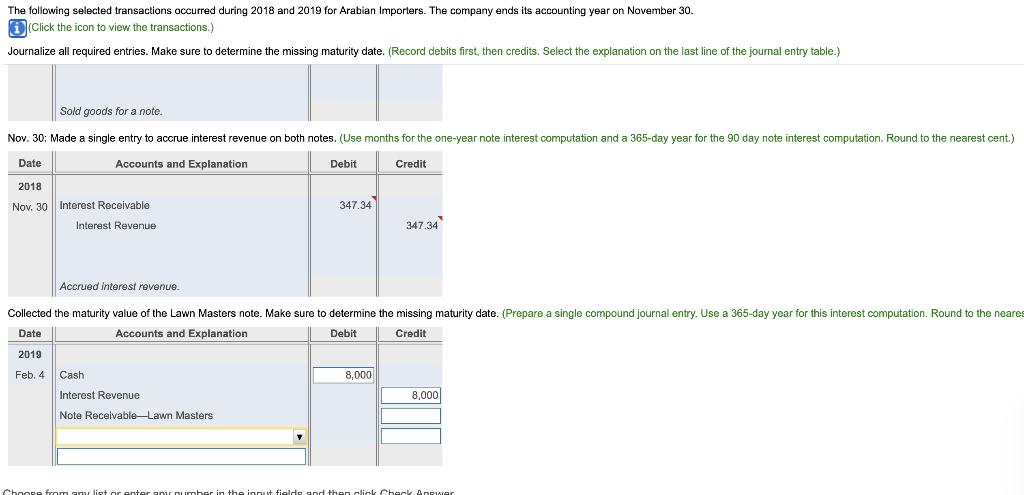

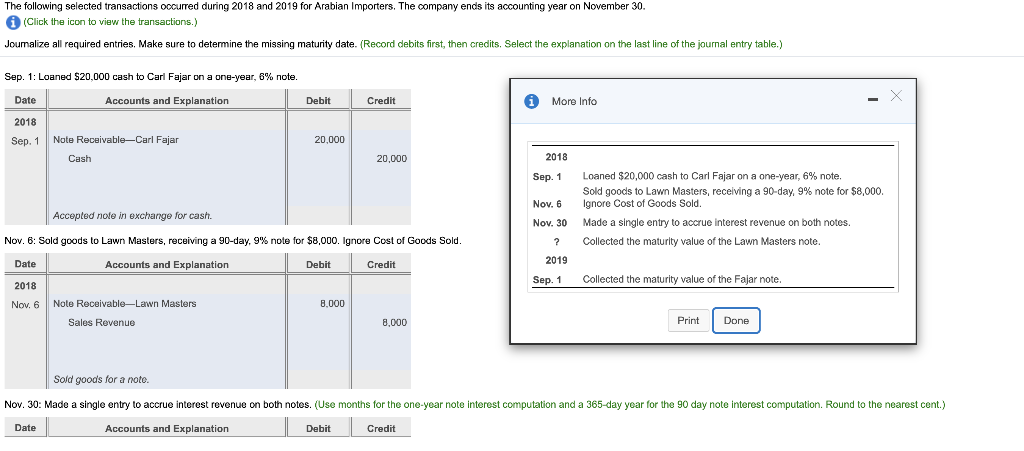

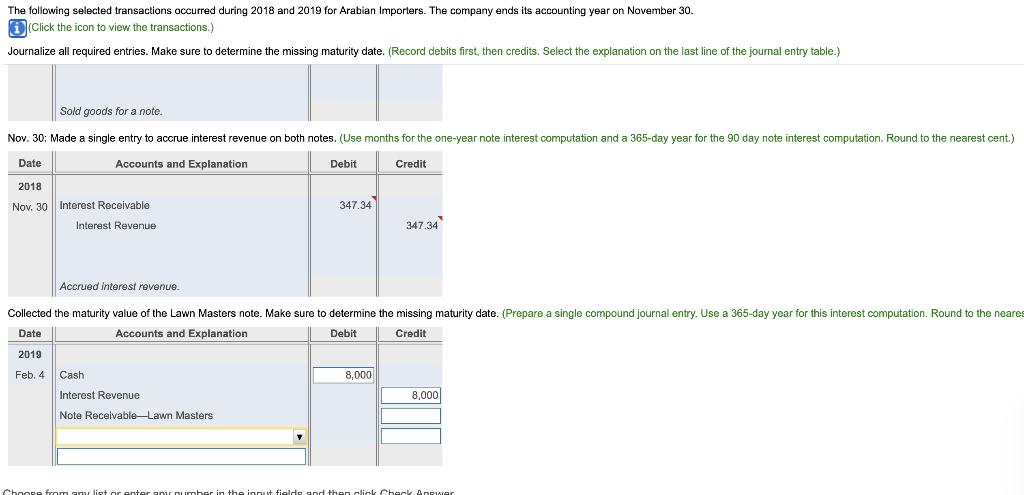

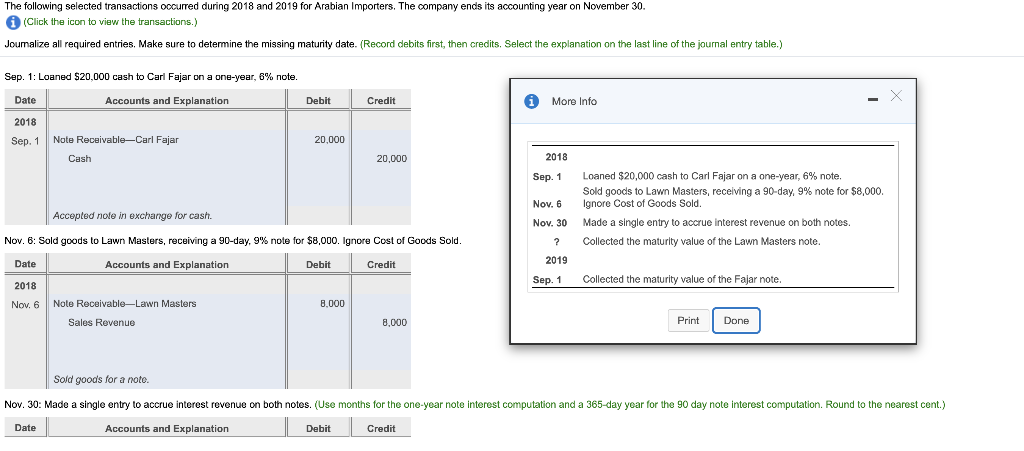

The following selected transactions occurred during 2018 and 2019 for Arabian Importers. The company ends its accounting year on November 30. Click the icon to view the transactions.) Journalize all required entries. Make sure to determine the missing maturity date. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Sold goods for a note. Nov. 30: Made a single entry to accrue interest revenue on both notes. (Use months for the one-year note interest computation and a 365-day year for the 90 day note interest computation. Round to the nearest cent.) Date Accounts and Explanation Debit Credit 2018 Nov. 30 347.34 Interest Receivable Interest Revenue 347.34 Accrued interest revenue. Collected the maturity value of the Lawn Masters note. Make sure to determine the missing maturity date. (Prepare a single compound journal entry. Use a 365-day year for this interest computation. Round to the neares Date Accounts and Explanation Debit Credit 2019 Feb. 4 Cash 8,000 Interest Revenue 8,000 Note Receivable Lawn Masters Choose from an list enter an umber in the innut fields and then click Check Ahrer The following selected transactions occurred during 2018 and 