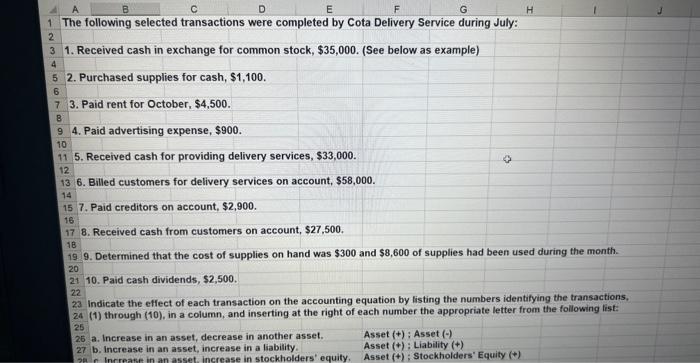

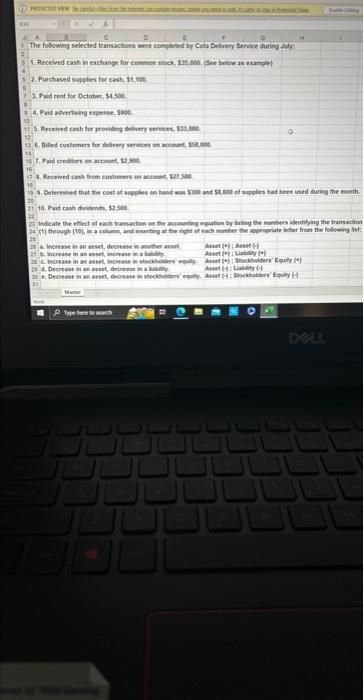

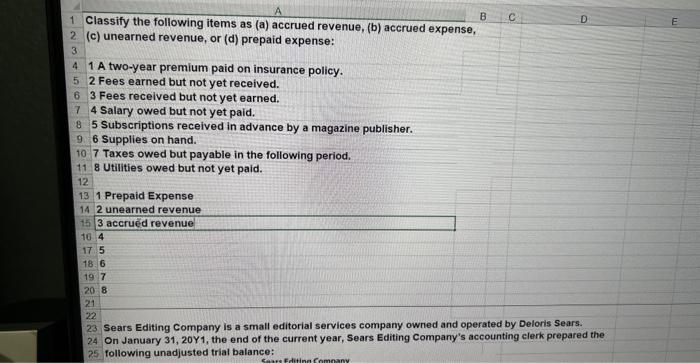

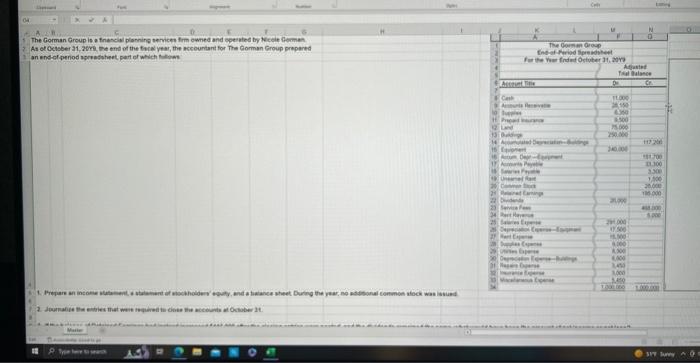

The following selected transactions were completed by Cota Delivery Service during July: 1. Received cash in exchange for common stock, $35,000. (See below as example) 2. Purchased supplies for cash, $1,100. 3. Paid rent for October, $4,500. 4. Paid advertising expense, $900. 5. Received cash for providing delivery services, $33,000. 6. Billed customers for delivery services on account, $58,000. 7. Paid creditors on account, $2,900. 8. Received cash from customers on account, $27,500. 19. 9. Determined that the cost of supplies on hand was $300 and $8,600 of supplies had been used during the month. 20 21 10. Paid cash dividends, $2,500. 22 23 Indicate the effect of each transaction on the accounting equation by listing the numbers identifying the transactions, 24 (1) through (10), in a column, and inserting at the right of each number the appropriate letter from the following list: 2525 a. Increase in an asset, decrease in another asset. Asset (t) ; Asset ( () b. Increase in an asset, increase in a liability. Asset (+) : Liability (+) 27b. Increase in an asset, increase in a liability. Asset (t) ; Stockholders" Equity (t) 2. Purchased supplies for cash, $1,100 3. Faid rent for October, s1 soe. 4. Paid abverting expense, sk6. 5. Aecented canh fer froviling detivery servens, sux boe. 1. Pail crediten on account, 12.909 18 10, Faid canh dividendw, 37300 Classify the following items as (a) accrued revenue, (b) accrued expense, B C D (c) unearned revenue, or (d) prepaid expense: 1 A two-year premium paid on insurance policy. 2 Fees earned but not yet received. 3 Fees received but not yet earned. 4 Salary owed but not yet paid. 5 Subscriptions received in advance by a magazine publisher. 6 Supplies on hand. 7 Taxes owed but payable in the following period. 8 Utilities owed but not yet paid. 31 Prepaid Expense 142 unearned revenue 3 accrued revenue 1644 175 18.6 197 8 Sears Editing Company is a small editorial services company owned and operated by Deloris Sears. 