Answered step by step

Verified Expert Solution

Question

1 Approved Answer

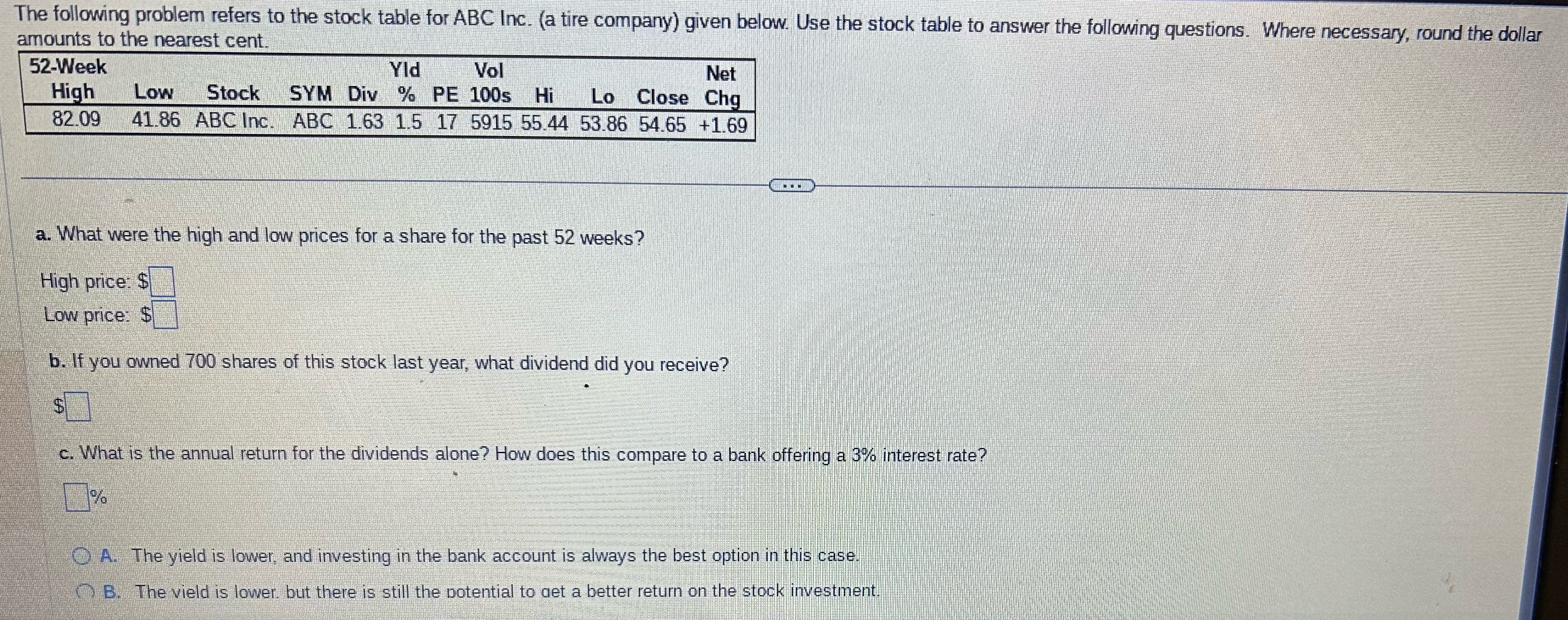

The following problem refers to the stock table for ABC Inc. ( a tire company ) given below. Use the stock table to answer the

The following problem refers to the stock table for ABC Inc. a tire company given below. Use the stock table to answer the following questions. Where necessary, round the dollar amounts to the nearest cent.

tabletable WeekHighLow,Stock,SYMDiv,PE sHiLoClose,NetABC Inc.,ABC,

a What were the high and low prices for a share for the past weeks?

High price: $

Low price: $

b If you owned shares of this stock last year, what dividend did you receive?

$

c What is the annual return for the dividends alone? How does this compare to a bank offering a interest rate?

A The yield is lower, and investing in the bank account is always the best option in this case.

B The vield is lower. but there is still the Dotential to aet a better return on the stock investment.

How many shares of this companys stock were traded yesterday?

What where the high and low prices for a share yesterday?

Whats was the price at which a share traded when the stock exchanged closed yesterday?

what was the change In price for a share of stock from the market close two days ago to yesterdays market close?

What is the companys anual earnings per share?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started