Answered step by step

Verified Expert Solution

Question

1 Approved Answer

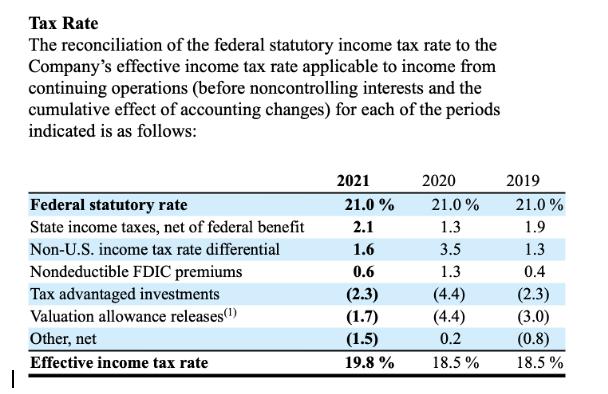

The following table is from Citi Group's 2022 annual report: Are these differences between the federal and effective income tax rate a result of

The following table is from Citi Group's 2022 annual report: Are these differences between the federal and effective income tax rate a result of permanent or temporary differences? Explain

| Tax Rate The reconciliation of the federal statutory income tax rate to the Company's effective income tax rate applicable to income from continuing operations (before noncontrolling interests and the cumulative effect of accounting changes) for each of the periods indicated is as follows: Federal statutory rate State income taxes, net of federal benefit Non-U.S. income tax rate differential Nondeductible FDIC premiums Tax advantaged investments Valuation allowance releases (1) Other, net Effective income tax rate 2021 21.0% 2.1 1.6 0.6 (2.3) (1.7) (1.5) 19.8 % 2020 21.0% 1.3 3.5 1.3 (4.4) (4.4) 0.2 18.5% 2019 21.0% 1.9 1.3 0.4 (2.3) (3.0) (0.8) 18.5%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Permanent vs Temporary Differences in Citigroups Effective Income Tax Rate The table you provided shows the breakdown of differences between Citigroups federal statutory income tax rate and its effective income tax rate By analyzing these differences we can determine whether they are permanent or temporary Permanent differences These are factors that will consistently cause a difference between the federal statutory rate and the effective rate regardless of yeartoyear fluctuations in income or expenses Temporary differences These are factors that cause a difference in the current year but may not persist in future years potentially leading to the effective rate converging towards the statutory rate Heres an analysis of each item in the table Federal statutory rate This is the benchmark rate set by the federal government and it remains constant at 210 in the years shown State income taxes net of federal benefit This is a permanent difference because state income taxes are a recurring expense not deductible for federal tax purposes NonUS income tax rate differential This could be permanent or temporary depending on the specific circumstancesIf it reflects a consistently lower tax rate in foreign jurisdictions where Citigroup ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started