2019 for Arabian Importers. The company ends its accounting year on November 30. (Click the icon to view the transactions.) Journalize all required entries. Make sure to determine the missing maturity date. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Sep. 1: Loaned $20,000 cash to Carl Fajar on a one-year, 6% note. Date Accounts and Explanation Debit Credit i More Info 2018 Sep. 1 20,000 Note ReceivableCarl Fajar Cash 20,000 2018 Sep. 1 Nov. 6 Nov. 30 Accepted nole in exchange for cash. Nov. 6: Sold goods to Lawn Masters, receiving a 90-day, 9% note for $8,000. Ignore Cost of Goods Sold. Accounts and Explanation Debit Credit Loaned $20,000 cash to Carl Fajar on a one-year, 6% note Sold goods to Lawn Masters, receiving a 90-day, 9% note for $8,000. Ignore Cost of Goods Sold. Made a single entry to accrue interest revenue on both notes. Collected the maturity value of the Lawn Masters note. ? Date 2019 Sep. 1 Collected the maturity value of the Fajar note. 2018 Nov. 6 8.000 Nole Receivable Lawn Masters - Sales Revenue 8,000 Print Done Sold goods for a note. Nov. 30: Made a single entry to accrue interest revenue on both notes. (Use months for the one-year note interest computation and a 365-day year for the 90 day note interest computation. Round to the nearest cent.) Date Accounts and Explanation Debit Credit