Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following is the capital structure of Astra Products Limited, as of March 3 1 , 2 0 2 2 : The Equity Shares has

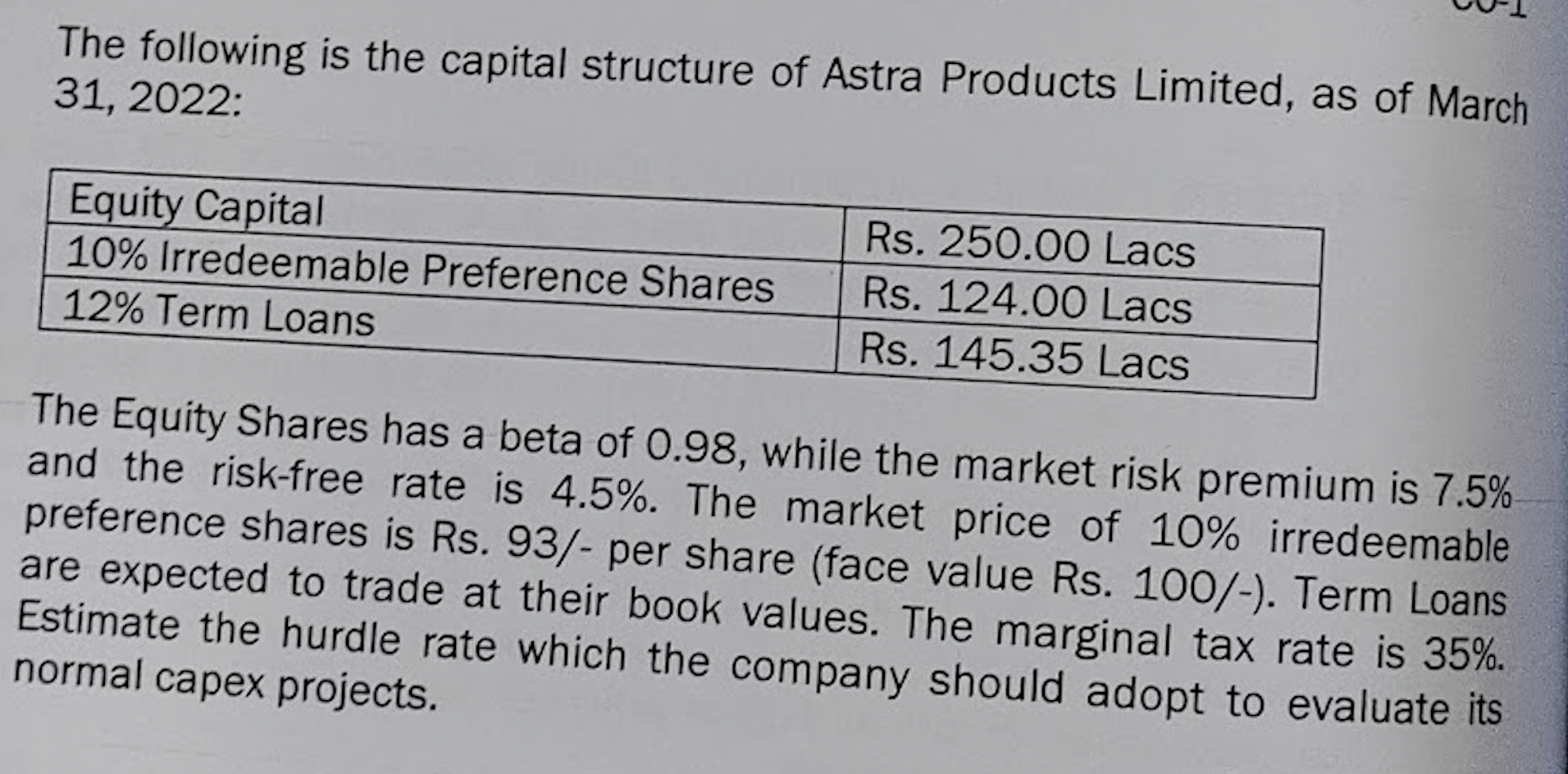

The following is the capital structure of Astra Products Limited, as of March

:

The Equity Shares has a beta of while the market risk premium is

and the riskfree rate is The market price of irredeemable

preference shares is Rs per share face value Rs Term Loans

are expected to trade at their book values. The marginal tax rate is

Estimate the hurdle rate which the company should adopt to evaluate its

normal capex projects.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started