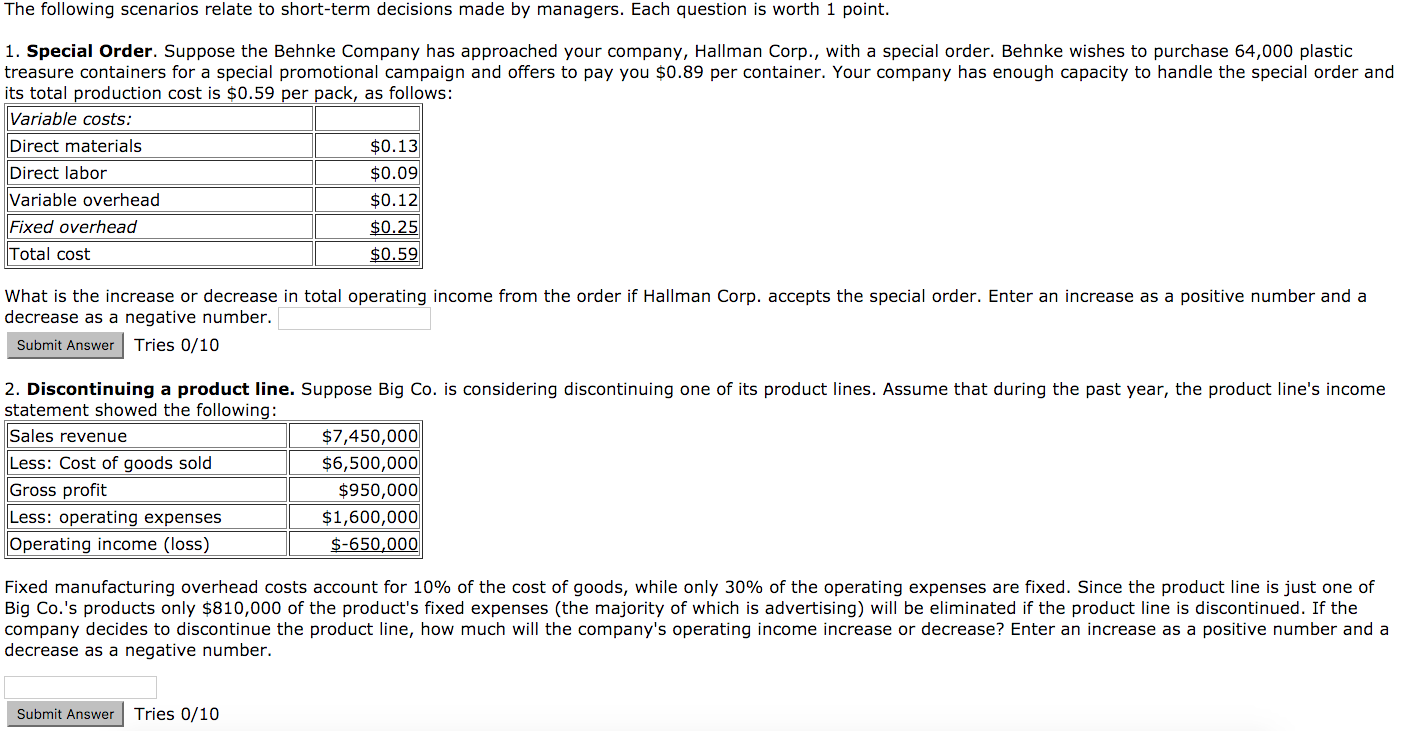

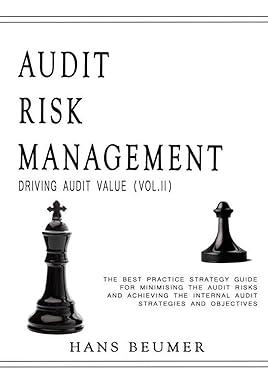

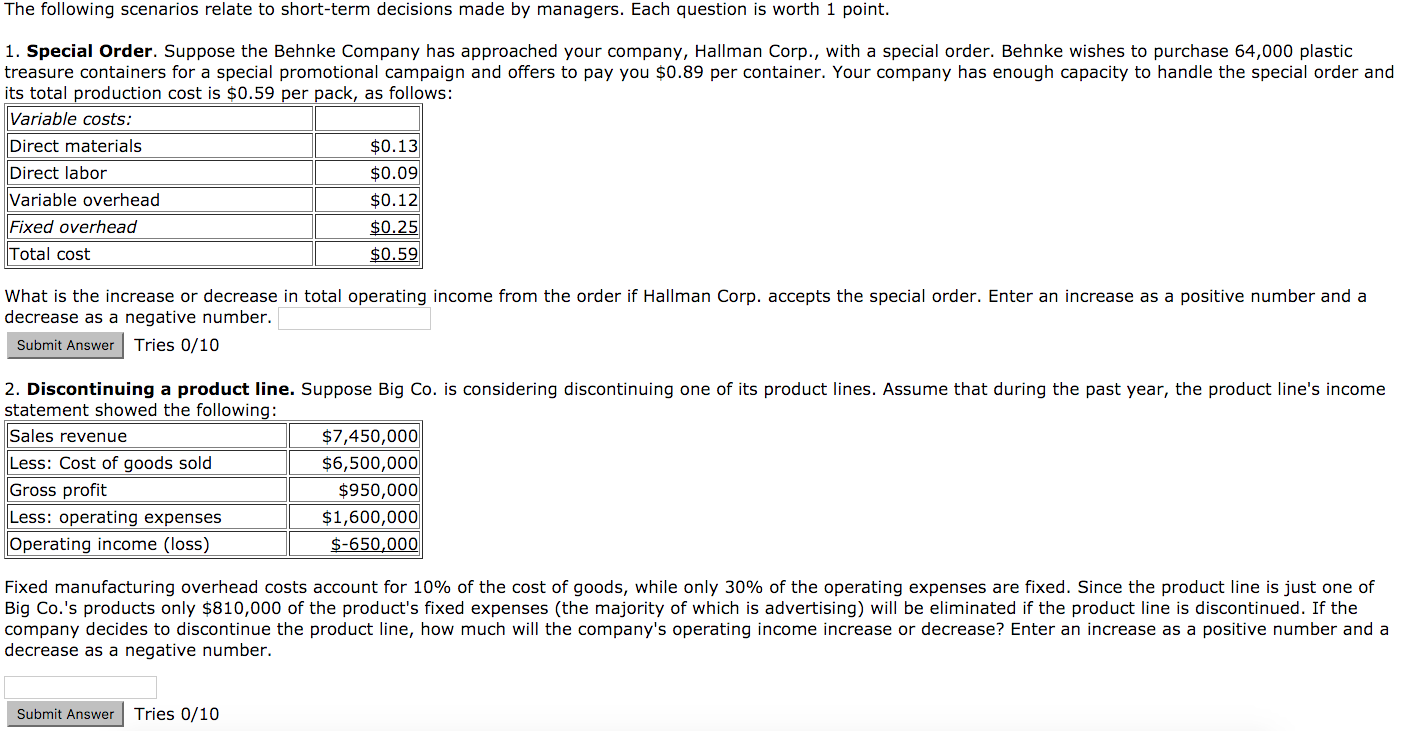

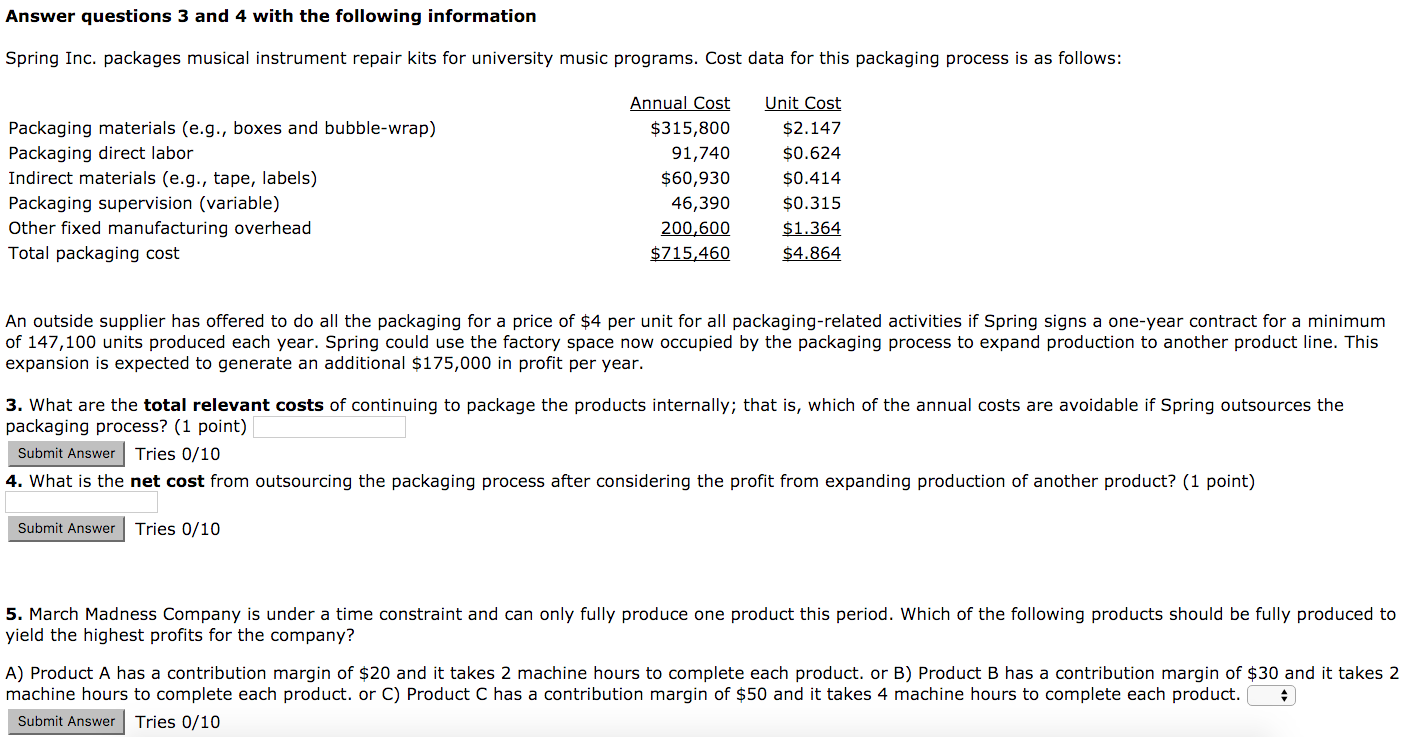

The following scenarios relate to short-term decisions made by managers. Each question is worth. 1. Special Order. Suppose the Behnke Company has approached your company, Hallman Corp., with a special order. Behnke wishes to purchase 64,000 plastic treasure containers for a special promotional campaign and offers to pay you $0.89 per container. Your company has enough capacity to handle the special order and its total production cost is $0.59 per pack, as follows: What is the increase or decrease in total operating income from the order if Hallman Corp. accepts the special order. Enter an increase as a positive number and a decrease as a negative number. 