Answered step by step

Verified Expert Solution

Question

1 Approved Answer

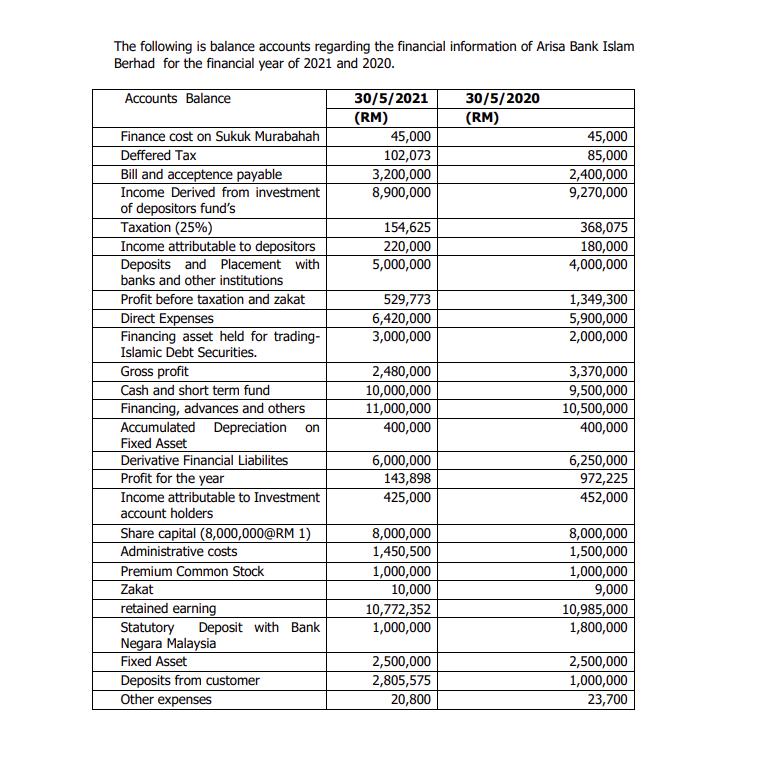

The following is balance accounts regarding the financial information of Arisa Bank Islam Berhad for the financial year of 2021 and 2020. Accounts Balance

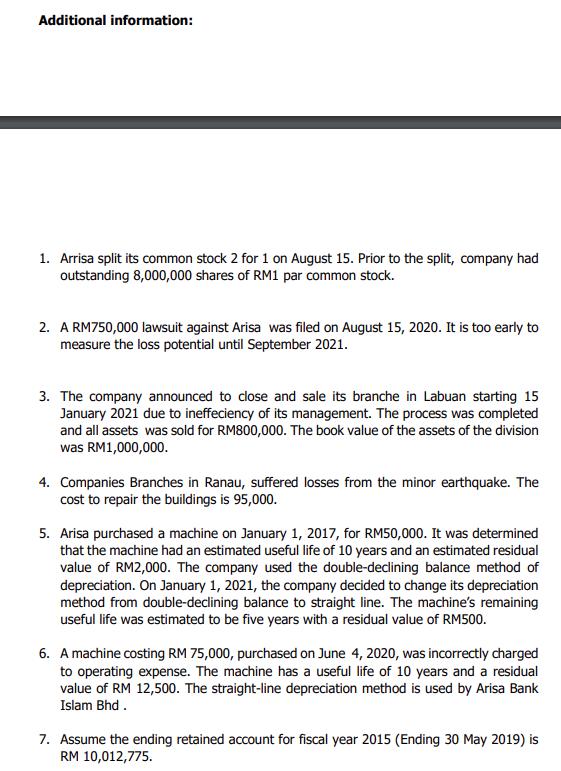

The following is balance accounts regarding the financial information of Arisa Bank Islam Berhad for the financial year of 2021 and 2020. Accounts Balance Finance cost on Sukuk Murabahah Deffered Tax Bill and acceptence payable Income Derived from investment of depositors fund's Taxation (25%) Income attributable to depositors Deposits and Placement with banks and other institutions Profit before taxation and zakat Direct Expenses Financing asset held for trading- Islamic Debt Securities. Gross profit Cash and short term fund Financing, advances and others Accumulated Depreciation on Fixed Asset Derivative Financial Liabilites Profit for the year Income attributable to Investment account holders Share capital (8,000,000@RM 1) Administrative costs Premium Common Stock Zakat retained earning Statutory Negara Malaysia Fixed Asset Deposit with Bank Deposits from customer Other expenses 30/5/2021 (RM) 45,000 102,073 3,200,000 8,900,000 154,625 220,000 5,000,000 529,773 6,420,000 3,000,000 2,480,000 10,000,000 11,000,000 400,000 6,000,000 143,898 425,000 8,000,000 1,450,500 1,000,000 10,000 10,772,352 1,000,000 2,500,000 2,805,575 20,800 30/5/2020 (RM) 45,000 85,000 2,400,000 9,270,000 368,075 180,000 4,000,000 1,349,300 5,900,000 2,000,000 3,370,000 9,500,000 10,500,000 400,000 6,250,000 972,225 452,000 8,000,000 1,500,000 1,000,000 9,000 10,985,000 1,800,000 2,500,000 1,000,000 23,700 Additional information: 1. Arrisa split its common stock 2 for 1 on August 15. Prior to the split, company had outstanding 8,000,000 shares of RM1 par common stock. 2. A RM750,000 lawsuit against Arisa was filed on August 15, 2020. It is too early to measure the loss potential until September 2021. 3. The company announced to close and sale its branche in Labuan starting 15 January 2021 due to ineffeciency of its management. The process was completed and all assets was sold for RM800,000. The book value of the assets of the division was RM1,000,000. 4. Companies Branches in Ranau, suffered losses from the minor earthquake. The cost to repair the buildings is 95,000. 5. Arisa purchased a machine on January 1, 2017, for RM50,000. It was determined that the machine had an estimated useful life of 10 years and an estimated residual value of RM2,000. The company used the double-declining balance method of depreciation. On January 1, 2021, the company decided to change its depreciation method from double-declining balance to straight line. The machine's remaining useful life was estimated to be five years with a residual value of RM500. 6. A machine costing RM 75,000, purchased on June 4, 2020, was incorrectly charged to operating expense. The machine has a useful life of 10 years and a residual value of RM 12,500. The straight-line depreciation method is used by Arisa Bank Islam Bhd. 7. Assume the ending retained account for fiscal year 2015 (Ending 30 May 2019) is RM 10,012,775. REQUIRED: a) Prepare income statement for the year ended 2020 and 2021 b) Prepare Statement of retained earning and the Balance sheet as at 31 Dsiember 2020 and 2021

Step by Step Solution

★★★★★

3.39 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Answers and Explanation a Income Statement For the year ended 2020 Revenue Income Derived from investment 9270000 Income attributable to depositors 18...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started