Answered step by step

Verified Expert Solution

Question

1 Approved Answer

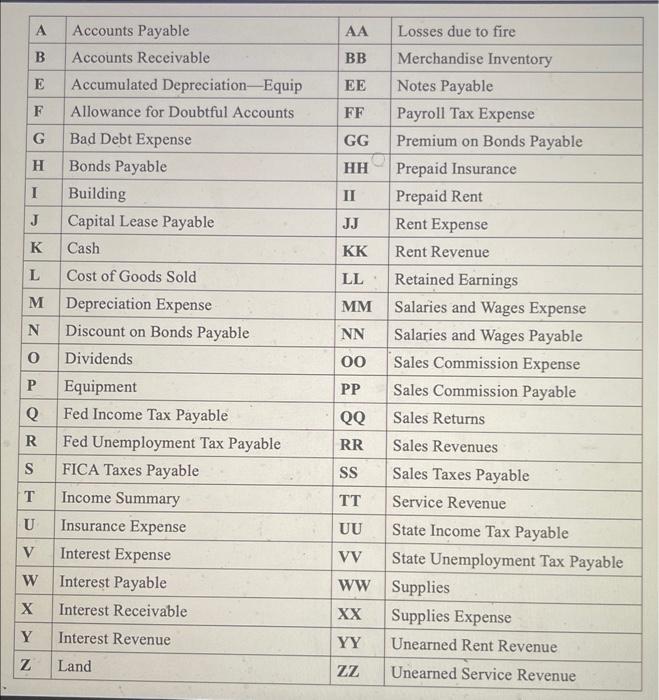

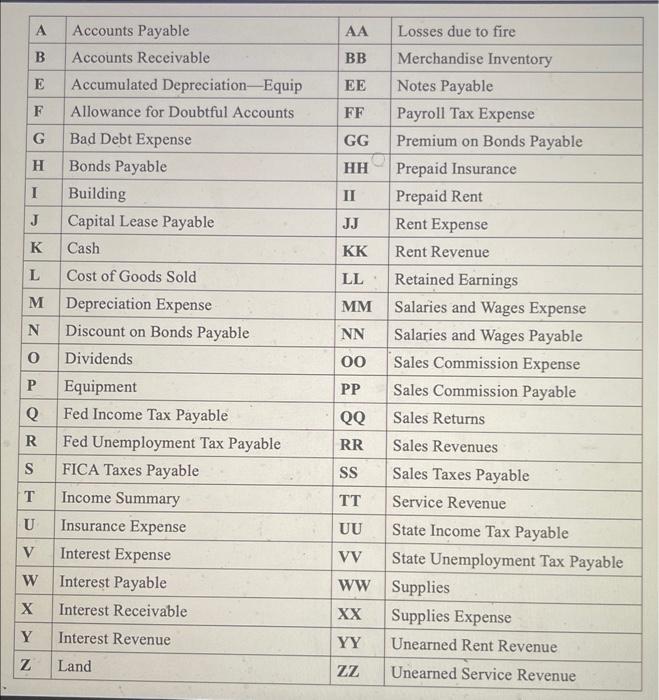

the following is list of accounts each represented by letters Examole of Journal Entry: K3000D,B2000D,TT5000C Where K denotes Cash account, 3000 is the amount, D