24 On January 31, 20Y1, the end of the current year, Sears Editing Company's accounting clerk prepared the 25 following unadjusted trial balance: an end-ef penod spreateheet patt of wich thibues erva lentioged Canvas Guide Sihet 7erer turanche Question 10 The following selected transactions were completed by Cota Delivery Service during July: 1. Received cash in exchange for common stock, $35,000. (See below as example) 2. Purchased supplies for cash, $1,100. 3. Paid rent for October, $4,500. 4. Paid advertising expense, $900. 5. Received cash for providing delivery services, $33,000. 6. Billed customers for delivery services on account, $58,000. 7. Paid creditors on account, $2,900. 8. Received cash from customers on account, $27,500. 19. 9. Determined that the cost of supplies on hand was $300 and $8,600 of supplies had been used during the month. 20 21 10. Paid cash dividends, $2,500. 22 23 Indicate the effect of each transaction on the accounting equation by listing the numbers identifying the transactions, 24 (1) through (10), in a column, and inserting at the right of each number the appropriate letter from the following list: 2525 a. Increase in an asset, decrease in another asset. Asset (t) ; Asset ( () b. Increase in an asset, increase in a liability. Asset (+) : Liability (+) 27b. Increase in an asset, increase in a liability. Asset (t) ; Stockholders" Equity (t) 2. Purchased supplies for cash, $1,100 3. Faid rent for October, s1 soe. 4. Paid abverting expense, sk6. 5. Aecented canh fer froviling detivery servens, sux boe. 1. Pail crediten on account, 12.909 18 10, Faid canh dividendw, 37300 Classify the following items as (a) accrued revenue, (b) accrued expense, B C D (c) unearned revenue, or (d) prepaid expense: 1 A two-year premium paid on insurance policy. 2 Fees earned but not yet received. 3 Fees received but not yet earned. 4 Salary owed but not yet paid. 5 Subscriptions received in advance by a magazine publisher. 6 Supplies on hand. 7 Taxes owed but payable in the following period. 8 Utilities owed but not yet paid. 31 Prepaid Expense 142 unearned revenue 3 accrued revenue 1644 175 18.6 197 8 Sears Editing Company is a small editorial services company owned and operated by Deloris Sears. 24 On January 31, 20Y1, the end of the current year, Sears Editing Company's accounting clerk prepared the 25 following unadjusted trial balance: an end-ef penod spreateheet patt of wich thibues erva lentioged Canvas Guide Sihet 7erer turanche Question 10