Answered step by step

Verified Expert Solution

Question

1 Approved Answer

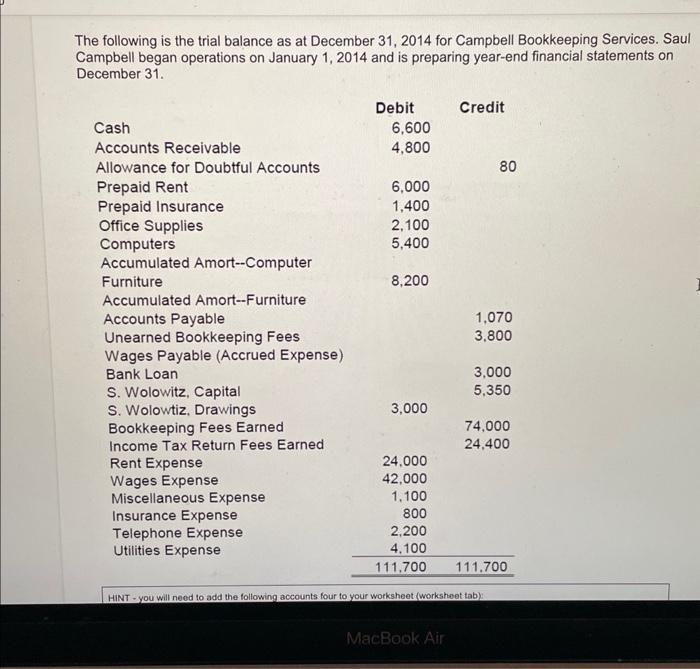

The following is the trial balance as at December 31, 2014 for Campbell Bookkeeping Services. Saul Campbell began operations on January 1, 2014 and

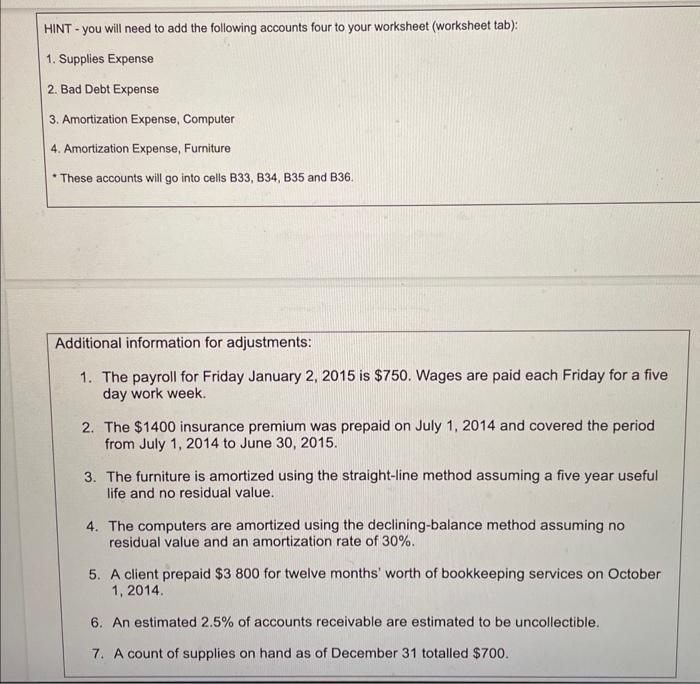

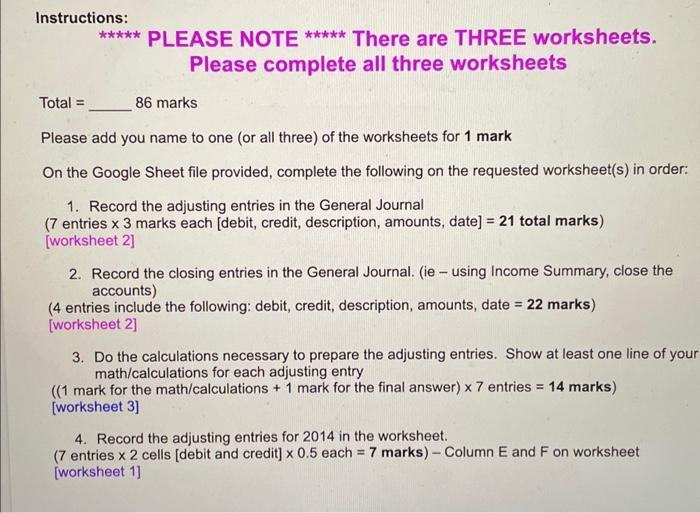

The following is the trial balance as at December 31, 2014 for Campbell Bookkeeping Services. Saul Campbell began operations on January 1, 2014 and is preparing year-end financial statements on December 31. Cash Accounts Receivable Allowance for Doubtful Accounts Prepaid Rent Prepaid Insurance Office Supplies Computers Accumulated Amort--Computer Furniture Accumulated Amort--Furniture Accounts Payable Unearned Bookkeeping Fees Wages Payable (Accrued Expense) Bank Loan S. Wolowitz, Capital S. Wolowtiz, Drawings Bookkeeping Fees Earned Income Tax Return Fees Earned Rent Expense Wages Expense Debit Miscellaneous Expense Insurance Expense Telephone Expense Utilities Expense 6,600 4,800 6,000 1,400 2,100 5,400 8,200 3,000 Credit MacBook Air 80 1,070 3,800 24,000 42,000 1,100 800 2,200 4.100 111,700 HINT-you will need to add the following accounts four to your worksheet (worksheet tab): 3,000 5,350 74,000 24,400 111.700 HINT-you will need to add the following accounts four to your worksheet (worksheet tab): 1. Supplies Expense 2. Bad Debt Expense 3. Amortization Expense, Computer 4. Amortization Expense, Furniture These accounts will go into cells B33, B34, B35 and B36. Additional information for adjustments: 1. The payroll for Friday January 2, 2015 is $750. Wages are paid each Friday for a five day work week. 2. The $1400 insurance premium was prepaid on July 1, 2014 and covered the period from July 1, 2014 to June 30, 2015. 3. The furniture is amortized using the straight-line method assuming a five year useful life and no residual value. 4. The computers are amortized using the declining-balance method assuming no residual value and an amortization rate of 30%. 5. A client prepaid $3 800 for twelve months' worth of bookkeeping services on October 1, 2014. 6. An estimated 2.5% of accounts receivable are estimated to be uncollectible. 7. A count of supplies on hand as of December 31 totalled $700. Instructions: Total = ***** PLEASE NOTE ***** There are THREE worksheets. Please complete all three worksheets 86 marks Please add you name to one (or all three) of the worksheets for 1 mark On the Google Sheet file provided, complete the following on the requested worksheet(s) in order: 1. Record the adjusting entries in the General Journal (7 entries x 3 marks each [debit, credit, description, amounts, date] = 21 total marks) [worksheet 2] 2. Record the closing entries in the General Journal. (ie - using Income Summary, close the accounts) (4 entries include the following: debit, credit, description, amounts, date = 22 marks) [worksheet 2] 3. Do the calculations necessary to prepare the adjusting entries. Show at least one line of your math/calculations for each adjusting entry ((1 mark for the math/calculations + 1 mark for the final answer) x 7 entries = 14 marks) [worksheet 3] 4. Record the adjusting entries for 2014 in the worksheet. (7 entries x 2 cells [debit and credit] x 0.5 each = 7 marks) - Column E and F on worksheet [worksheet 1]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Unadjusted Trial Balance Adjustment Adjusted Trial Balance Balance Sheet Income Statement Closing Entries Post Closing Trial Balance Debit Credit Debi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started