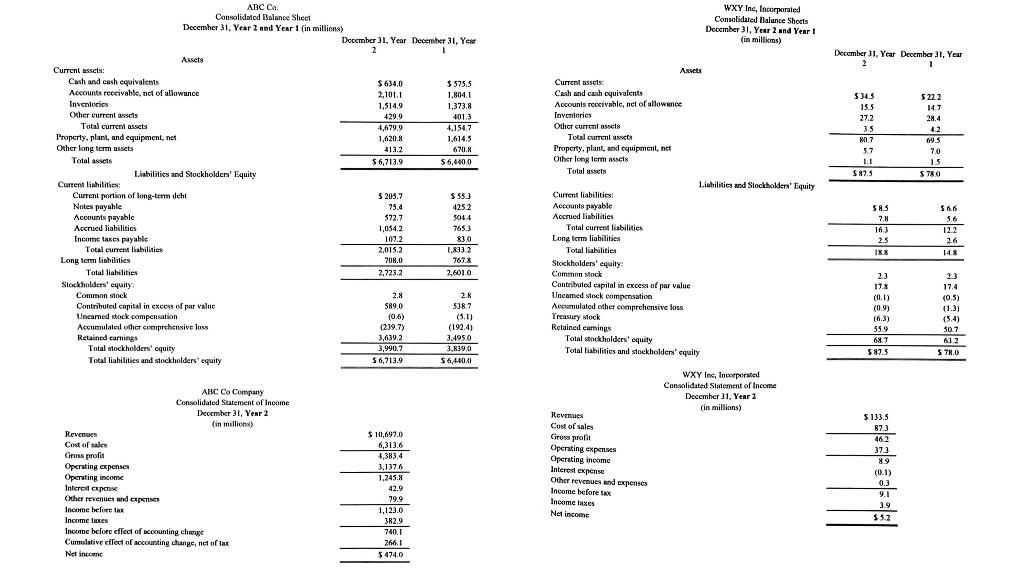

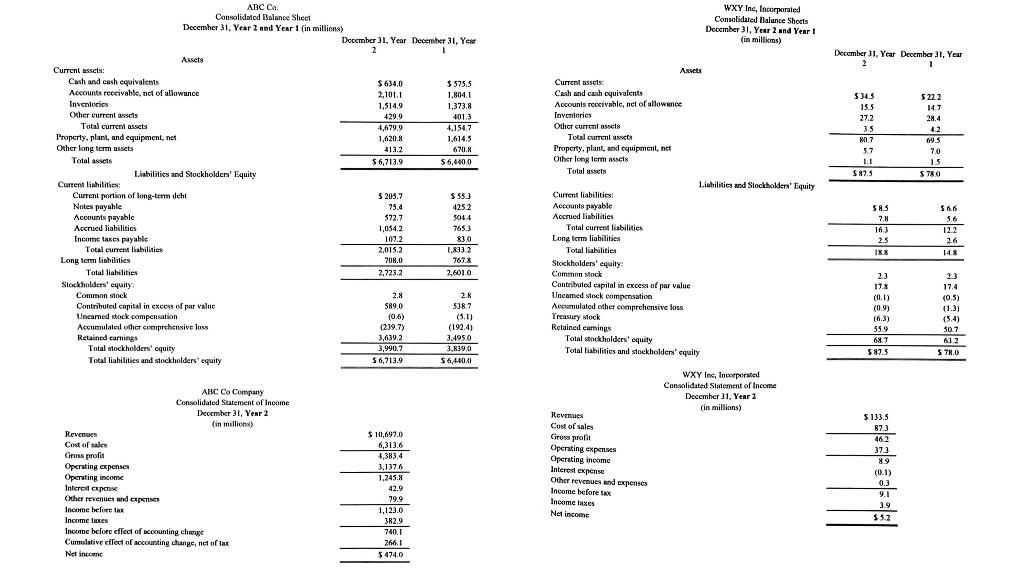

The following summaries from the income statements and balance sheets of ABC CO. and WXY INC., are presented below. A. For both companies for Year 2, compute the: (a) Current ratio (b) Acid-test ratio (c) Accounts receivable turnover (d) Inventory turnover (e) Days' sales in inventory (f) Days' sales uncollected

B. Which company do you consider to be the better short-term credit risk? Explain why.

C. For both companies for Year 2, compute the: (a) Profit margin ratio (b) Return on total assets (c) Return on common stockholders' equity

D. Which company do you consider to have better profitability ratios? Explain why.

WXY Inc, Incorporated Consolidated Balance Shorts December 31, Year 2 and Year 1 in millions) December 31. Year December 31, Year 1 5 34.5 15.5 27.2 3.5 10.7 57 1.1 $8.5 5222 147 28.4 4.2 695 7.0 15 15 $ 780 ADC Co. Consolidated Balance Sheet December 31, Year 2 nd Year 1 (in millions) December 31, Year December 31, Year 2 1 Assets Current assets: Cash and cash equivalents $ 634,0 $575.5 Accounts receivable, nct of allowance 2,101.1 1.804.1 Inventories 1,514.9 1,373.8 Oxher current assets 429.9 401 401.3 Total current assets 4,679,9 4.154.7 Property, plant, and equipment, net 1,620.8 1,614.5 Other long term assets 413.2 670.8 Total assets $ 6,713.9 $ 6,4400 Liabilities and Stockholders' Equity Current liabilities Current portion of long-term del S 203.7 $ 553 Notes payable 75.4 4252 Accounts payable 5722 5044 Accrued liabilities 1,054.2 7653 Income taxes payable 107.2 83.0 Total current liabilities 2,015.2 1,8332 Long term limbilities 208.0 767.8 Total lialities 2,723.2 2,6010 Stockholders' equity Common stock 2.8 2.8 son Contributed capital in excess of par valuc 589,0 538.7 Unearned stock compensation (0.6) (5.1) Accumulated other comprehensive loss (239.7) (1924) Retained earnings 3,639.2 3.4950 Total Mockholders' equity 3,990.7 3,839.0 Total liabilities and stockholders' equity $ 6,713.9 $6,4400 Assets Current assets Cash and cash equivalents Accounts receivable, net of allowance Inventories Other current assets Total current assets Property, plant, and equipment, net Other long term assets Total assets Liabilities and Stockholders' Equity Current liabilities: Accounts payable Accrued liabilities Total current liabilities Long term liabilities Total liabilities Stockholders' equity Common stock Contributed capital in excess of par value Uncamed stock compensation Accumulated other comprehensive loss Treasury stock Retained earings Total stockholders' equity Total liabilities and stockholders' equity SMS 7.8 163 2.5 183 $6.6 5.6 12.2 2.6 14.8 2.3 17.8 (0.1) (0.9) (6.3) 55.9 68.7 587.5 23 17.4 (0.5) (1.3) (5.4) 507 63.2 $ 78.0 WXY Inc, Incorporated Consolidated Statement of Income December 31, Year 2 (in millions) ABC Co Company Consolidated Sutement of Income December 31, Yenr 2 (in millions) Revenues Cost of sales Gross prodit Operating expenses Operating income Interest expose Other revenues and expenses Income before tax Income taxes Income before effect of accounting change Cumulative effect of accounting change, not of lax Net inn $ 10,692.0 6,313.6 4,383.4 3.137.6 1.245.8 42.9 79.9 1,123.0 382.9 Revenues Cost of sales Cross profit Operating expenses Operating income Interest expense Other revenues and expenses Income before tax Income taxes Net incom $133.5 87.3 46.2 373 8.9 (0.1) 0.3 9.1 3.9 $5.2 74011 2661 $ 474.0