Answered step by step

Verified Expert Solution

Question

1 Approved Answer

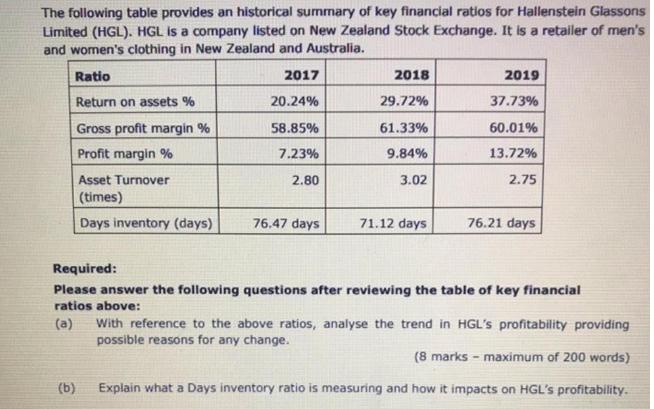

The following table provides an historical summary of key financial ratios for Hallenstein Glassons Limited (HGL). HGL is a company listed on New Zealand

The following table provides an historical summary of key financial ratios for Hallenstein Glassons Limited (HGL). HGL is a company listed on New Zealand Stock Exchange. It is a retailer of men's and women's clothing in New Zealand and Australia. Ratio 2017 Return on assets % 20.24% Gross profit margin % 58.85% Profit margin % 7.23% 2.80 Asset Turnover (times) Days inventory (days) 76.47 days (b) 2018 29.72% 61.33% 9.84% 3.02 71.12 days 2019 37.73% 60.01% 13.72% 2.75 76.21 days Required: Please answer the following questions after reviewing the table of key financial ratios above: (a) With reference to the above ratios, analyse the trend in HGL's profitability providing possible reasons for any change. (8 marks - maximum of 200 words) Explain what a Days inventory ratio is measuring and how it impacts on HGL's profitability. (a) (b) (c) Identify two reasons why the cost of long-term debt is cheaper than the cost of equity for a listed company. (4 marks- maximum of 80 words) Explain why you cannot simply just compare the non-discounted value of the cash returns when deciding between the two investment opportunities. (4 marks- maximum of 80 words) Explain why cash flows rather than profits from the Income Statement are used in the net present value method of investment appraisal. (4 marks- maximum of 100 words)

Step by Step Solution

★★★★★

3.38 Rating (142 Votes )

There are 3 Steps involved in it

Step: 1

a HGLs profitability has been trending upwards over the period shown as indicated by the increasing return on assets and profit margin ratios Return o...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started