Answered step by step

Verified Expert Solution

Question

1 Approved Answer

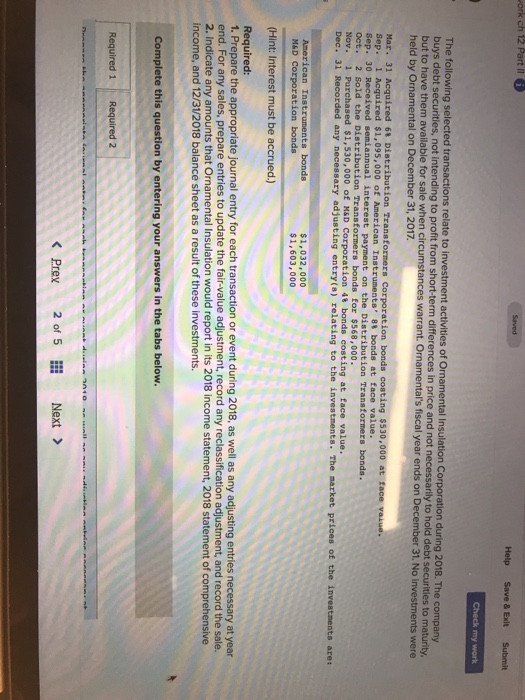

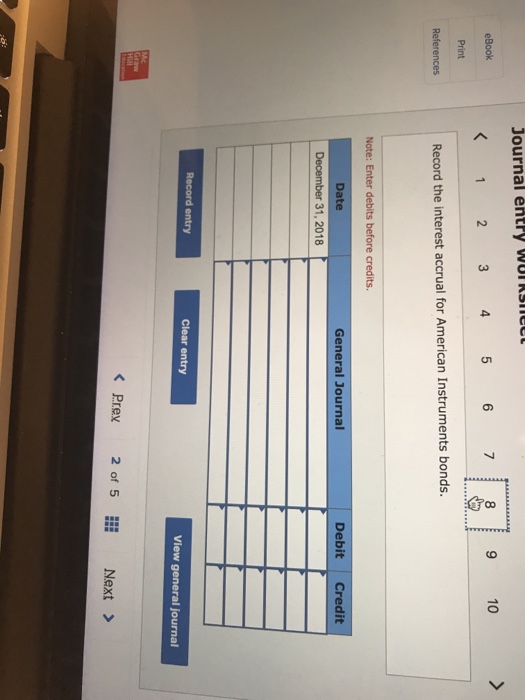

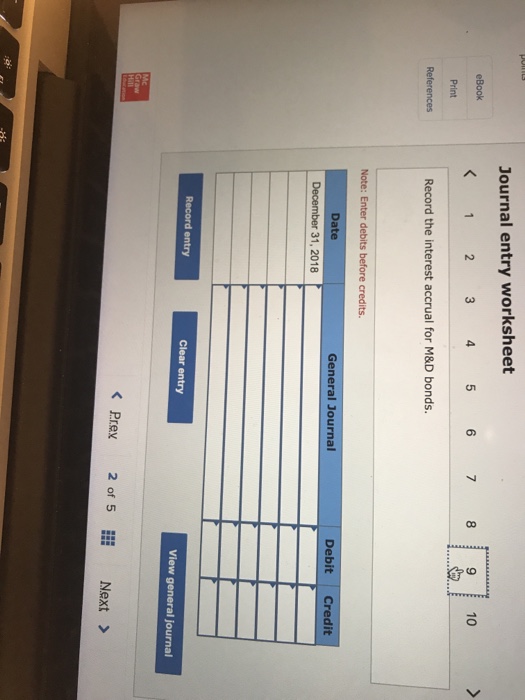

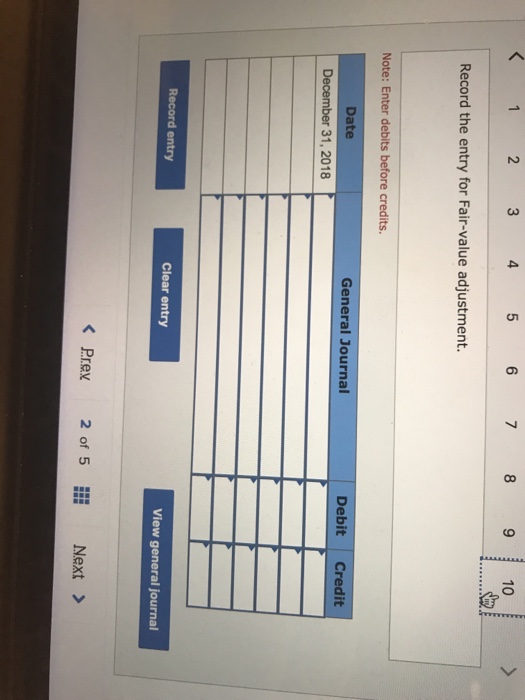

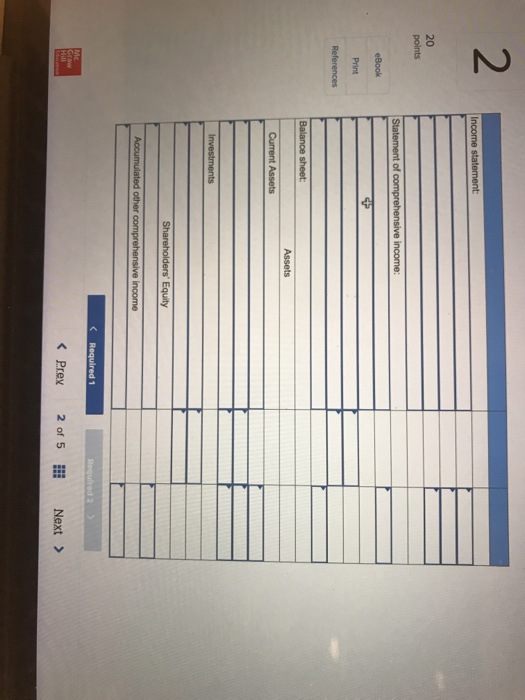

The following selected transactions relate to inve buys debt securities, not intending to but to have held by Ornamental on December 31, 2017 stment activities

