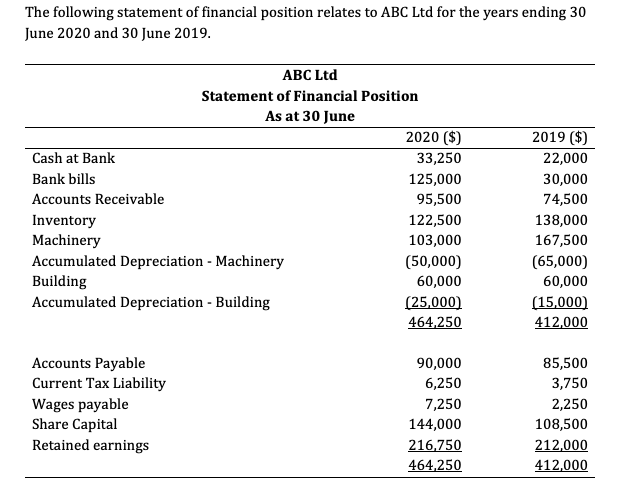

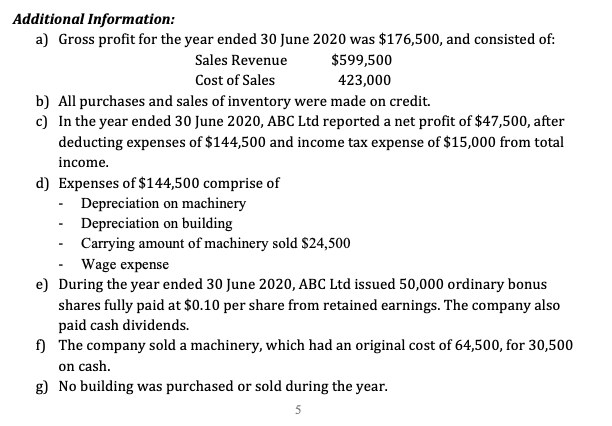

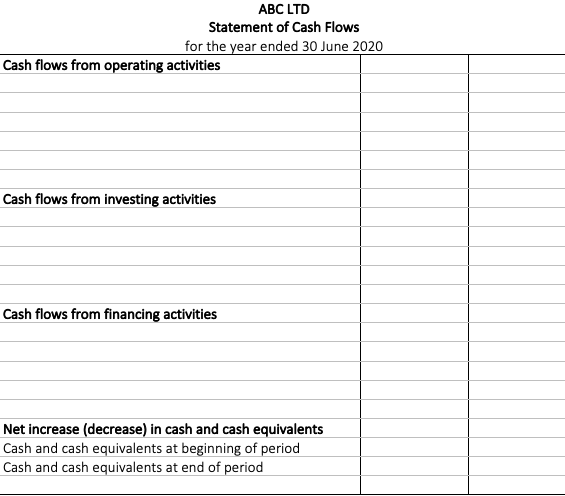

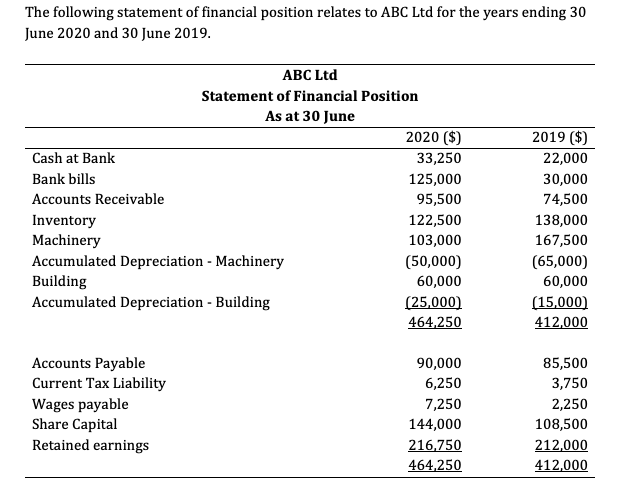

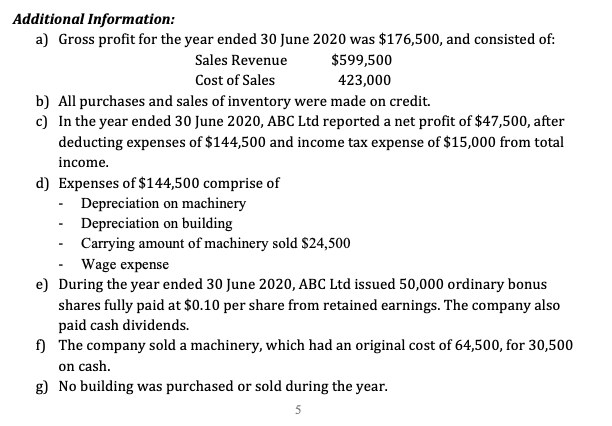

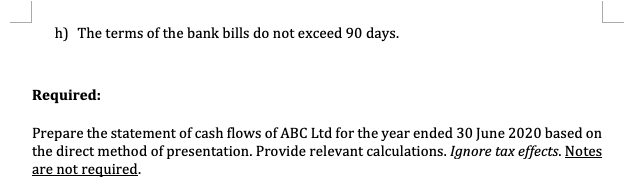

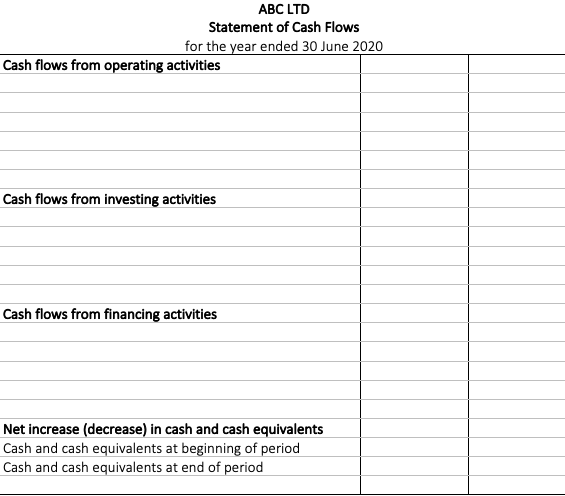

The following statement of financial position relates to ABC Ltd for the years ending 30 June 2020 and 30 June 2019. ABC Ltd Statement of Financial Position As at 30 June 2020 ($) Cash at Bank 33,250 Bank bills 125,000 Accounts Receivable 95,500 Inventory 122,500 Machinery 103,000 Accumulated Depreciation - Machinery (50,000) Building 60,000 Accumulated Depreciation - Building (25,000) 464,250 2019 ($) 22,000 30,000 74,500 138,000 167,500 (65,000) 60,000 (15,000) 412,000 Accounts Payable Current Tax Liability Wages payable Share Capital Retained earnings 90,000 6,250 7,250 144,000 216,750 464,250 85,500 3,750 2,250 108,500 212,000 412,000 Additional Information: a) Gross profit for the year ended 30 June 2020 was $176,500, and consisted of: Sales Revenue $599,500 Cost of Sales 423,000 b) All purchases and sales of inventory were made on credit. c) In the year ended 30 June 2020, ABC Ltd reported a net profit of $47,500, after deducting expenses of $144,500 and income tax expense of $15,000 from total income. d) Expenses of $144,500 comprise of Depreciation on machinery Depreciation on building Carrying amount of machinery sold $24,500 Wage expense e) During the year ended 30 June 2020, ABC Ltd issued 50,000 ordinary bonus shares fully paid at $0.10 per share from retained earnings. The company also paid cash dividends. f) The company sold a machinery, which had an original cost of 64,500, for 30,500 on cash. g) No building was purchased or sold during the year. 5 h) The terms of the bank bills do not exceed 90 days. Required: Prepare the statement of cash flows of ABC Ltd for the year ended 30 June 2020 based on the direct method of presentation. Provide relevant calculations. Ignore tax effects. Notes are not required. ABC LTD Statement of Cash Flows for the year ended 30 June 2020 Cash flows from operating activities Cash flows from investing activities Cash flows from financing activities Net increase (decrease) in cash and cash equivalents Cash and cash equivalents at beginning of period Cash and cash equivalents at end of period