Answered step by step

Verified Expert Solution

Question

1 Approved Answer

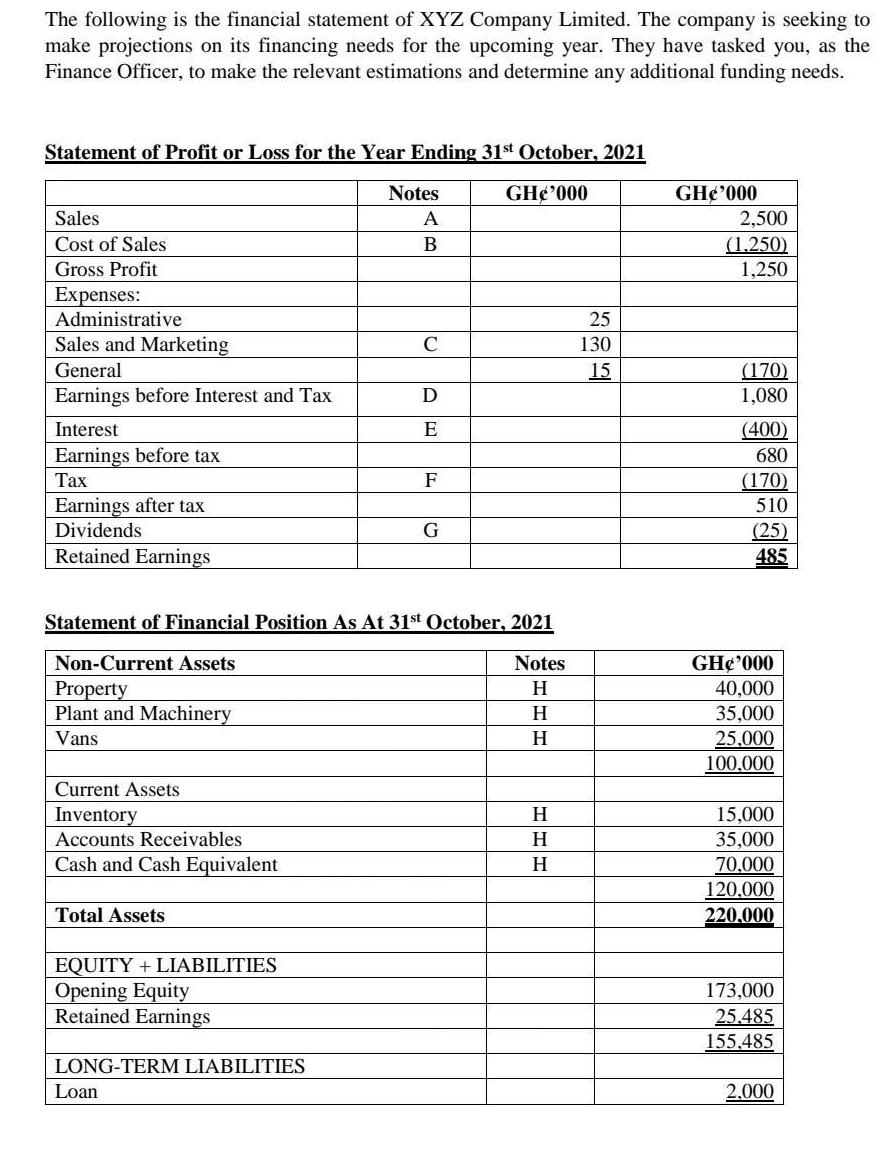

The following is the financial statement of XYZ Company Limited. The company is seeking to make projections on its financing needs for the upcoming

