Question

The following question is from my corporate finance homework, it did be really helpful if someone solves this question and gives complete and easy explanation.

The following question is from my corporate finance homework, it did be really helpful if someone solves this question and gives complete and easy explanation.

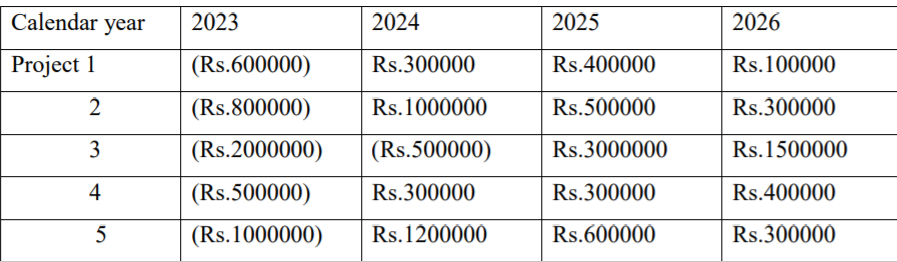

A newly formed company is considering its capital investment program for the calendar years 2023 and 2024. It has a policy of funding all investment proposals only by issue of equity shares whose cost of capital is 12% p.a. After considerable research the company has shortlisted for consideration five proposals whose cash inflows and outflows over the next 4 year period is estimated as follows:

None of the projects can be delayed. All the projects are divisible. Outlays may be reduced by any proportion in which case net cash inflows will reduce by the same proportion. In the year 2023 the funds available for investment will be only Rs.3500000 whereas required funds for investment will be available in the year 2024.Advise the Projects to be undertaken in the year 2023.

\begin{tabular}{|c|l|l|l|l} \hline Calendar year & 2023 & 2024 & 2025 & 2026 \\ \hline Project 1 & ( Rs.600000) & Rs.300000 & Rs. 400000 & Rs. 100000 \\ \hline 2 & ( Rs. 800000) & Rs. 1000000 & Rs. 500000 & Rs. 300000 \\ \hline 3 & ( Rs. 2000000) & ( Rs. 500000) & Rs.3000000 & Rs. 1500000 \\ \hline 4 & ( Rs. 500000) & Rs.300000 & Rs.300000 & Rs. 400000 \\ \hline 5 & ( Rs. 1000000) & Rs. 1200000 & Rs.600000 & Rs.300000 \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started