Answered step by step

Verified Expert Solution

Question

1 Approved Answer

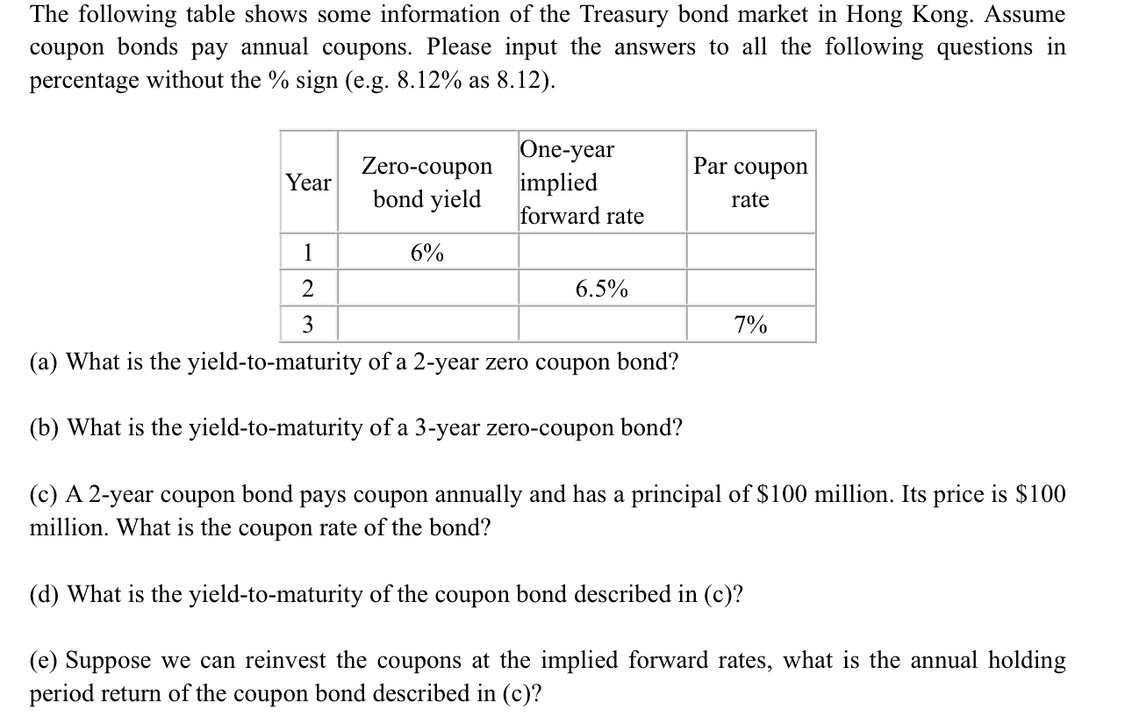

The following table shows some information of the Treasury bond market in Hong Kong. Assume coupon bonds pay annual coupons. Please input the answers

The following table shows some information of the Treasury bond market in Hong Kong. Assume coupon bonds pay annual coupons. Please input the answers to all the following questions in percentage without the % sign (e.g. 8.12% as 8.12). Year Zero-coupon bond yield One-year implied forward rate 6% 1 2 3 (a) What is the yield-to-maturity of a 2-year zero coupon bond? (b) What is the yield-to-maturity of a 3-year zero-coupon bond? (c) A 2-year coupon bond pays coupon annually and has a principal of $100 million. Its price is $100 million. What is the coupon rate of the bond? (d) What is the yield-to-maturity of the coupon bond described in (c)? (e) Suppose we can reinvest the coupons at the implied forward rates, what is the annual holding period return of the coupon bond described in (c)? Par coupon rate 6.5% 7%

Step by Step Solution

★★★★★

3.36 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION a To calculate the yieldtomaturity YTM of a zerocoupon bond we can use the formula YTM Face Value Price 1 Time 1 For the 2year zerocoupon bon...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started