the following is list of accounts each represented by letters

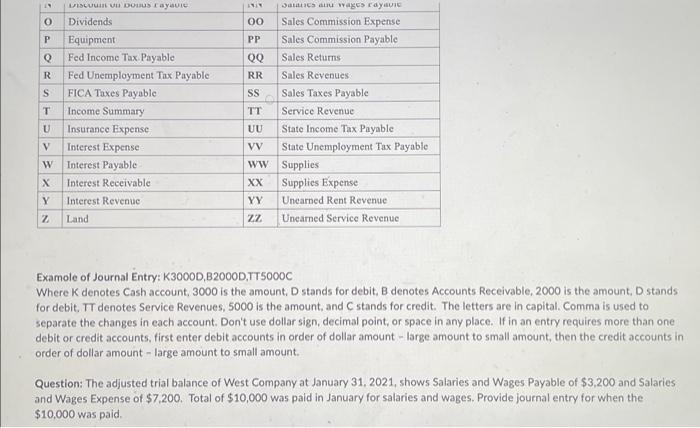

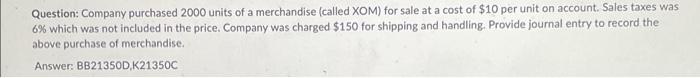

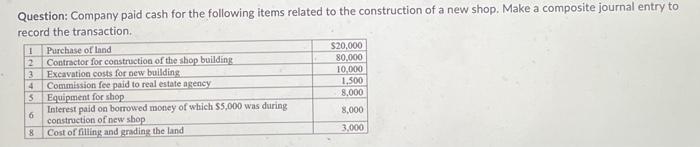

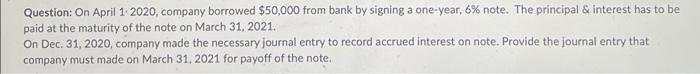

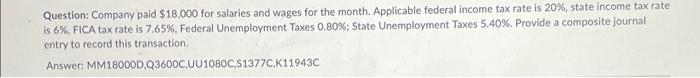

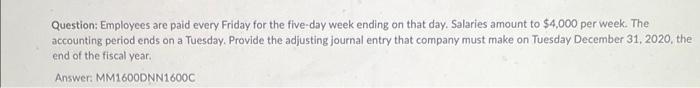

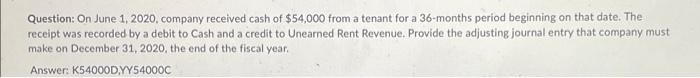

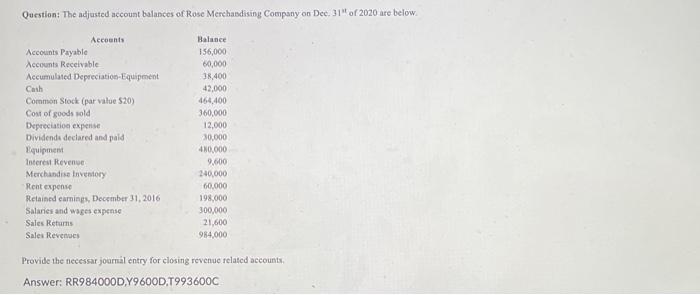

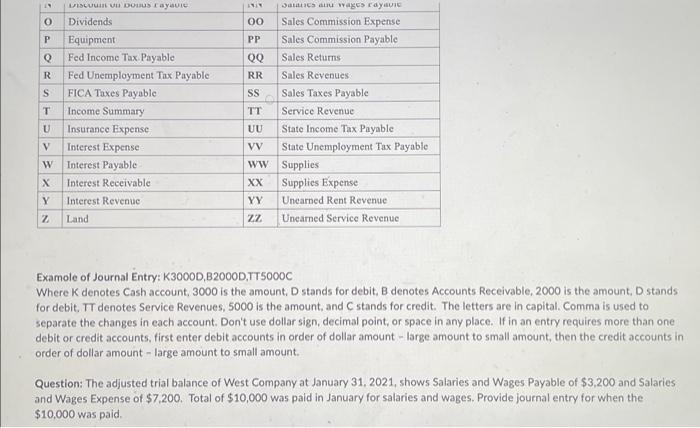

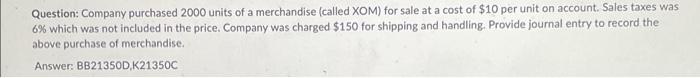

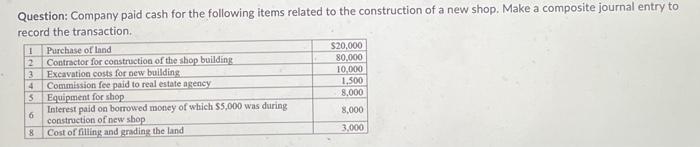

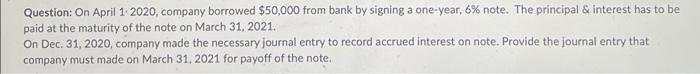

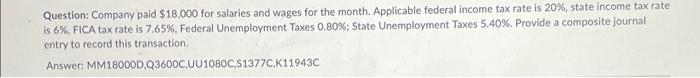

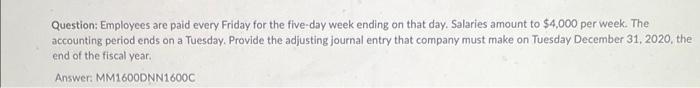

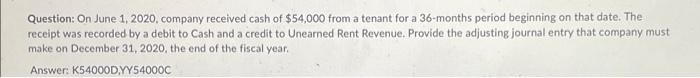

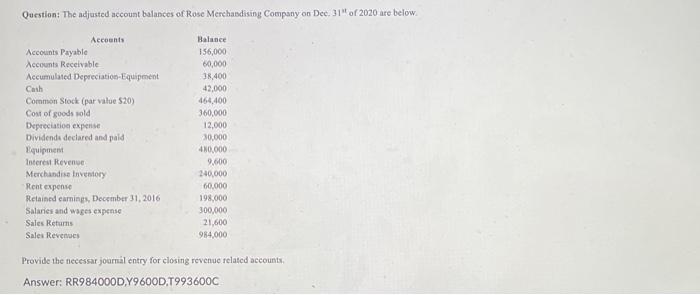

Examole of Journal Entry: K3000D,B2000D,TT5000C Where K denotes Cash account, 3000 is the amount, D stands for debit, B denotes Accounts Receivable, 2000 is the amount, D stands for debit. TT denotes Service Revenues, 5000 is the amount, and C stands for credit. The letters are in capital. Comma is used to separate the changes in each account. Don't use dollar sign, decimal point, or space in any place. If in an entry requires more than one debit or credit accounts. first enter debit accounts in order of dollar amount - large amount to small amount, then the credit accounts in order of dollar amount - large amount to small amount. Question: The adjusted trial balance of West Company at January 31, 2021, shows Salaries and Wages. Payable of $3,200 and $alaries and Wages Expense of $7,200. Total of $10,000 was paid in January for salaries and wages. Provide journal entry for when the $10,000 was paid. Question: Company purchased 2000 units of a merchandise (called XOM) for sale at a cost of $10 per unit on account. Sales taxes was 6% which was not included in the price. Company was charged $150 for shipping and handling. Provide journal entry to record the above purchase of merchandise. Answer: BB21350D,K21350C Question: Company paid cash for the following items related to the construction of a new shop. Make a composite journal entry to record the transaction. Question: On April 1. 