Question

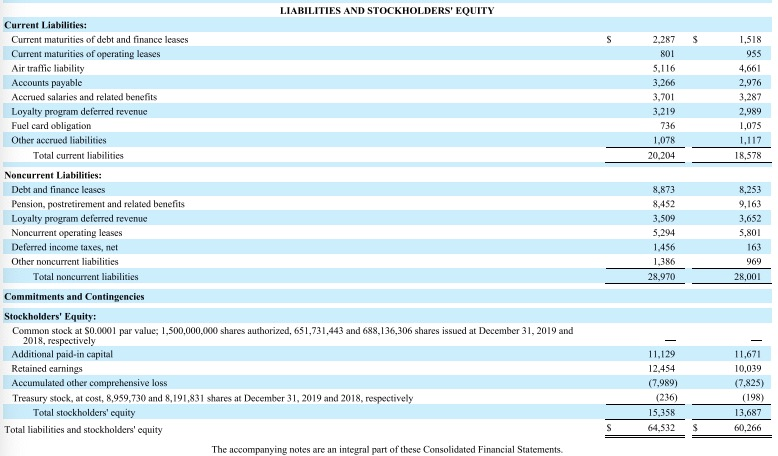

The following questions are about Delta Airlines Company a.How many shares are outstanding for Delta? Shares outstanding is equal to shares issued less shares in

The following questions are about Delta Airlines Company

a.How many shares are outstanding for Delta? Shares outstanding is equal to shares issued less shares in treasury stock.

b.Create a t-account for retained earnings including the effect of the net income attributable to Delta and dividends. Use the statement of shareholders equity to identify what additional item for Delta prevents the normal relationship of retained earnings = retained earnings last year + net income attributable to the firm -dividends.

some info

net income 2019:$4767 2018:$3935 2017: $3205

cash dividents: 2019:980 2018:909 2017:731

Delta Airlines financials

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started