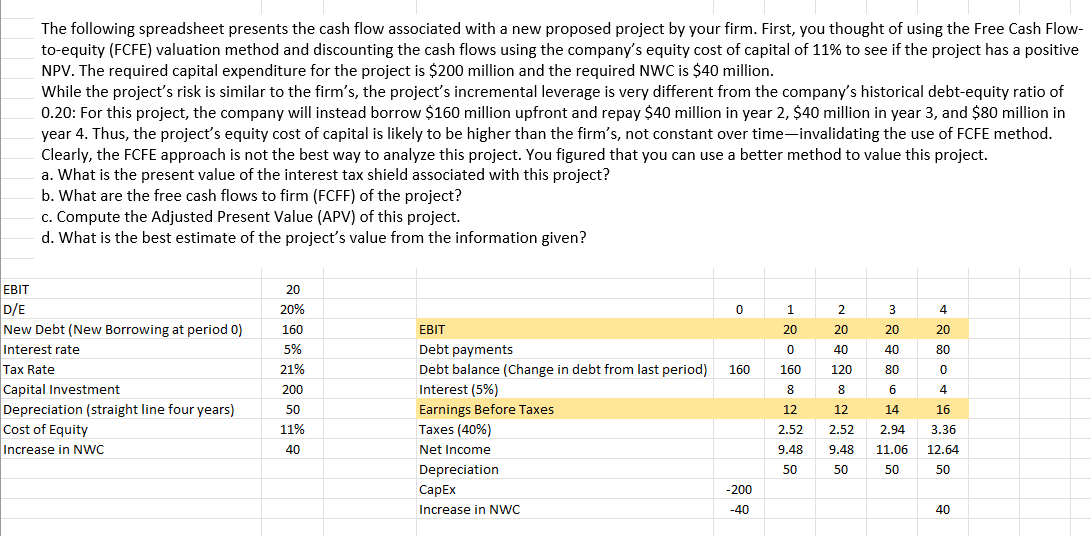

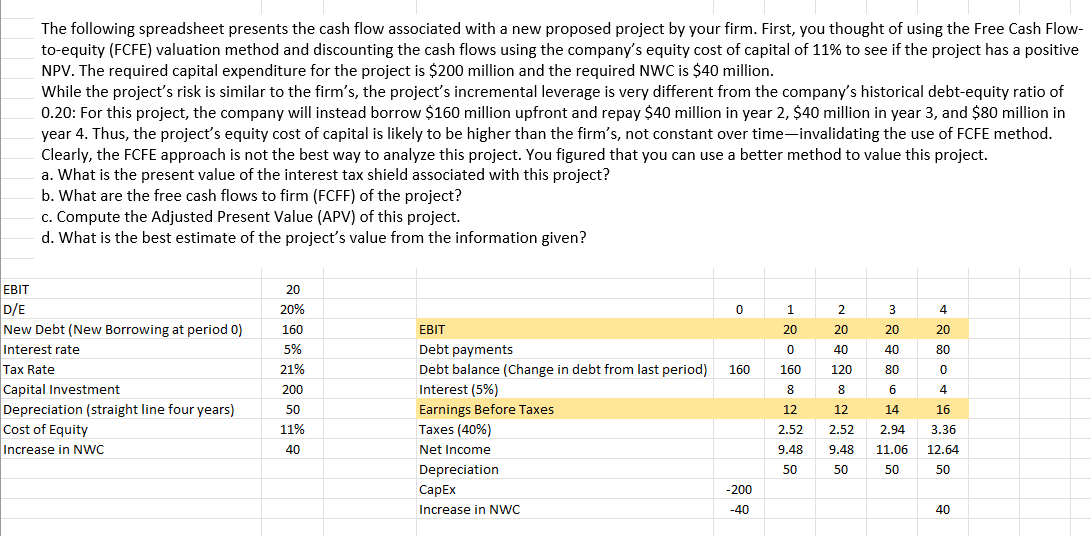

The following spreadsheet presents the cash flow associated with a new proposed project by your firm. First, you thought of using the Free Cash Flow- to-equity (FCFE) valuation method and discounting the cash flows using the company's equity cost of capital of 11% to see if the project has a positive NPV. The required capital expenditure for the project is $200 million and the required NWC is $40 million. While the project's risk is similar to the firm's, the project's incremental leverage is very different from the company's historical debt-equity ratio of 0.20: For this project, the company will instead borrow $160 million upfront and repay $40 million in year 2, $40 million in year 3, and $80 million in year 4. Thus, the project's equity cost of capital is likely to be higher than the firm's, not constant over time-invalidating the use of FCFE method. Clearly, the FCFE approach is not the best way to analyze this project. You figured that you can use a better method to value this project. a. What is the present value of the interest tax shield associated with this project? b. What are the free cash flows to firm (FCFF) of the project? c. Compute the Adjusted Present Value (APV) of this project. d. What is the best estimate of the project's value from the information given? 20 20% 0 2 3 4 1 20 0 20 20 20 40 40 80 EBIT D/E New Debt (New Borrowing at period 0) Interest rate Tax Rate Capital Investment Depreciation (straight line four years) Cost of Equity Increase in NWC 160 160 120 80 0 160 5% 21% 200 50 11% 8 8 6 4 12 12 14 EBIT Debt payments Debt balance (Change in debt from last period) Interest (5%) Earnings Before Taxes Taxes (40%) Net Income Depreciation Capex Increase in NWC 2.52 2.52 9.48 2.94 11.06 16 3.36 12.64 50 40 9.48 50 50 50 -200 -40 40 The following spreadsheet presents the cash flow associated with a new proposed project by your firm. First, you thought of using the Free Cash Flow- to-equity (FCFE) valuation method and discounting the cash flows using the company's equity cost of capital of 11% to see if the project has a positive NPV. The required capital expenditure for the project is $200 million and the required NWC is $40 million. While the project's risk is similar to the firm's, the project's incremental leverage is very different from the company's historical debt-equity ratio of 0.20: For this project, the company will instead borrow $160 million upfront and repay $40 million in year 2, $40 million in year 3, and $80 million in year 4. Thus, the project's equity cost of capital is likely to be higher than the firm's, not constant over time-invalidating the use of FCFE method. Clearly, the FCFE approach is not the best way to analyze this project. You figured that you can use a better method to value this project. a. What is the present value of the interest tax shield associated with this project? b. What are the free cash flows to firm (FCFF) of the project? c. Compute the Adjusted Present Value (APV) of this project. d. What is the best estimate of the project's value from the information given? 20 20% 0 2 3 4 1 20 0 20 20 20 40 40 80 EBIT D/E New Debt (New Borrowing at period 0) Interest rate Tax Rate Capital Investment Depreciation (straight line four years) Cost of Equity Increase in NWC 160 160 120 80 0 160 5% 21% 200 50 11% 8 8 6 4 12 12 14 EBIT Debt payments Debt balance (Change in debt from last period) Interest (5%) Earnings Before Taxes Taxes (40%) Net Income Depreciation Capex Increase in NWC 2.52 2.52 9.48 2.94 11.06 16 3.36 12.64 50 40 9.48 50 50 50 -200 -40 40