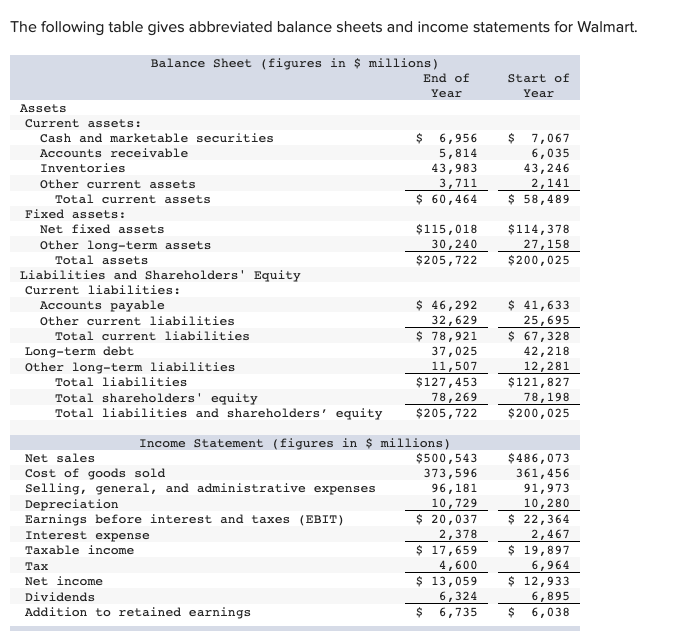

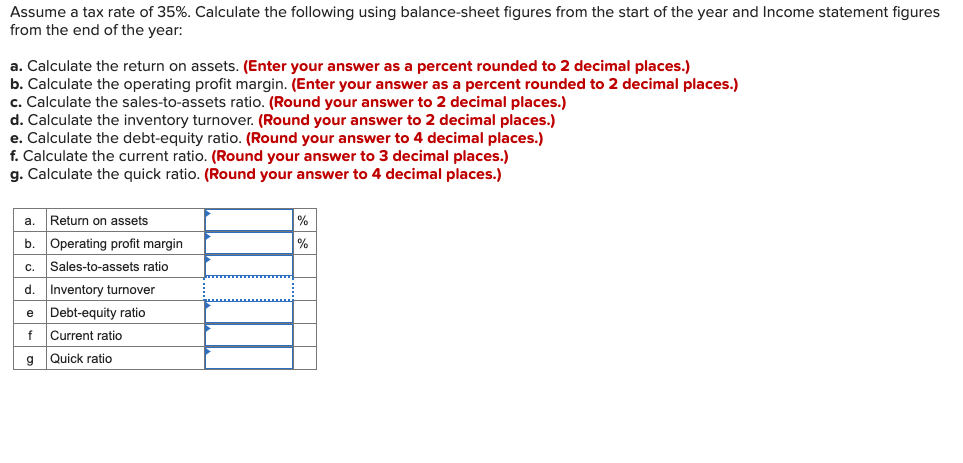

The following table gives abbreviated balance sheets and income statements for Walmart. Start of Year $ 7,067 6,035 43,246 2,141 $ 58,489 $114,378 27,158 $ 200,025 Balance Sheet (figures in $ millions) End of Year Assets Current assets: Cash and marketable securities $ 6,956 Accounts receivable 5,814 Inventories 43,983 Other current assets 3,711 Total current assets $ 60,464 Fixed assets: Net fixed assets $115,018 Other long-term assets 30, 240 Total assets $ 205,722 Liabilities and Shareholders' Equity Current liabilities: Accounts payable $ 46,292 Other current liabilities 32,629 Total current liabilities $ 78,921 Long-term debt 37,025 Other long-term liabilities 11,507 Total liabilities $127,453 Total shareholders' equity 78,269 Total liabilities and shareholders' equity $205,722 Income Statement (figures in $ millions) Net sales $500,543 Cost of goods sold 373,596 Selling, general, and administrative expenses 96,181 Depreciation 10,729 Earnings before interest and taxes (EBIT) $ 20,037 Interest expense 2,378 Taxable income $ 17,659 Tax 4,600 Net income $ 13,059 Dividends 6,324 Addition to retained earnings $ 6,735 $ 41,633 25,695 $ 67,328 42,218 12,281 $121,827 78,198 $200,025 $486,073 361,456 91,973 10,280 $ 22,364 2,467 $ 19,897 6,964 $ 12,933 6,895 $ 6,038 Assume a tax rate of 35%. Calculate the following using balance-sheet figures from the start of the year and Income statement figures from the end of the year: a. Calculate the return on assets. (Enter your answer as a percent rounded to 2 decimal places.) b. Calculate the operating profit margin. (Enter your answer as a percent rounded to 2 decimal places.) c. Calculate the sales-to-assets ratio. (Round your answer to 2 decimal places.) d. Calculate the inventory turnover. (Round your answer to 2 decimal places.) e. Calculate the debt-equity ratio. (Round your answer to 4 decimal places.) f. Calculate the current ratio. (Round your answer to 3 decimal places.) g. Calculate the quick ratio. (Round your answer to 4 decimal places.) % % a. Return on assets b. Operating profit margin C. Sales-to-assets ratio d. Inventory turnover e Debt-equity ratio f Current ratio g Quick ratio