Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following table gives the adjusted closing prices (adjusted for dividend payments) for the IBM and Bank of America common stocks in the beginning of

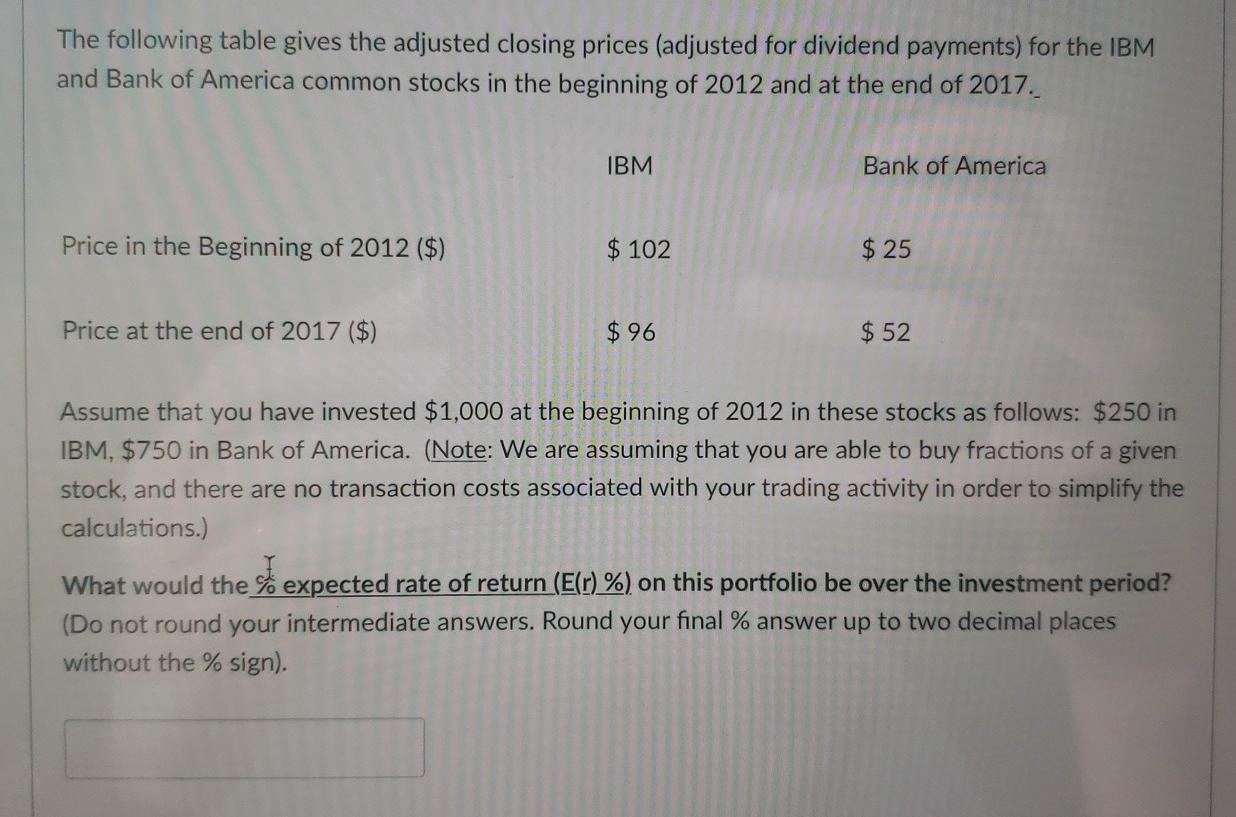

The following table gives the adjusted closing prices (adjusted for dividend payments) for the IBM and Bank of America common stocks in the beginning of 2012 and at the end of 2017. IBM Bank of America Price in the Beginning of 2012 ($) $ 102 $ 25 Price at the end of 2017 ($) $ 96 $ 52 Assume that you have invested $1,000 at the beginning of 2012 in these stocks as follows: $250 in IBM, $750 in Bank of America. (Note: We are assuming that you are able to buy fractions of a given stock, and there are no transaction costs associated with your trading activity in order to simplify the calculations.) What would the I expected rate of return (E(r) %) on this portfolio be over the investment period? (Do not round your intermediate answers. Round your final % answer up to two decimal places without the % sign)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started