Answered step by step

Verified Expert Solution

Question

1 Approved Answer

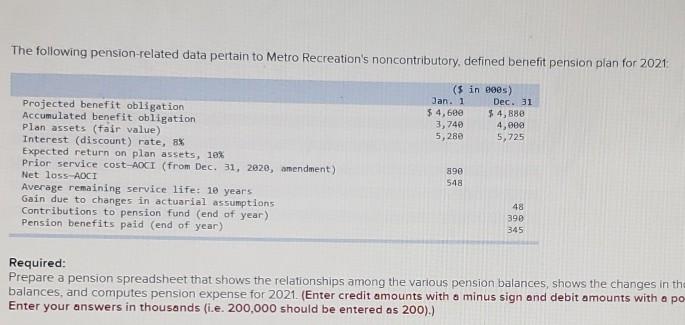

The following pension-related data pertain to Metro Recreation's noncontributory, defined benefit pension plan for 2021 (s in goes) Jan. 1 Dec. 31 $ 4,689 $

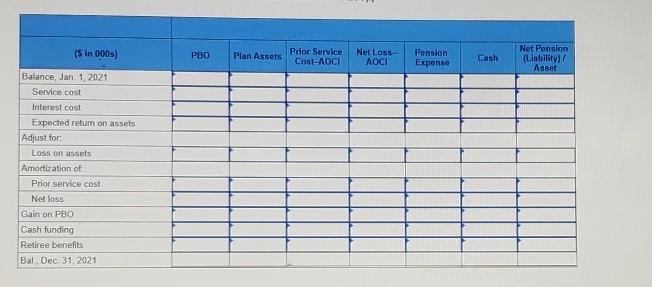

The following pension-related data pertain to Metro Recreation's noncontributory, defined benefit pension plan for 2021 (s in goes) Jan. 1 Dec. 31 $ 4,689 $ 4,888 3,740 4,900 5,280 5,725 Projected benefit obligation Accumulated benefit obligation Plan assets (fair value) Interest (discount) rate, 8% Expected return on plan assets, 10% Prior service cost-AOCI (from Dec. 31, 2020, amendment) Net loss AOCI Average remaining service life: 10 years Gain due to changes in actuarial assumptions Contributions to pension fund (end of year) Pension benefits paid (end of year) 890 548 48 390 345 Required: Prepare a pension spreadsheet that shows the relationships among the various pension balances, shows the changes in the balances, and computes pension expense for 2021. (Enter credit amounts with a minus sign and debit amounts with a po Enter your answers in thousands (i.e. 200,000 should be entered as 200).) (5 in 000) PBO Plan Assets Prior Service Cast-AOCI Net Loss AOCI Pension Expense Cash Net Pension (Liability Asset Balance, Jan. 1.2021 Service cost Interest cost Expected retum an assets Adjust for Loss on assets Amortization of Prior service cost Net loss Gain on PRO Cash funding Retiree benefits Bal Dec 31, 2021

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started