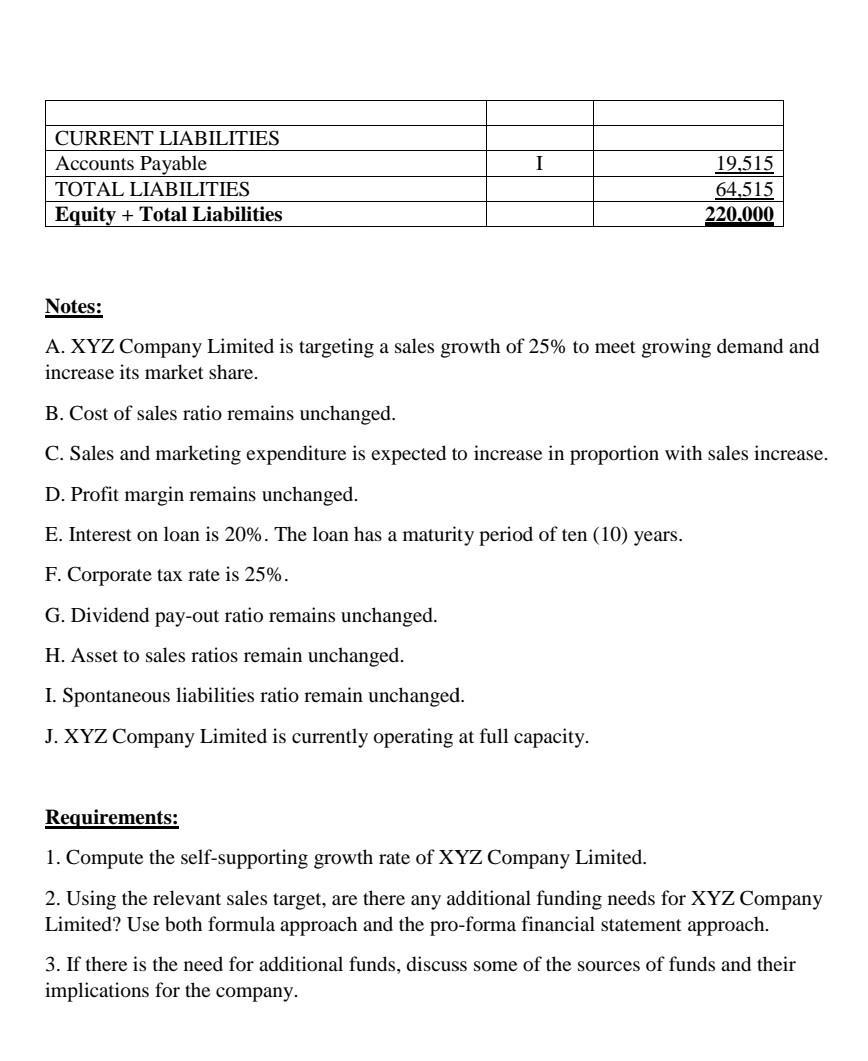

The following is the financial statement of XYZ Company Limited. The company is seeking to make projections on its financing needs for the upcoming year. They have tasked you, as the Finance Officer, to make the relevant estimations and determine any additional funding needs. Statement of Profit or Loss for the Year Ending 31st October, 2021 Notes GH'000 GH000 Sales A Cost of Sales B Gross Profit Expenses: Administrative Sales and Marketing C General Earnings before Interest and Tax D Interest E Earnings before tax Tax F Earnings after tax Dividends G Retained Earnings Statement of Financial Position As At 31st October, 2021 Non-Current Assets Notes Property H H Plant and Machinery Vans H Current Assets Inventory H Accounts Receivables H Cash and Cash Equivalent H Total Assets EQUITY + LIABILITIES Opening Equity Retained Earnings LONG-TERM LIABILITIES Loan 25 130 15 2,500 (1,250) 1,250 (170) 1,080 (400) 680 (170) 510 (25) 485 GH'000 40,000 35,000 25,000 100,000 15,000 35,000 70,000 120,000 220,000 173,000 25.485 155,485 2,000 CURRENT LIABILITIES Accounts Payable I 19,515 64,515 TOTAL LIABILITIES Equity Total Liabilities 220.000 Notes: A. XYZ Company Limited is targeting a sales growth of 25% to meet growing demand and increase its market share. B. Cost of sales ratio remains unchanged. C. Sales and marketing expenditure is expected to increase in proportion with sales increase. D. Profit margin remains unchanged. E. Interest on loan is 20%. The loan has a maturity period of ten (10) years. F. Corporate tax rate is 25%. G. Dividend pay-out ratio remains unchanged. H. Asset to sales ratios remain unchanged. I. Spontaneous liabilities ratio remain unchanged. J. XYZ Company Limited is currently operating at full capacity. Requirements: 1. Compute the self-supporting growth rate of XYZ Company Limited. 2. Using the relevant sales target, are there any additional funding needs for XYZ Company Limited? Use both formula approach and the pro-forma financial statement approach. 3. If there is the need for additional funds, discuss some of the sources of funds and their implications for the company.

Step by Step Solution

★★★★★

3.42 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

1 The selfsupporting growth rate is the rate at which the company can grow without needing to raise any additional funds To calculate the selfsupporti...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started