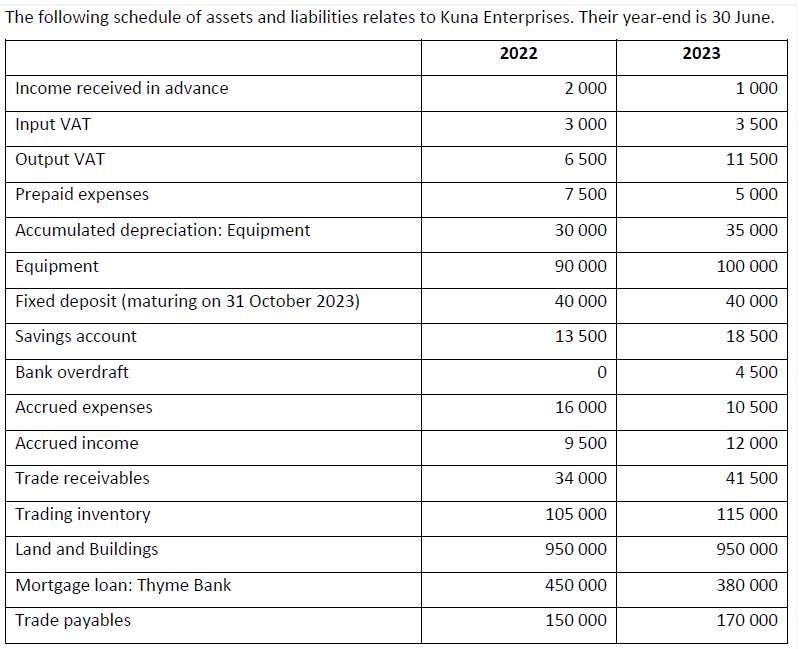

The following schedule of assets and liabilities relates to Kuna Enterprises. Their year-end is 30 June. 2022 2023 Income received in advance Input VAT

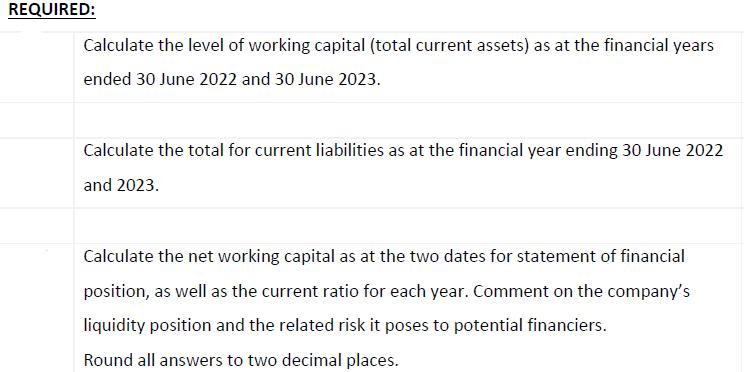

The following schedule of assets and liabilities relates to Kuna Enterprises. Their year-end is 30 June. 2022 2023 Income received in advance Input VAT Output VAT Prepaid expenses Accumulated depreciation: Equipment Equipment Fixed deposit (maturing on 31 October 2023) Savings account Bank overdraft Accrued expenses Accrued income Trade receivables Trading inventory Land and Buildings Mortgage loan: Thyme Bank Trade payables 2 000 3 000 6 500 7 500 30 000 90 000 40 000 13 500 0 16 000 9 500 34 000 105 000 950 000 450 000 150 000 1 000 3 500 11 500 5 000 35 000 100 000 40 000 18 500 4 500 10 500 12 000 41 500 115 000 950 000 380 000 170 000 REQUIRED: Calculate the level of working capital (total current assets) as at the financial years ended 30 June 2022 and 30 June 2023. Calculate the total for current liabilities as at the financial year ending 30 June 2022 and 2023. Calculate the net working capital as at the two dates for statement of financial position, as well as the current ratio for each year. Comment on the company's liquidity position and the related risk it poses to potential financiers. Round all answers to two decimal places.

Step by Step Solution

3.34 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the level of working capital total current liabilities net working capital and current ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started