2. Discontinuing a product line. Suppose Big Co. is considering discontinuing one of its product lines. Assume that during the past year, the product line's income statement showed the following: Fixed manufacturing overhead costs account for 10% of the cost of goods, while only 30% of the operating expenses are fixed. Since the product line is just one of Big Co.'s products only $810,000 of the product's fixed expenses (the majority of which is advertising) will be eliminated if the product line is discontinued. If the company decides to discontinue the product line, how much will the company's operating income increase or decrease? Enter an increase as a positive number and a decrease as a negative number. Spring Inc. packages musical instrument repair kits for university music programs. Cost data for this packaging process is as follows: An outside supplier has offered to do all the packaging for a price of $4 per unit for all packaging-related activities if Spring signs a one-year contract for a minimum of 147,100 units produced each year. Spring could use the factory space now occupied by the packaging process to expand production to another product line. This expansion is expected to generate an additional $175,000 in profit per year. 3. What are the total relevant costs of continuing to package the products internally; that is, which of the annual costs are avoidable if Spring outsources the packaging process? 4. What is the net cost from outsourcing the packaging process after considering the profit from expanding production of another product? 5. March Madness Company is under a time constraint and can only fully produce one product this period. Which of the following products should be fully produced to yield the highest profits for the company? A) Product A has a contribution margin of $20 and it takes 2 machine hours to complete each product, or B) Product B has a contribution margin of $30 and it takes 2 machine hours to complete each product, or C) Product C has a contribution margin of $50 and it takes 4 machine hours to complete each product