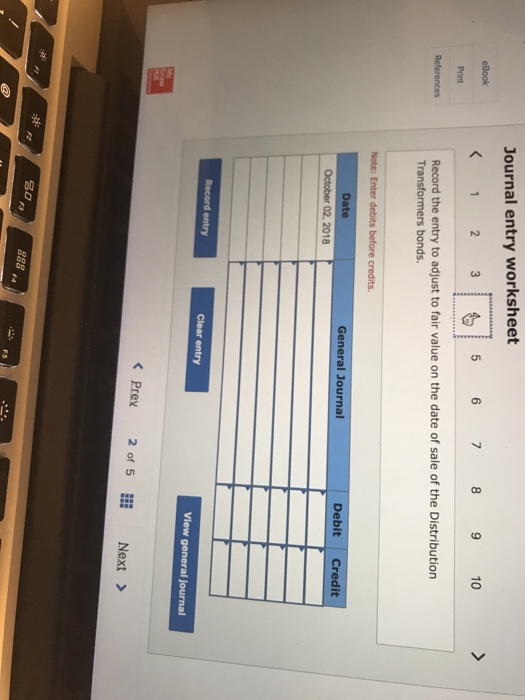

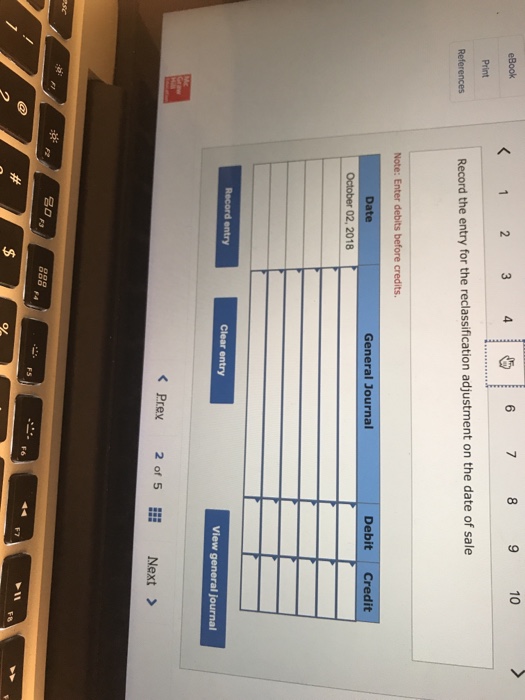

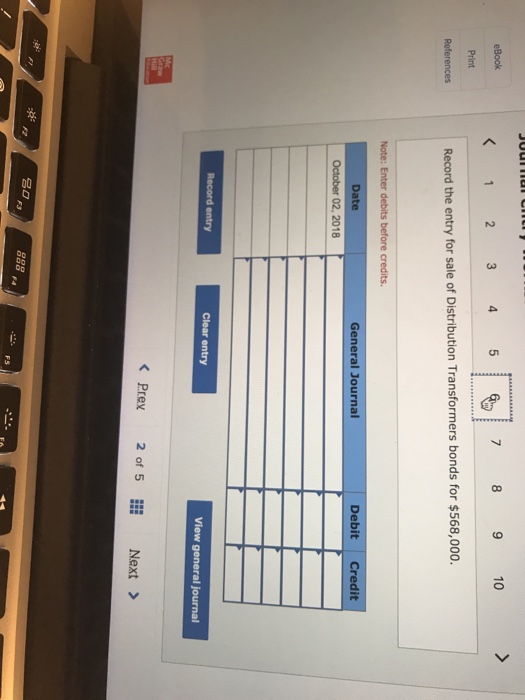

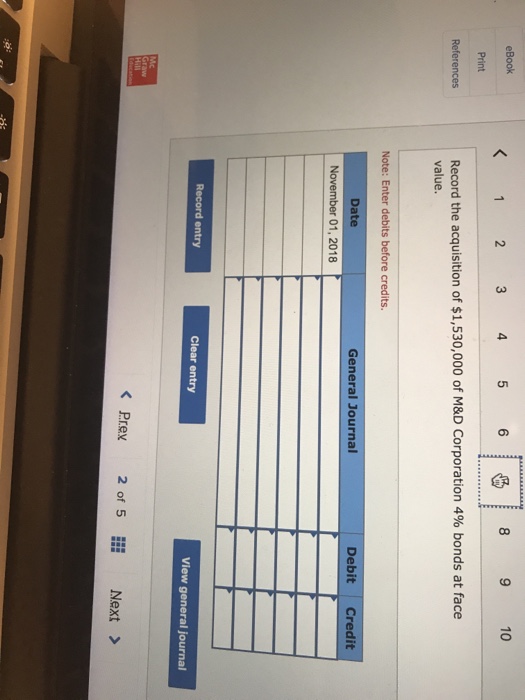

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started