Answered step by step

Verified Expert Solution

Question

1 Approved Answer

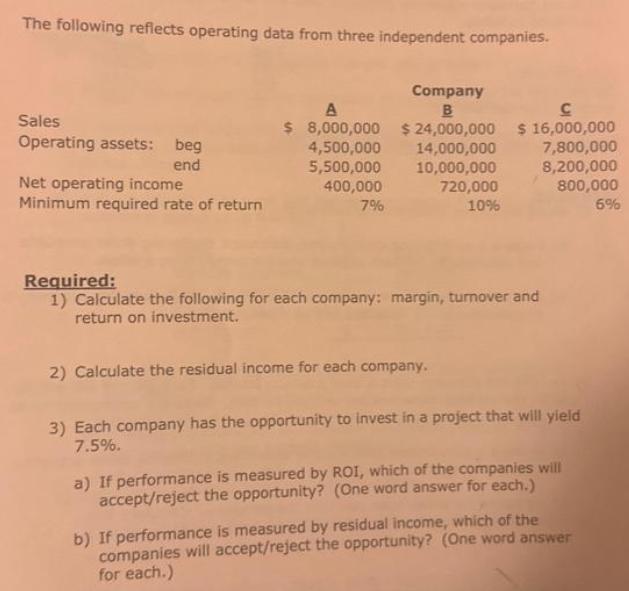

The following reflects operating data from three independent companies. Sales Operating assets: beg end Net operating income Minimum required rate of return Company B

The following reflects operating data from three independent companies. Sales Operating assets: beg end Net operating income Minimum required rate of return Company B A C $ 8,000,000 $24,000,000 $ 16,000,000 4,500,000 14,000,000 7,800,000 5,500,000 10,000,000 8,200,000 400,000 720,000 800,000 7% 10% 6% Required: 1) Calculate the following for each company: margin, turnover and return on investment. 2) Calculate the residual income for each company. 3) Each company has the opportunity to invest in a project that will yield 7.5%. a) If performance is measured by ROI, which of the companies will accept/reject the opportunity? (One word answer for each.) b) If performance is measured by residual income, which of the companies will accept/reject the opportunity? (One word answer for each.)

Step by Step Solution

★★★★★

3.39 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the requested financial metrics and determine the acceptance or rejection of the investment opportunity well use the given operating data Lets calculate the required values for each compa...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started