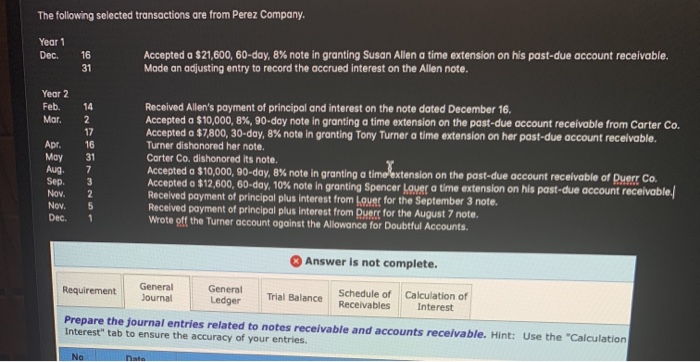

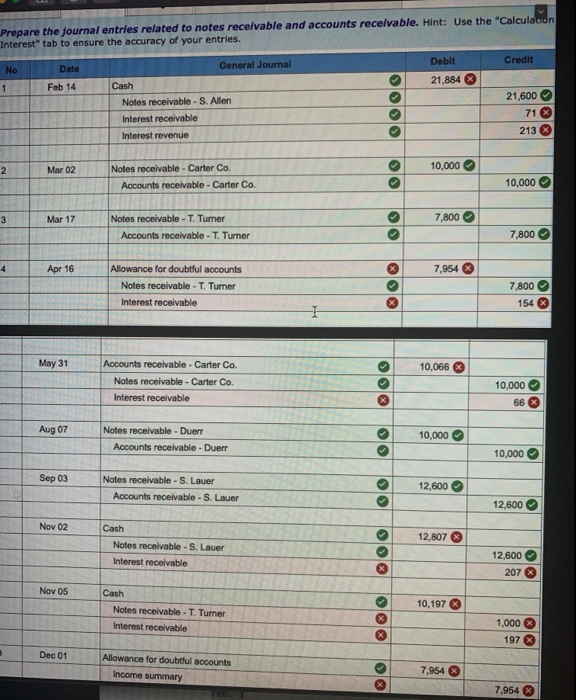

The following selected transactions are from Perez Company. Year 1 Dec. 16 31 Accepted a $21,600, 60-day, 8% note in granting Susan Allen a time extension on his past-due account receivable. Made an adjusting entry to record the accrued interest on the Allen note. Year 2 Feb. Mar. Apr. May Aug Sep. Nov. Nov. Dec. 14 2 17 16 31 7 3 2 5 1 Received Allen's payment of principal and interest on the note dated December 16. Accepted a $10,000,8%, 90-day note in granting a time extension on the past-due account receivable from Carter Co. Accepted a $7,800, 30-day, 8% note in granting Tony Turner a time extension on her past-due account receivable. Turner dishonored her note. Carter Co. dishonored its note. Accepted a $10,000, 90-day, 8% note in granting a time extension on the post-due account receivable of Duerr Co. Accepted a $12,600, 60-day, 10% note in granting Spencer Lover a time extension on his past-due account receivable. Received payment of principal plus interest from Lover for the September 3 note. Received payment of principal plus interest from Duerr for the August 7 note. Wrote off the Turner account against the Allowance for Doubtful Accounts. Answer is not complete. Requirement General Journal General Ledger Trial Balance Schedule of Receivables Calculation of Interest Prepare the journal entries related to notes receivable and accounts receivable. Hint: Use the "Calculation Interest" tab to ensure the accuracy of your entries No Prepare the journal entries related to notes receivable and accounts receivable. Hint: Use the "Calculation Interest" tab to ensure the accuracy of your entries. Debit Credit No Date 21,884 1 Feb 14 General Journal Cash Notes receivable - S. Allen Interest receivable 21,600 71 213 Interest revenue 2 Mar 02 10,000 Notes receivable - Carter Co. Accounts receivable - Carter Co. O 10,000 3 Mar 17 Notes receivable - T. Turner Accounts receivable - T. Turner SIS 7,800 7,800 4 Apr 16 7,954 Allowance for doubtful accounts Notes receivable - T. Turner Interest receivable 0 7,800 154 X X May 31 10,066 Accounts receivable - Carter Co. Notes receivable - Carter Co. Interest receivable 10,000 66 X Aug 07 Notes receivable - Duerr Accounts receivable - Duerr 10,000 10,000 Sep 03 Notes receivable - S. Lauer Accounts receivable - S. Lauer 12,600 C 12,600 Nov 02 12,807 X Cash Notes receivable - S. Lauer Interest receivable 12,600 207 Nov 05 10,197 Cash Notes receivable - T. Turner Interest receivable 1,000 197 . Dec 01 Allowance for doubtful accounts Income summary ol 7,954 7,954