2020 , company borrowed $50,000 from bank by signing a one-year, 6% note. The principal \& interest has to be paid at the maturity of the note on March 31,2021 . On Dec. 31, 2020, company made the necessary journal entry to record accrued interest on note. Provide the journal entry that company must made on March 31,2021 for payoff of the note. Question: Company paid $18,000 for salaries and wages for the month. Applicable federal income tax rate is 20%, state income tax rate is 6\%, FICA tax rate is 7.65\%. Federal Unemployment Taxes 0.80%; 5tate Unemployment Taxes 5.40%. Provide a composite journal entry to record this transaction. Answer: MM18000D.Q3600C.UU1080C,S1377C.K11943C Question: Employees are paid every Friday for the five-day week ending on that day. Salaries amount to $4,000 per week. The accounting period ends on a Tuesday. Provide the adjusting journal entry that company must make on Tuesday December 31,2020 , the end of the fiscal year. Answer: MM1600DNN1600C Question: On June 1, 2020, company received cash of $54,000 from a tenant for a 36 -months period beginning on that date. The receipt was recorded by a debit to Cash and a credit to Unearned Rent Revenue. Provide the adjusting journal entry that company must make on December 31,2020, the end of the fiscal year. Answer: K54000D, Y54000C Question: The acjusted accouat balances of Rose Merchasdising Company on Dec. 31tt of 2020 are below. Provide the necessar joarnal entry for closing revenue felated accounts. Answer: RR984000D,Y9600D.T993600C

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started