Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following procedures are used by The Taco Truck (TTT). a. TTT has two employees given the following tasks: the counter staff person's job

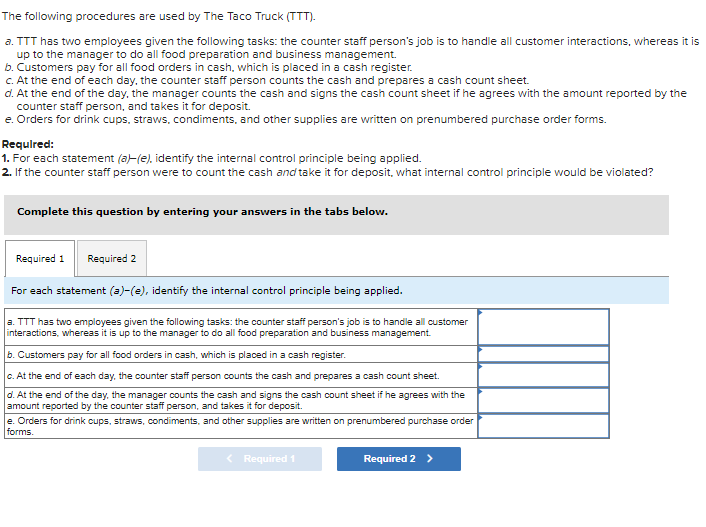

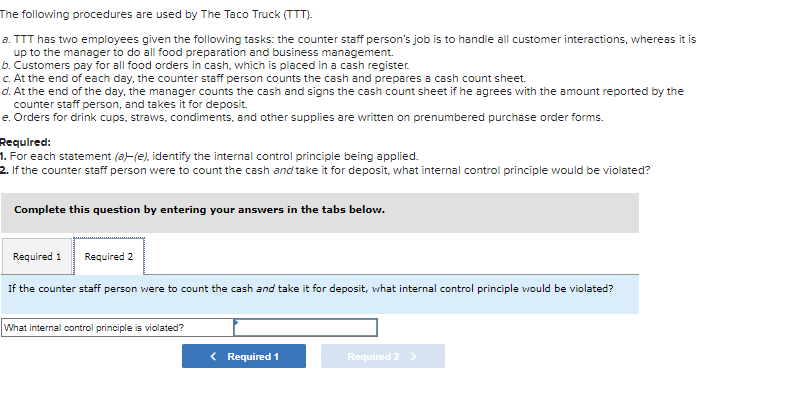

The following procedures are used by The Taco Truck (TTT). a. TTT has two employees given the following tasks: the counter staff person's job is to handle all customer interactions, whereas it is up to the manager to do all food preparation and business management. b. Customers pay for all food orders in cash, which is placed in a cash register. c. At the end of each day, the counter staff person counts the cash and prepares a cash count sheet. d. At the end of the day, the manager counts the cash and signs the cash count sheet if he agrees with the amount reported by the counter staff person, and takes it for deposit. e. Orders for drink cups, straws, condiments, and other supplies are written on prenumbered purchase order forms. Required: 1. For each statement (a)-(e), identify the internal control principle being applied. 2. If the counter staff person were to count the cash and take it for deposit, what internal control principle would be violated? Complete this question by entering your answers in the tabs below. Required 1 Required 2 For each statement (a)-(e), identify the internal control principle being applied. a. TTT has two employees given the following tasks: the counter staff person's job is to handle all customer interactions, whereas it is up to the manager to do all food preparation and business management. b. Customers pay for all food orders in cash, which is placed in a cash register. c. At the end of each day, the counter staff person counts the cash and prepares a cash count sheet. d. At the end of the day, the manager counts the cash and signs the cash count sheet if he agrees with the amount reported by the counter staff person, and takes it for deposit. e. Orders for drink cups, straws, condiments, and other supplies are written on prenumbered purchase order forms. < Required 1 Required 2 > The following procedures are used by The Taco Truck (TTT). a. TTT has two employees given the following tasks: the counter staff person's job is to handle all customer interactions, whereas it is up to the manager to do all food preparation and business management. b. Customers pay for all food orders in cash, which is placed in a cash register. c. At the end of each day, the counter staff person counts the cash and prepares a cash count sheet. d. At the end of the day, the manager counts the cash and signs the cash count sheet if he agrees with the amount reported by the counter staff person, and takes it for deposit. e. Orders for drink cups, straws, condiments, and other supplies are written on prenumbered purchase order forms. Required: 1. For each statement (a)-(e), identify the internal control principle being applied. 2. If the counter staff person were to count the cash and take it for deposit, what internal control principle would be violated? Complete this question by entering your answers in the tabs below. Required 1 Required 2 If the counter staff person were to count the cash and take it for deposit, what internal control principle would be violated? What internal control principle is violated? < Required 1 Required 2 >

Step by Step Solution

★★★★★

3.39 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

1 a Segregation of Duties b Cash Handling and Control c Independent Verification d Independent Verification e Documentation and Records Required 2 If ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started