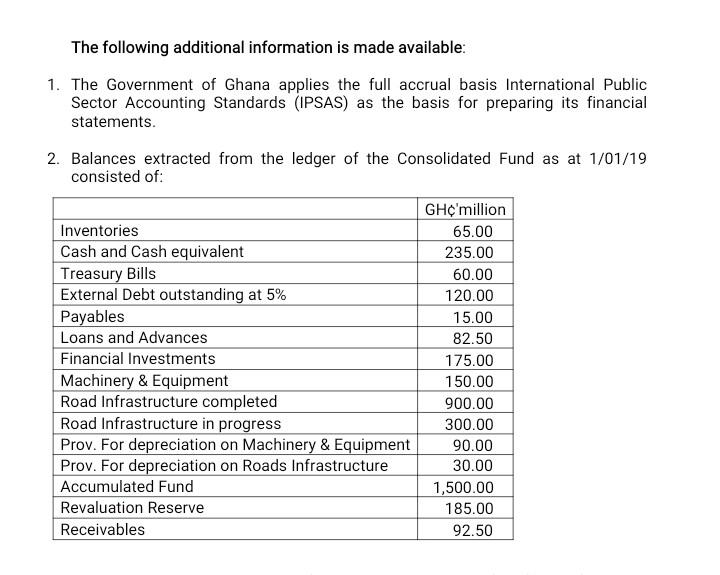

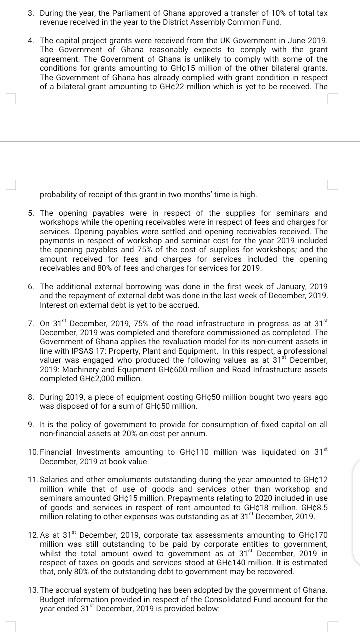

7:50 PM P Edit Financial investment curing the year Established post salaries Custom and Excise duties Non-established post salaries 13% SSF contribution Transfer to the District Assembly Comman Fund (DACF) Seminar and workshops Medical support for pregnant women Training and capacity building Value added taxes Transfer to the Road Fund Repayment of external borrowing during the year Corporate Income tax QUESTION ONE The following is a summarized list of the receipts and payments extracted from the ledger of the Consolidated Fund account for the year ended 31 December, 2019. Loans and advances granted during the year Recovenes of Ioans and advances External borrowing during the year at 5% Net Treasury Account Grant received in support of school fonding programma Subsidies on fuel Income tax (PAYE) External debt interest paid Subsidies on utilities Other bilateral grants Fines, Penalties and Forfeiture Transfer to GET Fund Other expenses Staff allowances Transfer to other statutory funds Administrative cost Proceeds from liquidation of Investments Tees and charges for services Payments for Road Infrastructure in progress Trust funds Proceeds from sale of Machinery & Equipment Cash payment to support the aged Foreign travelling cost Dividends and other investment income National award and celebrations Repairs and maintenance Purchase of machinery and equipment Capital project grants received DO DO Tools U Mobile View 8 GHe million 325.00 155.00 550.00 55.00 32.50 25.00 45.00 35.00 25.00 300.00 15.00 195.00 350.00 135.00 65.00 295.00 45.00 105.00 35.00 80.00 5.00 10.00 15.00 55.00 40.00 30.00 45.00 50.00 22.50 110.00 270.00 700.00 45.00 50.00 12.00 33.00 35.00 Bis 16.00 14.00 300.00 85.00 Share 46 X The following additional information is made available: 1. The Government of Ghana applies the full accrual basis International Public Sector Accounting Standards (IPSAS) as the basis for preparing its financial statements. 2. Balances extracted from the ledger of the Consolidated Fund as at 1/01/19 consisted of: Inventories Cash and Cash equivalent Treasury Bills External Debt outstanding at 5% Payables Loans and Advances Financial Investments Machinery & Equipment Road Infrastructure completed Road Infrastructure in progress Prov. For depreciation on Machinery & Equipment Prov. For depreciation on Roads Infrastructure Accumulated Fund Revaluation Reserve Receivables GH'million 65.00 235.00 60.00 120.00 15.00 82.50 175.00 150.00 900.00 300.00 90.00 30.00 1,500.00 185.00 92.50 3. During the year, the Parliament of Ghane approved a transfer of 10% of total tax revenue received in the year to the District Assembly Common Fund. 4. The capital project grants were rannived from the UK Government in June 2019. The Government of Ghana reasonably expects to comply with the grant agreement. The Government of Ghana is unlikely to comply with some of the conditions for grants amounting to GHC15 milion of the other bilateral grants. The Government of Ghana has already compled with grant condition in respect of a bilateral grant amounting to GHC22 million which is yet to be received. The probability of resnipt of this grant in two months' time is high 5. The opening payables were in respect of the supplies for seminars and workshops while the opening receivables were in respect of fees and charges for services. Opening payables were settled and opening rennivables received. payments in respect of workshop and seminar cast for the year 2019 included the opening payables and 25% of the cost of supplies for workshops and the amount received for fees and charges for services included the opening receivables and B0% of tees and charges for services for 2019 6. The additional external borrowing was done in the first week of January, 2019 and the repayment of external debt was done in the last week of December, 2019. Interest on external debt is yet to be accrued. 7 On 31 December, 2019, 75% of the road infrastructure in progress as at 31% December, 2019 was completed and therefore commissioned as completed. The Government of Ghana applies the revaluation model for its non current assets in line with IPSAS 17: Property, Plant and Equipment. In this respect, a professional valuer was engaged who produced the following values as at 31 December, 2019: Machinery and Equipment GHC600 million and Road infrastructure assets completed GHc2,003 million. 8. During 2019, a piece of equipment costing CHC50 million bought two years ago was disposed of for a sum of GHc 50 million. 9. It is the policy of govemment to provide for consumption of fixed capital on all non financial assets at 20%, ar cast per annum. 10. Financial Investments amounting to GHC110 million was quidated on 31 December, 2019 at book value 11. Salaries and other emoluments outstanding during the year amounted to GHC12 million while that of use of goods and services other than workshop and seminars amounted GH15 million. Prepayments relating to 2020 included in use of goods and services in respect of rent amounted to GHC18 million. GHC8.5 million relating to other expenses was outstanding as at 31 December, 2019 12. As at 31 December, 2013, corporate tax assessments amounting to GHC170 million was still outstanding to be paid by corporate entities to government whist the total amount owed to government as at 31 December, 2019 in respect of taxes on goods and services stood at GHC140 million. It is estimated that, only 80% of the outstanding debt to government may be recovered. 13. The accrual system of budgeting has been adopted by the government of Ghane. Budget information provided in respect of the Consolidated Fund account for the year ented 31 December, 2019 is provided below

Step by Step Solution

★★★★★

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

WHAT information is provided under an IPSASbased system HOW IPSASs improve the quality of financial reporting for governments WHY you should adopt IPSASs focusing on expected benefits IPSASs are stand...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started