Question

The following is the monthly payroll for the last 3 months of the year for Titans' Sporting Goods Shop, 2 Boat Road, Lynn, MA 01945.

The following is the monthly payroll for the last 3 months of the year for Titans' Sporting Goods Shop, 2 Boat Road, Lynn, MA 01945.

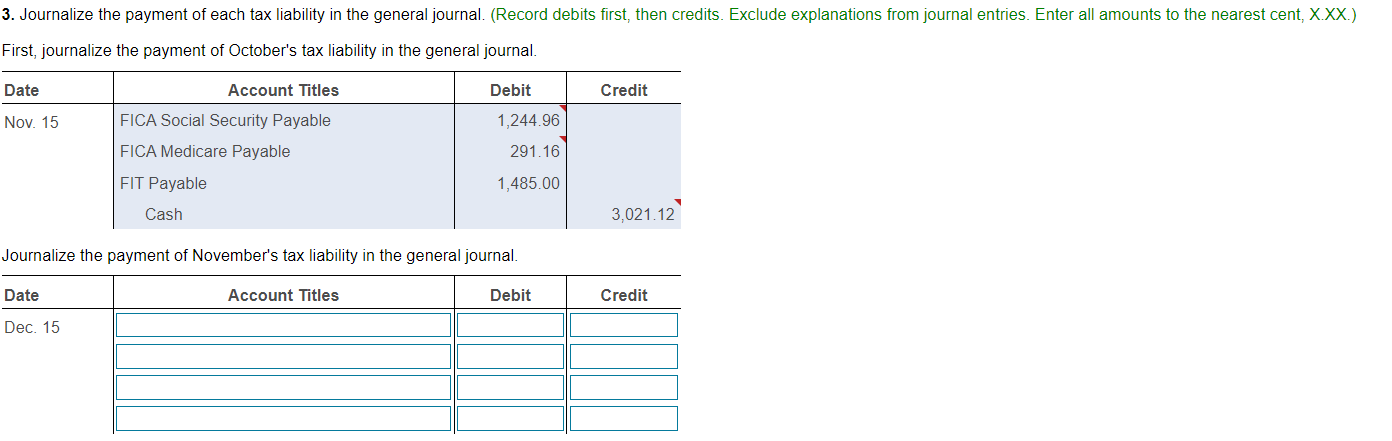

3. Journalize the payment of each tax liability in the general journal. (Record debits first, then credits. Exclude explanations from journal entries. Enter all amounts to the nearest cent, X.XX.)

First, journalize the payment of October's tax liability in the general journal.

October

|

|

|

| FICA |

| |

| Employee | Monthly Earnings | YTD Earnings | Social Security | Medicare | Federal Income Tax |

| Amber Bixby | $2,820 | $138,200 | $174.84 | $40.89 | $531.00 |

| Susan Lincoln | 3,420 | 39,650 | 212.04 | 49.59 | 424.00 |

| Hector Walker | 3,800 | 44,150 | 235.60 | 55.10 | 530.00 |

| $10,040 | $222,000 | $622.48 | $145.58 | $1,485.00 | |

November

|

|

|

| FICA |

| |

| Employee | Monthly Earnings | YTD Earnings | Social Security | Medicare | Federal Income Tax |

| Amber Bixby | $2,860 | $141,060 | $177.32 | $41.47 | $601.00 |

| Susan Lincoln | 3,920 | 43,570 | 243.04 | 56.84 | 462.00 |

| Hector Walker | 3,850 | 48,000 | 238.70 | 55.83 | 556.00 |

| $10,630 | $232,630 | $659.06 | $154.14 | $1,619.00 | |

December

|

|

|

| FICA |

| |

| Employee | Monthly Earnings | YTD Earnings | Social Security | Medicare | Federal Income Tax |

| Amber Bixby | $4,280 | $145,340 | $107.88 | $62.06 | $871.00 |

| Susan Lincoln | 3,740 | 47,310 | 231.88 | 54.23 | 482.00 |

| Hector Walker | 4,450 | 52,450 | 275.90 | 64.53 | 703.00 |

| $12,470 | $245,100 | $615.66 | $180.82 | $2,056.00 | |

Journalize November and December entries.

Explain how you find the values for FICA please.

Journalize the payment of November's tax liability in the general journal. Journalize the payment of November's tax liability in the general journalStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started