Answered step by step

Verified Expert Solution

Question

1 Approved Answer

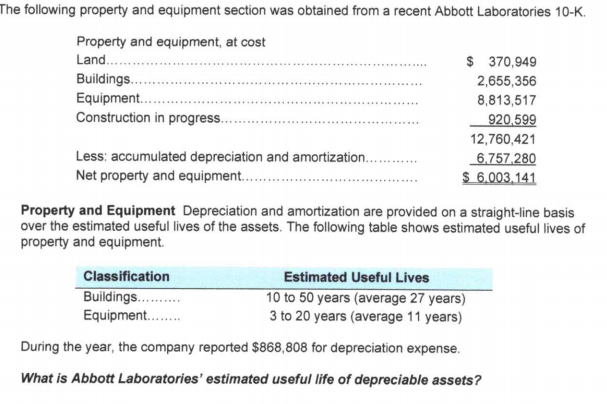

The following property and equipment section was obtained from a recent Abbott Laboratories 10-K. Property and equipment, at cost Land... Buildings... $ 370,949 2,655,356

The following property and equipment section was obtained from a recent Abbott Laboratories 10-K. Property and equipment, at cost Land... Buildings... $ 370,949 2,655,356 Equipment... Construction in progress.. Less: accumulated depreciation and amortization............ Net property and equipment..... 8,813,517 920,599 12,760,421 6,757,280 $ 6,003,141 Property and Equipment Depreciation and amortization are provided on a straight-line basis over the estimated useful lives of the assets. The following table shows estimated useful lives of property and equipment. Classification Buildings.... Equipment.... Estimated Useful Lives 10 to 50 years (average 27 years) 3 to 20 years (average 11 years) During the year, the company reported $868,808 for depreciation expense. What is Abbott Laboratories' estimated useful life of depreciable assets?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer To find the estimated useful life of depreciable assets for Abbott Laboratories we can use th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started