Question

The following question is based on the material in Chapter 5 of the textbook Prepare Tax Documentation for Individuals 17th edition (Termination, Medicare Levy Surcharge,

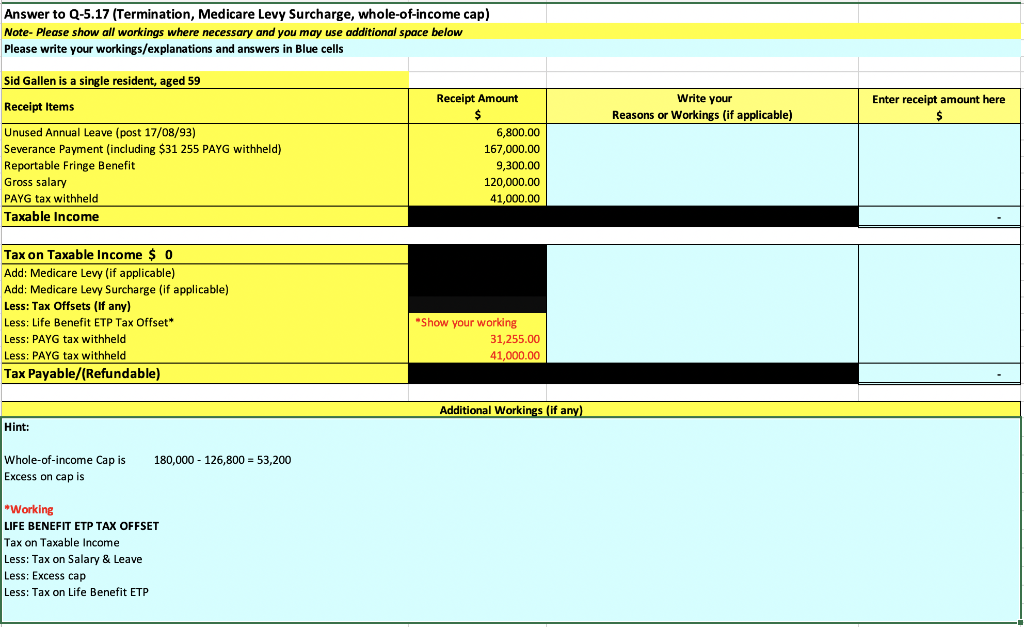

The following question is based on the material in Chapter 5 of the textbook Prepare Tax Documentation for Individuals 17th edition (Termination, Medicare Levy Surcharge, whole-of-income cap) Sid Galen is a single resident tax payer aged 59. On 15April 2020, it was mutually agreed that his appointment as head coach of the Lesser Easter Sydney AFL team would be terminated. On termination, Sid received the following: Unused Annual Leave(post 17/8/93) $6800 Severance Payment(including $31255 PAYG tax withheld) $167000 Reportable fringe benefits (The club allowed Sid to keep some air tickets that had been booked) $9300 Sid had received a gross salary of $120000 during the year up until the date of termination (PAYG tax withheld $41000). Sid has no private health insurance and does not have any dependent children.

Calculate Sid's taxable income for the 2019/20 tax year.

Calculate tax payable or refundable for the 2019/20 year.

Calculate tax payable or refundable for the 2019/20 year.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started