Answered step by step

Verified Expert Solution

Question

1 Approved Answer

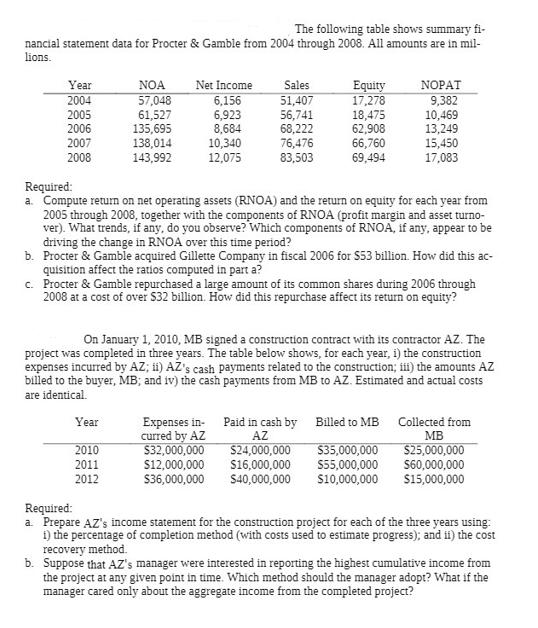

The following table shows summary fi- nancial statement data for Procter & Gamble from 2004 through 2008. All amounts are in mil- lions. Year

The following table shows summary fi- nancial statement data for Procter & Gamble from 2004 through 2008. All amounts are in mil- lions. Year 2004 2005 2006 2007 2008 NOA 57,048 61,527 135,695 138,014 143,992 Net Income 6,156 6,923 8,684 10,340 12,075 Year 2010 2011 2012 Sales 51,407 56,741 68,222 76,476 83,503 Required: a. Compute return on net operating assets (RNOA) and the return on equity for each year from 2005 through 2008, together with the components of RNOA (profit margin and asset turno- ver). What trends, if any, do you observe? Which components of RNOA, if any, appear to be driving the change in RNOA over this time period? Procter & Gamble acquired Gillette Company in fiscal 2006 for $53 billion. How did this ac- quisition affect the ratios computed in part a? Expenses in- curred by AZ Equity 17,278 18,475 62,908 66,760 69,494 b. c. Procter & Gamble repurchased a large amount of its common shares during 2006 through 2008 at a cost of over $32 billion. How did this repurchase affect its return on equity? On January 1, 2010, MB signed a construction contract with its contractor AZ. The project was completed in three years. The table below shows, for each year, i) the construction expenses incurred by AZ; ii) AZ's cash payments related to the construction; iii) the amounts AZ billed to the buyer, MB; and iv) the cash payments from MB to AZ. Estimated and actual costs are identical. Paid in cash by AZ NOPAT 9,382 10,469 13,249 Billed to MB $35,000,000 $55,000,000 $40,000,000 $10,000,000 15,450 17,083 $32,000,000 $24,000,000 $12,000,000 $16,000,000 $36,000,000 Collected from MB $25,000,000 $60,000,000 $15,000,000 Required: a. Prepare AZ's income statement for the construction project for each of the three years using: 1) the percentage of completion method (with costs used to estimate progress); and ii) the cost recovery method. b. Suppose that AZ's manager were interested in reporting the highest cumulative income from the project at any given point in time. Which method should the manager adopt? What if the manager cared only about the aggregate income from the completed project?

Step by Step Solution

★★★★★

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Answer Question 1 a Calculation of return on net operating assets RNOA and return on equity ROE for each year from 2005 through 2008 along with the components of RNOA profit margin and asset turnover ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started