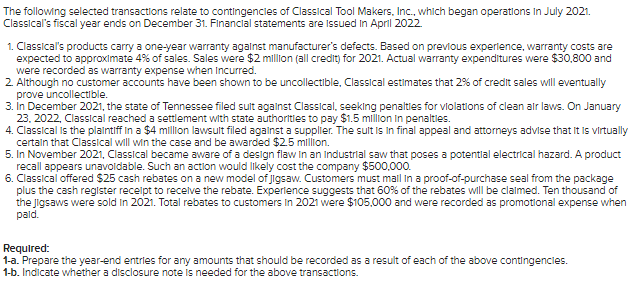

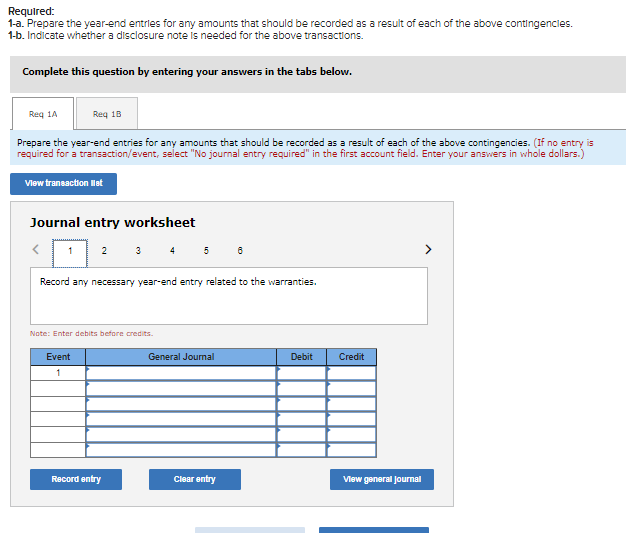

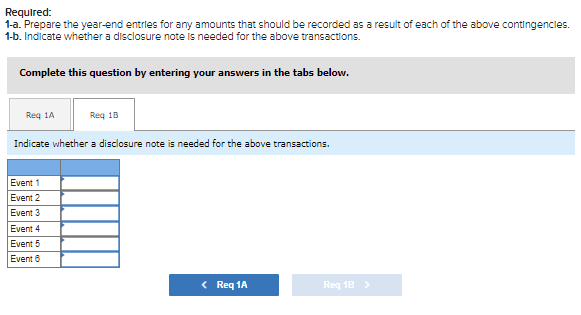

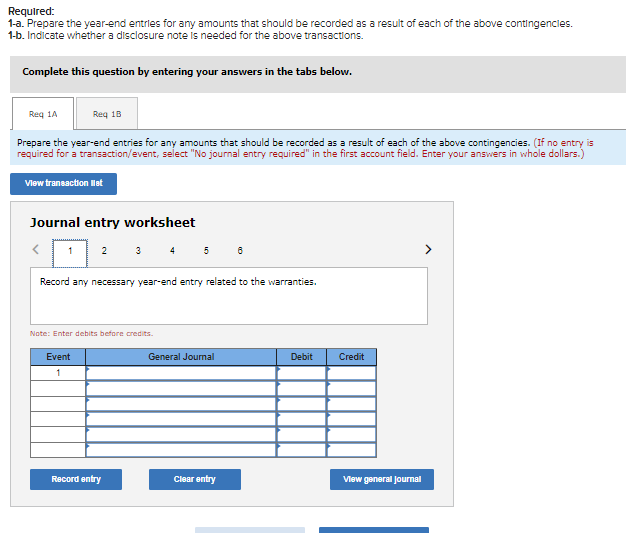

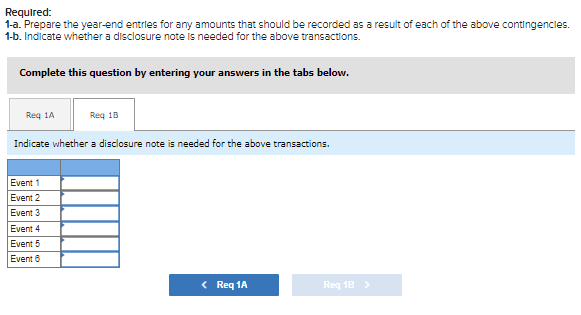

The following selected transactions relate to contingencles of Classical Tool Makers, Inc., which began operations in July 2021. Classical's fiscal year ends on December 31 . Financlal statements are Issued in April 2022. 1. Classical's products carry a one-year warranty agalnst manufacturer's defects. Based on previous experlence, warranty costs are expected to approximate 4% of sales. Sales were $2 million (all credit) for 2021 . Actual warranty expenditures were $30,800 and were recorded as warranty expense when Incurred. 2. Although no customer accounts have been shown to be uncollectible, Classical estlmates that 2% of credit sales will eventually prove uncollectible. 3. In December 2021, the state of Tennessee filed sult against Classical, seeking penaltles for violatlons of clean alr laws. On January 23, 2022, Classical reached a settlement with state authoritles to pay $1.5 million in penalties. 4. Classical is the plaintiff In a $4 million lawsult filed against a supplier. The sult is in final appeal and attorneys advise that it is virtually certain that Classical will win the case and be awarded $2.5 million. 5. In November 2021, Classical became aware of a design flaw In an industrial saw that poses a potential electrical hazard. A product recall appears unavoidable. Such an action would likely cost the company $500,000. 6. Classical offered $25 cash rebates on a new model of Jlgsaw. Customers must mall in a proof-of-purchase seal from the package plus the cash register recelpt to recelve the rebate. Experlence suggests that 60% of the rebates will be claimed. Ten thousand of the Jigsaws were sold in 2021 . Total rebates to customers in 2021 were $105,000 and were recorded as promotional expense when pald. Required: 1-a. Prepare the year-end entrles for any amounts that should be recorded as a result of each of the above contingencles. 1-b. Indicate whether a disclosure note is needed for the above transactions. Required: I-a. Prepare the year-end entrles for any amounts that should be recorded as a result of each of the above contingencles. I-b. Indicate whether a disclosure note is needed for the above transactions. Complete this question by entering your answers in the tabs below. Prepare the year-end entries for any amounts that should be recorded as a result of each of the above contingencies. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in whole dollars.) Journal entry worksheet Record any necessary year-end entry related to the warranties. Note: Enter debits before cred ts. Required: 1-a. Prepare the year-end entrles for any amounts that should be recorded as a result of each of the above contingencles. 1-b. Indicate whether a disclosure note is needed for the above transactions. Complete this question by entering your answers in the tabs below. Indicate whether a disclosure note is needed for the above transactions